Post #80: Short-lived QT, revisited – we will soon all be Japanese

Metrics and valuations:

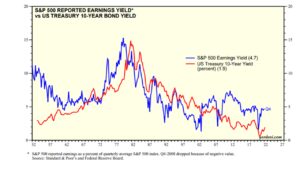

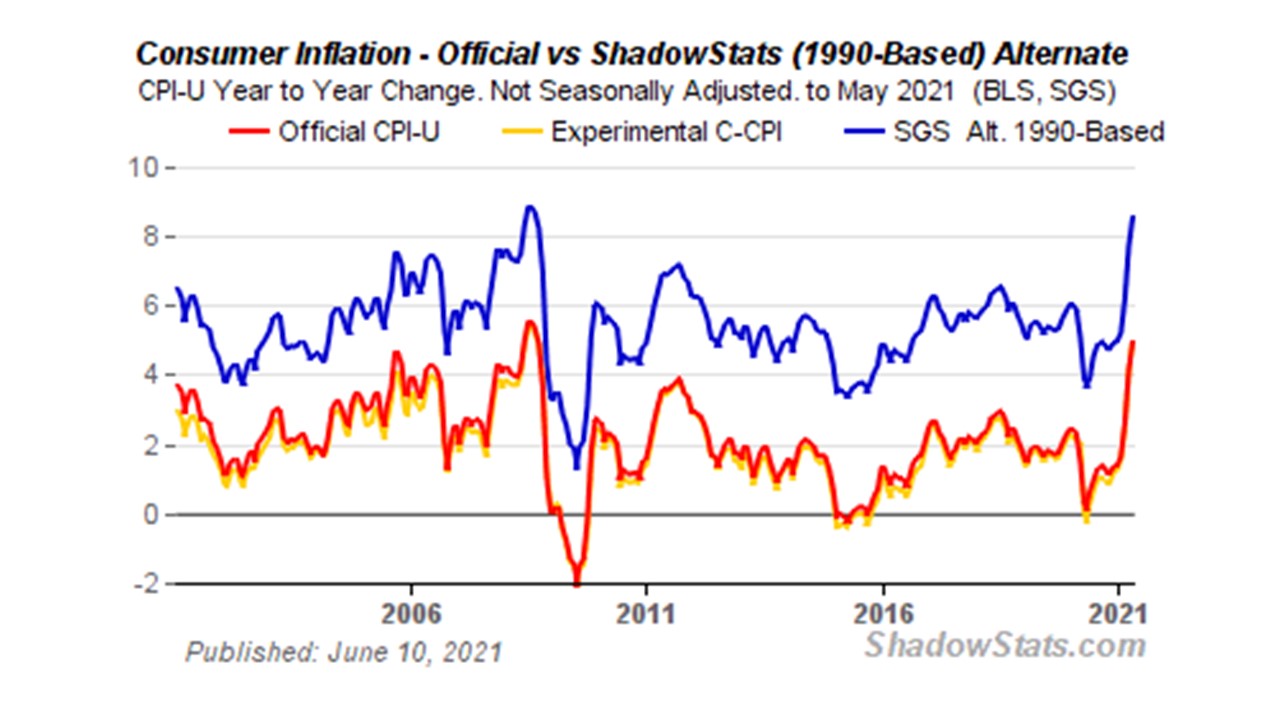

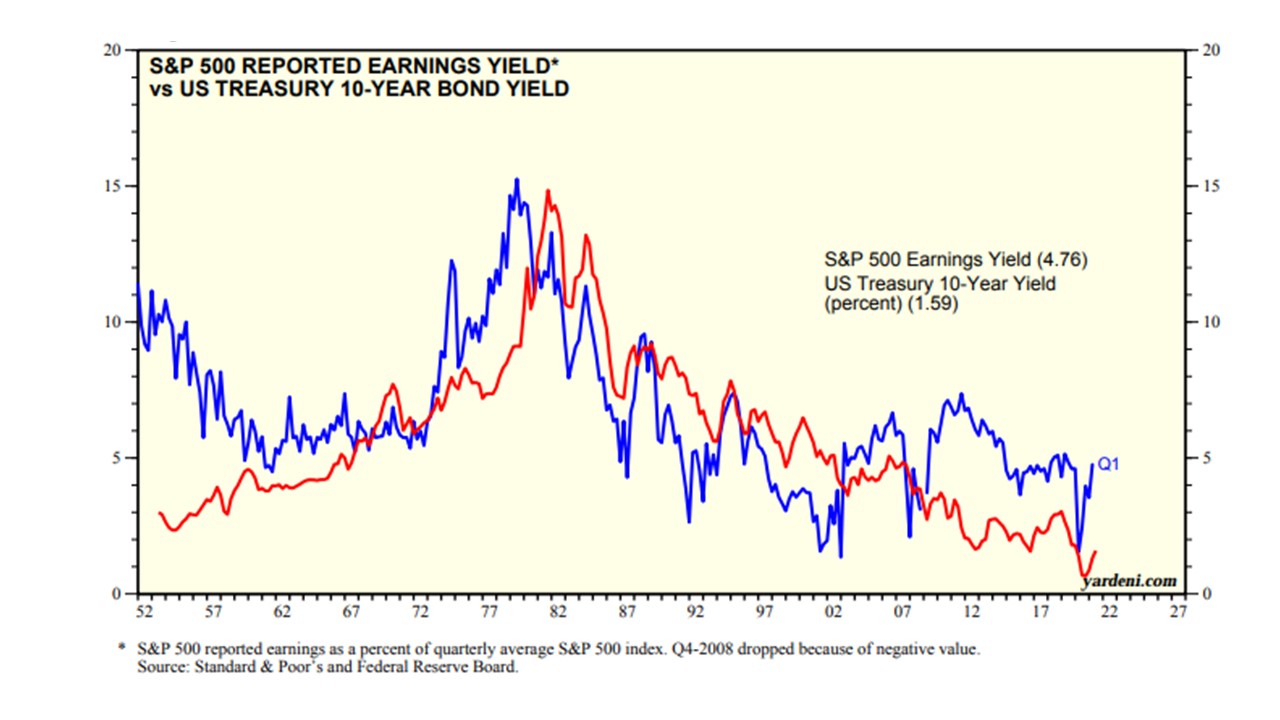

US$:103.2; Fed’s B/S: $44bn short of $9.0trn and down $10bn from prior week; US government debt: $30.4trn; total US debt: $88.3trn or 3.6x US GDP; US net international investment position: -$18.1trn; US 10-yr: 2.8%; the real yield: -14.2%; 700-year average real risk free yield: +4.78%; Vanguard Bond ETF YTD return: -9.0%; CPI: 8.5%; ShadowStats CPI: 17%; S&P 500: 4183; S&P 500 GAAP P/E: 21.1x for a 4.7% earnings yield; Oil: $101.92; Gold:$ 1,884; Silver: $23.37

Post #80: Short-lived QT, revisited – we will soon all be Japanese

The Fed’s balance sheet (sorry about the terrible quality of this graph — please click on link to get a crisp image):

Source: https://fred.stlouisfed.org/series/WALCL

First, a US dollar valuation comment:

As some of you may know, I have long thought the buck tremendously overvalued, especially based on the huge and growing deficits America has at both the governmental and the trade levels. Just as I like free cash flow generating companies, same thing applies for countries and their currencies. Alas, the dollar has long defied gravity, cheering on a hugely negative free cash flow nation and extending America more rope to hang itself with. And it continues to defy gravity and econ 101. There is only one explanation that makes any sense to me whatsoever currently, and it is a tragic thought: with no resolution in sight on the Ukrainian war front — deep state puppet Zelenksy won’t save his own people by declaring the Ukraine a neutral nation, the West refuses to stop arming the Ukraine as both Sweden and critical Finland are being incentivized to join NATO, and Russia most understandably refuses to have NATO and NATO missiles on its border after decades of NATO (the US and its European lackeys) provokingly and accord shatteringly moving east — money/capital could be heading for American shores to distance itself from a potentially frightening and possibly even nuclear war in Europe. God help us all if this happens.

If the ultimate horror doesn’t happen, despite our psychopath politicians, let me ask you this: would you rather own a currency whose central bank prints the money to buy huge amounts of vital goods and commodities that America needs to procure overseas or the currencies of nations that sell them to America and the ROW, very much including the Russian ruble?

