DK Analytics, Post #42: If QT keeps ramping up to $600bn, look for an accelerated “reset” 7/14/2018

Trade weighted US$: 89.58; US 10-yr: 2.83%; S&P 500: 2,801; Oil: $70.58; Gold: $1,242; Silver: $15.84

YOY (year-over-year) change in monetary base as per 7/5/2018: –$84bn

Growing financing needs juxtaposed against a shrinking Fed balance sheet (“QT”) spell trouble:

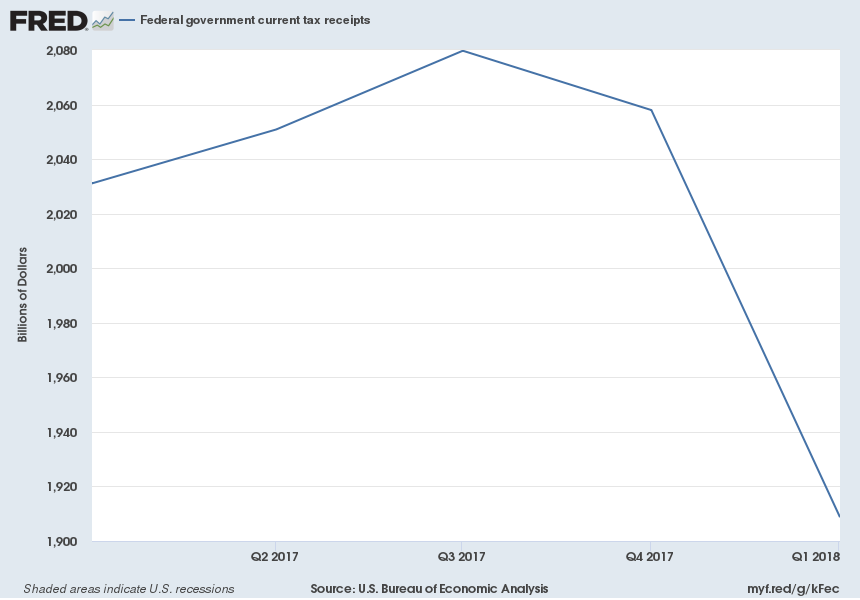

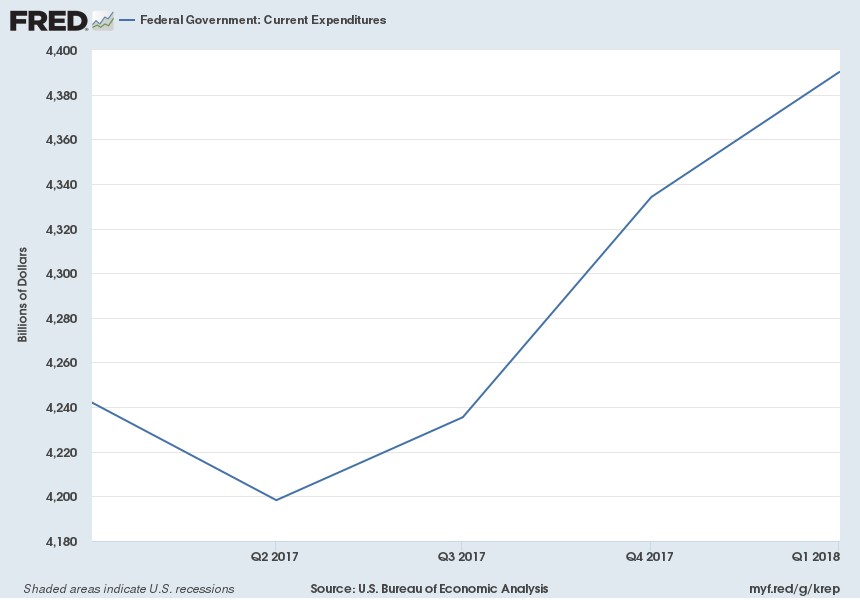

- The $1.36trn YOY increase in US federal debt through 7/6/2018 is not only indicative of the true deficit, but it is up from a $501bn increase over the 12 months ended 7/6/2017. The $860bn expansion in the federal government deficit, which reflects an expanding gap between US government receipts and spending, will mushroom in a weakening economy featuring lower tax receipts and higher social safety net spending such as jobless and welfare benefits.

- (Calendar YTD, federal debt is up by $715bn.)