Fed QT and Fed QE:

Back to the topic of this post, namely short-lived QT, revisited, a topic that I have published on numerous times, including in Post #44, where one of the sections was titled: “That Fed QT (bond sales) will morph into record Fed QE (bond purchases or debt monetization) amidst reversion beyond the mean.” Note that between November 2016 and September 2019, the Fed’s balance sheet fell from $4.47trn to $3.78trn, a reduction of nearly $700bn over 2.8 years, or an average annual reduction of $250bn. Please see the Fed (fred) link above for both the depiction and the balance sheet numbers upon which the graph is based.

From that $3.78trn low point, the Fed’s balance sheet, mostly consisting of short-term US debt and to a lesser degree mortgage bonds, has ballooned to $8.96trn in just 2.7 years, an increase of 137% or a whopping $5.2trn. Makes the $700bn balance sheet reduction over a similar time period look puny.

The Fed’s counterfeiting — or bond purchases, most recently at the rate of $125bn per month or $1.5trn p.a. — has not only soaked up bonds, in the process creating an artificially low yield (financial repression or the enablement of outsized government spending and deficits), but the central bank bond purchases have increased the monetary base by a similar magnitude, again opening the door to widespread growth in the money supply in a fractional reserve monetary system such as ours/the world’s.

That same Fed now wants to revisit QT (if it ever gets off the ground), which is the same as shrinking its balance sheet or the monetary base. The Fed has targeted selling bonds at up to a $95bn monthly clip, which amounts to $1.1trn a year in bonds that it will sell, in the process taking the same amount of money out of the system. Mopping it up, if you will. (And this is prior to considering the leveraged impact this will have on a fractional reserve monetary system, which traditionally has been 10:1.)

Now, $1.5trn in less money created/printed coupled with $1.1trn p.a. of money absorbed and effectively disappearing from the monetary system spells a sea change of $2.6trn p.a. in liquidity. That’s huge.

Juxtapose this against a fiscal 2021 US federal deficit of $2.8trn prior to a formal recession. This is a spending binge-fueled deficit: Congress enacted a whopping $7trn in new spending over the past 18 months. The deficit, which is already expanding markedly half-way through fiscal 2022, will likely bloat by $1trn to $2trn given lower tax revenues and higher transfer payments associated with an even stouter recession (than the one I am convinced we are in currently). Said would be prior to another $5.8trn in the spending pipeline on redistributionist entitlements ($1.8trn) and on green energy cronyism ($4trn), which, if enacted, would pulverize leveraged output (productivity!), property right protections, and energy affordability even further. The gathering recession will feature significant job losses, greatly reduced consumer purchasing power, and heightened poverty in an increasingly stagflationary environment — official US consumer inflation is now running at 8.5% on an annualized basis or about 17% p.a. in street terms. As such, in a deepening recession the federal deficit could be even larger than $3.8trn to $4.8trn as goods and services people need continue to get ever pricier and those that they want, yet have to forgo, inevitably become cheaper, but define neither Main Street consumer inflation nor do they offer material “affordability relief.” That affordability relief will have to come from heightened, deficit-widening transfer payments, especially in election years — think 2022.

Also juxtapose Fed QT against a trade deficit in goods and services moving into the $1trn plus range annually, and you have a financing dilemma that by definition will exert substantial pressure on the cost of money (up to 12 months in duration) or capital (more than one year in duration).

In aggregate, if the Fed really commences with substantial and sustained bond sales, about $2.6trn in less liquidity will be set against something on the order of $3.8trn plus in federal government deficit financing needs in a mounting recession (note that average total federal receipts amount to “only” about $4trn in a non-recession year, about $2.5trn below total federal outlays). Moreover, and as observed, Fed QT or bond sales would not only make it substantially more difficult to finance a $1trn trade deficit with foreigners increasingly reluctant to finance US deficits, but foreigners looking to front run or at least “ape” the Fed may even begin selling some of their net US dollar-based assets of over $18trn, especially given the growing weaponization/politicization of the US dollar and thus its declining transactional allure and significance. And yes, the US is a net overseas debtor of over $18trn, meaning if foreigners really sought to jettison dollars for other transaction currencies (think of Russians selling natural gas in rubles or the Saudis eventually selling oil in renminbi) in which to conduct international trade, the buck would collapse and US inflation would go through the roof. All said, there could suddenly be a major, multi-trillion-dollar shortfall of capital to finance something like $4.8trn in USD-based financing needs at the governmental and trade deficit levels BEFORE any net sales of US assets by foreigners. And the Fed wants to sell bonds?

Short of WWIII, please tell me how this won’t ultimately result in higher, potentially significantly higher, interest rates as a heavily indebted American private sector, both corporate and households, will require a greater incentive to even consider purchasing government bonds now that the Fed wants to get out of the game on the one hand and even sell bonds (QT) into the market on the other hand.

To add insult to injury, a misallocated, $1.9trn annual compliance cost American bubble economy with ever more regulatory cost and regulatory insanity that also has a) total interest-bearing debt of $88trn, b) short-term financing, and c) a de facto increased interest expense of roughly $880bn for every 100 basis point (one percentage point) increase in the average cost of financing is a very fragile economy indeed. As a percent of US GDP, $880bn amounts to a chunky 3.6% of national output. A 200 basis point increase, which would correlate with a 4.8% “risk free” rate of return on a 10-year US Treasury bond, a level not too far above its average multi-century yield of 4.5%, would amount to $1.76trn in additional interest expense, or a whopping 7.2% of current GDP, an economy killer. A 15.84% yield on the 10-year Treasury, or the previous peak in investment grade bond yields back in September 1981 when America was much less leveraged and was still a net creditor nation to the tune of over $227bn, would result in a $11.44trn higher financing cost, which would equate to 46.8% of current US GDP, an obvious impossibility but of illustrative use in terms of depicting how unsustainable our financing has become even if creditors accept smaller negative real returns instead of demanding positive real returns. (Note that a 15.84% yield on the 10-year Treasury would still be below current real world consumer inflation of 17%, a rate poised to go higher, possibly substantially.)

I’ve long called our Frankenstein finance and economics the progeny of a highly toxic public policy stew enabled by the printing press. A wealth of nations’ poison that punishes savers and thus stunts real (versus printed) capital formation with which to invest in order to facilitate both productivity and organic growth — you can’t have free market capitalism without capital, and sustained crony capitalism only works wonders for the fascist elites while threatening reimposition of serfdom for the masses. Now consider this epic mess against the backdrop of a grossly misallocated bubble economy and the long-standing, misallocation-enabling zero interest rate policy that, together with unprecedented Fed money printing and foreign financing of US deficits, has resulted in deeply negative real US interest rates of around MINUS 14.2% (a 10-year Treasury yielding 2.8% less 17% real world consumer inflation). The deeply negative real rates promise to stoke even more inflation and even more malinvestment and redistributionism from non-crony, Main Street makers to takers from K Street to illegal aliens while it fleeces creditors, pension funds, and grandma. How long until bond vigilantes return? Will they want to sell their vulnerable low-yielding bonds, which are already closing in on a -10% return only four months into 2022, together with the Fed before they decline further, or will they start front running the Fed?

Moreover, dwell on a 40-year bond bull market that is set to reverse powerfully into a very deep and long bear market given our extreme money printing induced indebtedness, raging inflation, and ever-growing solvency risks in public and private sectors alike. Again, the only ugly caveat here would be if the Russian/Ukrainian war spills over into wider Europe, which would then cause a flight into the dollar, again letting America get away with fiscal, monetary, and rule of law “murder.” In fact, this may already be occurring. This is the big wild card, although obviously no one will be able to hide if the war goes nuclear. Then the only concern will soon be survival. Globally. In other words, everything else will be rendered academic.

Assuming we are spared such a horror despite our psychopath politicians, how long does the Fed think it can carry forward a tightening policy in an over-indebted economy with short-term financing on the one hand and asset bubbles that rising interest rates would pop on the other hand? It was already tried between 2016 and 2019, and it was an utter failure. Debt, grotesque misallocations, cronyism, Coronacrat Main Street destruction, and even more onerous, freedom and property rights pummeling decisions, legislation or regulations, including even more insidious social, environmental, corporate, and government engineering, promise to increase the political and economic straight jacket further still, requiring yet more money printing as the economy and the enabling productivity wilt in progressively more pronounced terms. To wit (please note that productivity growth not only underpins economic growth and enhances consumer purchasing power, but it tempers inflation — in fact, each secular growth company IS a deflation story):

Nonfarm business sector labor productivity decreased 7.5 percent in the first quarter of 2022, the U.S. Bureau of Labor Statistics reported today, as output decreased 2.4 percent and hours worked increased 5.5 percent. This is the largest decline in quarterly productivity since the third quarter of 1947, when the measure decreased 11.7 percent.