Sources: https://fred.stlouisfed.org/series/W006RC1Q027SBEA & https://fred.stlouisfed.org/series/FGEXPND

- In fact, if the last recession is any guide, and given today’s even more pressing economic and financial concerns, the current federal deficit could easily bloat by $1.25trn. Washington having to potentially fund a $2.6trn plus annual deficit via new debt (Treasury) offerings would constitute unprecedented supply hitting the bond market.

- The “Treasury’s” current outstanding debt of $21.2trn has an average weighted maturity of 5.9 years. Upshot: on top of a rapidly expanding US government deficit, on average about $3.6trn needs to be refinanced annually.

- An ever-more indebted economy can ill-afford higher interest rates, much less a recession. With total US debt already expanding at a $2.6trn annual rate and closing in on $69trn, which amounts to 3.4x GDP, a one percentage point (100 BPs) rise in the 10-year Treasury (“benchmark”) yield would reverberate throughout the “debt structure landscape,” starting with the public sector. This is because a substantial portion of outstanding debt in both consumer and corporate loan realms is tied to the benchmark yield plus a risk premium. As investors seek greater “solvency protection (max time frame),” private sector interest rates will surge thanks to widening risk premiums or “spreads.” Let us take a “back of the envelope” stab at the implications of a rising benchmark yield:

- Let’s assume, for the sake of argument, a 5.9-year average maturity for “all US debt” (it may be longer or shorter, given outstanding “Treasury Yield Plus” household loans of shorter durations, shorter and longer corporate liabilities, and 7% homeownership turnover rates superimposed on 15 and 30-year mortgage refis).

- In such a world, some $11.6trn of refinancing ($68.6trn/5.9 years) would coalesce with an assumed $2.6trn plus in new debt issuance at a higher interest rate.

- With about 69% of all American debt consisting of non-US government debt (US debt service is supported by a printing press thus is less risky, in nominal terms), a 100 BPs higher Treasury yield could easily result in the cost of much of the other debt (including state, corporate, and household liabilities) rising, in aggregate, at 1.5x – 2.0x the benchmark yield increase, for a “blended rate” increase of some 1.5 percentage points, or 150 BPs. (Swelling debt growth and a $16trn higher debt load than a decade ago may result in a higher “blended rate,” much as elevated monetary debasement risks may push the Treasury yield higher.)

- Thus, $11.6trn of refinancing per 100 BP rise in the benchmark rate could easily result in $174bn higher refinancing cost (for outstanding debt) per annum for America.

- Toss in an additional $111bn in interest expense for $2.6trn in new annual debt issuance, and America could loosely be looking at a $285bn ($111bn + $174bn) annual “step-up” in financing costs that would roll out for some six years assuming solely a 100 BP increase in the benchmark rate combined with annual debt growth.

- Over six years, that could spell $1.7trn in higher annual financing costs, or 8.5% of current GDP.

- Talk about cost of funds headwind prior to any interest rate “reversion beyond the mean,” much less interest rates reaching average levels (a 4.6% benchmark yield), which could raise the annual financing cost bogey to $486bn.

A potential annual barrage of $2.6trn plus in new total US debt issuance coupled with $600bn in annual debt securities sales targeted by the Fed amidst a) rising liquidity issues in a budding recession, b) mounting private sector and state-level solvency concerns, and c) a concerted global effort to reduce reliance on the dollar in global trade collectively suggest that a surge of US debt coming to market will overwhelm demand at current yields. Said differently, higher returns/yields will be sought by investors — likely much higher yields, especially from today’s near-historically low levels.

Meanwhile, weaker US economic indicators add another layer of uncertainty:

- Sinking productivity growth threatens profits and payrolls alike.

- The personal savings rate, near a 59-year low, keeps falling, limiting consumers’ ability to spend (out of an empty pocket).

- (An 8/31/18 note: the BEA arbitrarily doubled the personal savings rate after this post! Call it a blast from the 2014 past, when the personal savings rate that had been calculated since 2007 as more than doubled, retroactively. More “politically acceptable” numbers magic! No more negative savings rates. Presto. (Similar “magic” has long been been taking place other macro stats such as unemployment, inflation, real GDP, and, by extension, productivity tabulations.)

- A low labor force participation rate and high “real” unemployment (if all discouraged workers were included) further restrict spending vitality, especially given the rise in household debt to a new all-time high of $13.2trn.

- Falling consumer confidence suggests a reduced spending proclivity going forward.