Therefore, look for a rapid, even more outrageous return to QE and a reversal of any baby steps on the Fed Funds rate front sooner rather than later, which, in a high inflation landscape, promise to increasingly entrench consumer goods inflation and add even more pressure on the dollar’s reserve currency and leading commercial currency (the petrodollar) role beyond that which is already beckoning in Russia, China, Iran, and Saudi Arabia. Add to that the corporate shift from just-in-time to just-in-case (it costs more and is unavailable) inventory practices, consumer hoarding, the rising proclivity to spend increasingly rapidly depreciating dollars, euros, pounds, and yen, and you have the HUGE global increase in the monetary base of leading central banks all the sudden getting a lot of money multiplier traction to yield way too many counterfeit currencies chasing a deficit of goods and services made much worse by the “plandemic” lockdowns and the related supply chain destruction.

Stagflationary investing and inflation:

Allocation advice: get out of incredibly overvalued bonds, get out of non-resource focused equities that sell things you want but don’t need, especially hyperinflated growth stocks in the tech sector that will suffer most when economics again trumps politics and real interest rates go from about -14.2% in the US back into positive territory. Consider increasing your exposure to the vital ag/food and dense energy arenas because this is what people won’t stop buying; it’s what they need to survive. In the reallocation process, raise liquidity, and, when you do that, opt to start or increase your allocation to physical precious metals in your possession. And recall this: if you can’t touch it, you don’t own it, which also goes for stock certificates. Physical precious metals are not only a store of value that protects purchasing power over time, but gold and silver could prove to be money on steroids once confidence in our sick world being able to sustain itself wanes, making precious metals a source of funds on steroids with which to purchase Blue Chip crony stocks once they again sport single digit P/Es/double-digit earnings yields (figure 10, page 7 — or, please see chart below) and high single-digit dividend yields. We saw this in the stagflationary ’70s, and this time around valuations ought to be even more enticing because our stagflation will be much, much worse on the heels of decades of terrible fiscal, monetary, regulatory, and economic policy which have crushed productivity growth and brought us record debt.

Source: S&P 500 Dividend & Earnings Yield (yardeni.com)

Precious metals dry powder may also be useful for purchasing investment grade bonds, i.e., if there will be any left, that again offer double-digit yields thanks to investors demanding such returns to offset outsized inflation and insolvency risks. Reflect on the late 1970s and into the very early 1980s as a preview of coming attractions, revisited. Today’s investors will also increasingly balk at buying ever more bonds thrown on to the market given firming stagflation, in the process ultimately demanding positive real yields, at first only at the margin, then much more so. This is because neither ZIRP nor NIRP help defined benefit pension plans generate the 7% – 8% annual returns they need to avoid eventual insolvency much less meet their payment obligations in nominal dollars or other fiat currency terms. It is also because bond losses will multiply as a secular bond bear market establishes itself, adding to the sting of yield starvation on the one hand and mandating double-digit yields on new bond commitments in order to have any chance at all of meeting commitments made to pensioners on the other hand, something an even greater coming glut of bond issuance ought to underpin. In short, boom-bust history will repeat. Take advantage of bubble valuations to position yourself correctly as time grows short for the inevitable bond and stock busts that will make today’s negative returns (-9% YTD in bond land) look good in comparison.

Speaking of stagflation or negative real growth accompanied by rising inflation, it will continue to percolate given a massive, utterly unprecedented expansion in the domestic and global monetary base, widespread and lingering “plandemic“-triggered sourcing and production issues, and, last but not least, a huge change in inflation psychology. We are looking at the beginning of a secular story. As alluded to above, a “crack up boom” is on the horizon as corporations and people will increasingly want to unload depreciating currency to stock up on inventory and to buy vital real goods, respectively. Progressively more negative real interest rates will add even more incentive to borrow cheaply and purchase progressively more expensive “scarcity assets.” And a weak economy defined by consumers’ wages and salaries continuing to broadly lag services and goods inflation, likely by growing amounts, will ironically usher in a return to QE, Japanese style, from what I am convinced will be very abbreviated QT for political reasons. That last shoe to drop will turbocharge inflation, i.e., until governmentally-imposed “wage and price controls, revisited” prove to be yet another supply side hammer, worsening both scarcity and (black market) inflation, in the process driving another nail into the economy’s coffin while further fraying the social compact, a horrific double-whammy.

For a precursor of what is ahead at the consumer price level, consider that US producer prices surged at a historic 11.2% annualized rate in March, (again) handily outstripping annualized “8.5%” consumer inflation and way ahead of annualized wage gains of 4.7% during the same month. Even more significantly, US import prices surged at an unprecedented 12.5% annual rate in March as export prices rocketed 18.8% higher YOY, also a record, indicating a) that sanctions-impacted import prices will continue to surge despite a strong dollar and b) that domestic prices will eventually surge in sync with how much more exporting corporations are charging their foreign customers. And remember that consumer inflation and economic weakness go hand in hand in fiat currency economies.

Note that there are pundits pointing to the “global” deflationary impact from rising prices of goods and services that you need, such as food, energy, lodging, and insurance, and those that you want, such as Netflix streaming and Disney entertainment, which will come under pressure – as if this will moderate overall inflation substantially in a fiat currency world. As said, it won’t. Things that you need will go up in price in the process absorbing an ever-greater portion of our liquid means, and things that you want but don’t need will suffer less demand and less pricing power. This is called Main Street price inflation, and thus national price inflation, which the Fed and other central banks will inevitably stoke even further in an effort to rescue their asset bubbles, their political friends’ election prospects, and, as regards the Fed, the money center bank balance sheets and earnings – in short, the balance sheets and earnings of the Fed’s owners. For perspective on just what central banks will do to save asset bubbles, consider the BOJ’s decision to launch unlimited bond purchases to keep the 10-year JGB from rising above 0.25% as inflation in Japan and in Germany is soaring on the back of supply chain disruptions, Western sanctions against Russia, and of course unprecedented counterfeiting by the BOJ over decades and the ECB since 2008. This is called spiking the inflationary punch bowl. We will all soon be Japanese.

Separately, pundits are also pointing to the potential deflationary fallout from substantial illness and deaths from the Corona virus clot shots. As you may be aware based on various publications on this topic, I share that horrific concern at the health level, but not at all at the consumer price inflation level. Think about the former USSR long suffering under a declining population, low life expectancy, and a large Vodka problem. Did that prevent hyperinflation in that former country? No. Do shortages, lacking medical care, and starving people prevent hyperinflation in North Korea? No. Do wars, falling output, and genocide prevent hyperinflation in African nations suffering from same? No. HELLO, pundits, time for a reality check in a fiat money world with paper and electronic printing presses! It’s like the incessant babbling about “reversion to the mean.” There is no reversion to the mean, only beyond the mean, otherwise known as asset bubbles and busts. That mean valuation level of bonds and stocks is but a rare moment in time on the way to a bubble or a bust, and we’ve been in bubble land for an unprecedented period of time. Markets, just like the humans that create them, have manic depressive tendencies.

In terms of how to position your investable assets for our world, think beyond the Fed and ECB hype and their baby steps regarding raising central banks’ short-term rates to a level that will still be way below consumer price inflation, both as regards the fake CPI and real-world consumer inflation, which is roughly twice as high and rising. Think beyond central bank balance sheet reductions (selling the very bonds that investors don’t want thanks to negative real yields and rising inflation and solvency risks). Just like before, and just like the BOJ today, the Fed and the ECB may well institute open-ended counterfeiting to hold down long bond yields while enabling even larger negative real yields at the short end of the curve they control. Ultimately, the world’s leading central banks will lose both the inflation war and the interest rate suppression war, in the process pushing nations into insolvency, economic chaos, and political instability, a horrific fiat currency legacy, revisited.

THIS TIME IS DIFFERENT, the four most dangerous words in the investment business! Why will it be different this time? Why will there be no “happy ending?” Because the globally unparalleled monetary inflation genie can’t be put back into her bottle and because monetary policy changes typically have a substantial time lag – think of how long it took to really get “official” (deeply understated) price inflation cooking after the initial off-the-rails global money printing binge back in 2008, a binge that can no longer be absorbed or contained in a collapsing bond bubble. Add the deficit-laden fiscal and toxic regulatory policy into the mix, which (I am convinced) has so eviscerated productivity growth, and then consider our gaping retirement underfunding, which politically can only be met with even money printing to at least meet commitments in nominal dollar and other fiat currency terms, and the post #80 title may make even more sense, i.e., until our fiat currencies are increasingly repudiated, which is also why you will want to have at least a physical precious metals insurance policy.