- Higher oil prices/rising pump prices are sapping consumers’ non-transportation spending capacity.

- Industrial production, which is currently below its 2007 high, could be topping out, especially if tariffs keep rising.

Plus, the 2018 US fall election suggests the Fed could suddenly put back on its political hat:

Under Obama, the Fed raised the fed funds rate only once. Under Trump, the rate has been hiked six times. Trump nominated the new Fed chairman, Keynesian Jerome Powell, last November. Midterm elections are around the corner even as the economy is losing steam amidst rising, and perhaps metastasizing, geopolitical — trade war — risks. Could this provide the Fed with the perfect rationalization, even prior to a stock market rout, to revisit its rate and QE toolkit (and surely the Fed would seek to re-inflate a key yield starvation offspring, a pricked equity bubble)? Moreover, the Fed tends to support the party in power, especially if the chairman has been appointed by a sitting president.

Conclusion — it is high noon head for a restrictive Fed amidst an “ecosystem” rushing to the ER:

The Fed has effectively been tightening since it started to reduce its monthly QE as of December 2013, only to end its bond purchases completely in October 2014. Cessation of QE has been augmented by an interest rate tightening cycle since 2016. Now, despite a) unprecedented and growing governmental, corporate, and household debt mountains, b) huge policy-induced distortions and misallocations, c) drooping productivity, d) very poor real wage growth (most new jobs have been low-paying, non-benefit, part-time in nature), and e) a long-overdue “official” recession, the Fed is desperately trying to raise rates enough to be able to lower them! In so doing, a government-defined recession will be hastened, and asset bubbles endangered.

That same Fed is also seeking a reduction of its unparalleled balance sheet so that it can again be expanded when necessity dictates it (protecting the balance sheets of its owners, the money center banks) and politics mandate it. In a nutshell, the Fed appears determined to take away its “cocaine and heroin” and push an economy with the albatross of a toxic public policy stew around its neck (financial repression-enabled statism, cronyism, and redistributionism amidst sustained property rights-shredding, cronyism-abetting regulatory and litigation insanity) over the edge so the Fed “can save it again.”

If the Fed continues its restrictive trajectory both on the interest rate (fed funds rate) and on the QT/bond sales front, it is virtually assuring that the fabricated and overstated economic recovery will implode even sooner. That very reality, coupled with the fact that other major central banks, such as the ECB and the BOE, have just commenced shifts to more restrictive monetary policies, suggests that a forced US monetary loosening could well occur just as a (likely fleeting) monetary tightening occurs elsewhere. An unexpected dollar rout would quickly develop.

Perhaps the yield curve, which is close to inverting, will be our single best guide as to when the Fed needs to “smell the ease ASAP coffee.” An inverted yield curve is a well-known precursor of a recession, having predicted all nine US recessions since 1955 with a lag time of six months to two years. Given America’s fragile economy, …

Talk about a perfect revaluation storm — the dollar down, bonds down (pages 8–9), stocks down, and precious metals up — in the making, otherwise also known as a “reset.”

Or, as a brilliant macro analyst from London so precisely retorted during a recent email exchange:

Your author’s comment to the macro analyst:

A German once nailed it about 25 years ago at a Rubbermaid road show in Zurich. He said to me: “you Americans focus on getting the stock price up, we Germans focus on getting our products right.”

There’s more than a speck of truth to that!

That sage analyst’s response:

Agreed. A good product is the real value. The rest is just a distraction.

The takeaway: the value of a nation’s currency will ultimately reflect a nation’s competitiveness in the global marketplace. Bonds are “currency promises.” And stocks are linked to bonds. Meanwhile, all price manipulations eventually end, and over the long pull precious metals (PM) protect purchasing power against both the ravages of deflation and inflation. Call PM a current “double-dip” satellite allocation opportunity. The likely PM price “uncorking:” a sprightly and unexpected shift from QT back to possibly unparalleled QE by the Fed. The irony that this would be triggered by a Fed-hastened reset will be hard to miss. The good news: “Frankenstein Finance” can be capitalized on.

Sincerely,

Dan Kurz, CFA

This commentary is not intended as investment advice or as an investment recommendation. Past performance is not a guarantee of future results. Price and yield are subject to daily change and as of the specified date. Information provided is solely the opinion of the author at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Information provided has been prepared from sources deemed to be reliable but is not a complete summary or statement of all available data necessary for making an investment decision. Liquid securities can fall in value.