Conclusion:

Investors should be selling long-duration bonds and stocks before central banks do for a spell, and then selling them to the central banks once they follow the BOJ’s lead to initiate unlimited bond purchases to keep long-term rates from rising above 0.25% in the Land of Nippon. And take the gifts from our serial counterfeiters and bubble blowers to increase your exposure to assets that people will need, especially in the secularly challenged ag and dense energy patches (there is a low single-digit P/E fire sale going on in Russia right now also known as Gazprom shares!), two industries that I have been recommending exposure to over the past nearly 13 years, including during my tenure as thematic strategist at Credit Suisse’s CIO Office, and as DK Analytics posts, videos, and reports bear out.

Sincerely,

Dan Kurz, CFA

DK Analytics

The obligatory boilerplate:

This commentary is not intended as investment advice or as an investment recommendation. Past performance is not a guarantee of future results. Price and yield are subject to daily change and as of the specified date. Information provided is solely the opinion of the author at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Information provided has been prepared from sources deemed to be reliable but is not a complete summary or statement of all available data necessary for making an investment decision. Liquid securities can fall in value.

FYI: select edits, grammatical improvements/corrections, and/or additional links have been incorporated into this post past the initial publishing date of April 27th, 2022. That said, neither the thrust of the piece nor the overarching message that was communicated at the initial publishing date have been altered in the slightest.

Post #79: Federalism to the rescue? Gov. Ron DeSantis (R-FL) decried lockdowns and mandates

US$: 92.75; Fed’s B/S: $8.3trn; US debt: $28.7trn; US 10-yr: 1.4%; S&P 500 P/E: 34; S&P 500: 4513; Oil: $69.32; Gold: $ 1,788; Silver: $24.07

Post #79: Federalism to the rescue? Gov. Ron DeSantis (R-FL) decried lockdowns and mandates — while promoting monoclonal antibodies

(Please scroll to bottom of page for post publication updates)

Federalism led by the Sunshine State government

Very impressive and much too rare in today’s age. Freedom over tyranny. Science and statistics over lies, scaremongering, oxygen deprivation, and unconscionable, forced vaccinations of the very cohort, young people, that are least likely to succumb to the Corona virus. Sanity over destructive insanity. Humanity over inhumanity. Sovereignty over a wide open southern border. And penalties for FL-based employers, both public and private, that demand Corona virus vaccine documentation, which the Sunshine State governor and legislature view as infringements of 4th Amendment privacy rights and, I strongly assume, as infringements of unenumerated, yet inalienable rights codified in the 9th Amendment. In short, penalties for documentation demands that threaten employee discrimination and termination and violate state and federal medical privacy rights are being addressed by the pivotal executive and legislative branches of the Florida State government.

Isn’t this what we should expect from every governor who took an oath to uphold his/her respective state’s constitution, which closely mirrors the US Constitution to which the original states gave birth, and to which every state is bound, as concerns the Bill of Rights protections for all Americans, thanks to the 14th Amendment to the US Constitution? Isn’t this what we should expect from every state level legislator that took the same oath, especially if the federal government acts tyrannically, i.e., if the separation of powers doctrine between the legislative, executive, and judicial branches, clearly enumerated and limited powers, and the 10th Amendment enshrined into the US Constitution fail to prevent tyranny and uphold freedom? Isn’t it then — now — up to the states, which gave birth to the US government and clearly “ring-fenced” its power over both states and individuals, to fight for a revival of the very inalienable rights protections they insisted upon when drafting and signing off on the US Constitution, very much including the incorporation of the Bill of Rights?

Federalism in limited, but stout action:

Go Freedom Ron! Go Florida State legislature, which has worked with the governor to recover various inalienable rights that were indefinitely and unconstitutionally suspended or stripped from the people of Florida by tyrannical bureaucrats at county, state or federal levels. These usurpations were either:

— A violation of the 10th Amendment to the US Constitution assuring substantial state and citizen rights not explicitly delegated to the United States in the federal constitution

— And/or a violation of the Takings Clause of the 5th Amendment thanks to prolonged, bankrupting lockdowns imposed especially on small businesses and churches

— And/or a violation of the US Constitution’s Commerce Clause, whose prime purpose is to underpin international and interstate trade at the federal level, not to impede it, as per the CDC’s long-standing sailing ban, which Florida succeeded in getting overturned

— And/or a violation of other aspects of state or federal statutory or constitutional law that protect the rights and powers of individuals while limiting the extent to which government can “lord over them,” very much including daily masking up, for up to eight hours a a time, five days a week, of the very school children that are at virtually zero risk to the Corona virus, even if parents opposed it.

How did the Florida legislature specifically reinstate greater freedom for Floridians? Via new bills issued by the legislature which were signed into law by the governor to ban unconstitutional usurpations (“Governor Ron DeSantis Signs Landmark Legislation to Ban Vaccine Passports and Stem the Tide of Local and State Government Overreach“) and, in truly landmark fashion, to end increasingly destructive indoctrination over education. Recall that statutory laws, which have deference only to constitutional law, or the supreme law of the state (and country), have constitutional primacy and legitimacy over any executive orders issued by governors, the true nature of which is not legislation, but to execute statutory law in a constitutional order where only the legislature gets to legislate, not the executive or judicial branch, or an un-elected, unaccountable bureaucracy, as is befitting of a representative republic featuring separation of powers. Plus, executive orders are easy to overturn, as we have seen since the early days of the Biden administration. Legislation, in contrast, is much more strictly construed and harder to overturn, much as it is harder to institute, as it requires majority votes in both legislative chambers in favor of a bill (would be legislation) as well as the governor’s or the president’s signature to become a new statutory law.

I’m also referring to the fine Republican Florida legislature working in tandem with a liberty-loving, gutsy, common sense Republican Florida governor who put out the first executive order by any governor in the nation on September 25th, 2020 to end months of mandates and lockdowns. These are mandates and lockdowns which made a mockery of 5th Amendment property right protections. In the process, they have ruined so many small businesses (the Corona virus policy insanity and tyranny has resulted in 44% less small US businesses) without leading to lower Corona virus death rates per 100,000 residents since January 21st, 2020 in heavily locked down states such as Pennsylvania, Michigan, North Dakota, and New Mexico.

Furthermore, I’m referring to the Florida legislature working with the Florida governor to eliminate mask mandates and forced vaccinations, which eviscerate bodily integrity protections clearly afforded by the encompassing 9th Amendment, as well as by the God-given right to breathe freely and to determine which substances we allow to enter our bodies. As regards the latter, I’m not only referring to the executive branch working with the legislative branch to make “vaccine passports” illegal in Florida — and, by extension, adding teeth to statutory law by fining public or private employers that insist on such information $5,000 per (reported) incident — I’m referring more broadly to Florida preserving the pivotal, constitutional right of medical privacy and overall privacy, for if you have no privacy, you clearly have no freedom.

Finally, the elimination of Corona virus mandates (distancing, capacity limitations, masks, vaccinations, etc.) and lockdowns thanks to the Florida State government striking down unduly, irrationally, counter-productively, and unconstitutionally imposed diktats, whether at the county, state or federal level, is all the more sensible given the following truisms: first, if masks work, then the masked are protected against the unmasked, so why should the masked worry about the unmasked? Second, if inoculations work, then the inoculated are protected against getting infected by the Corona virus, so why should they worry about the uninoculated?

Isn’t it wonderful when politicians uphold their constitutional oaths, and when this dovetails with science, i.e., as long as same hasn’t become politicized, which has sadly become more of an exception than a rule? Isn’t this how it is supposed to be in a country that has the most constitutional individual freedom and inalienable rights protections? A constitutional, federalist, representative order is designed to protect individual liberty, maximize local decision-making authority, and limit the reach and tyranny of the federal government. Why isn’t every governor and every state legislature, or at least the vast majority of red state governors and legislatures, doing exactly what the Florida governor and legislature are doing here and elsewhere when constitutionally protected inalienable rights are being usurped, especially by fascistic, demonic Coronacrats? Didn’t state level politicians swear to uphold their state constitutions, in which inalienable rights protections are an integral part? Therefore, shouldn’t our elected representatives become very active when these rights are being taken away by any source, be it bureaucratic, judicial, corporate or other? And even if neither the governor nor the legislature can trump judicial tyranny in the short-term, at least they can make a principled stand against it and take their appeal to the ultimate sovereigns, the people, so that the state level legislature gets “we the people support” to reconfigure courts (via new appointments as judges retire — no “court-packing” — or via more prevalent term limits) or even to impeach unconstitutional judges, which a liberty-loving governor such as Ron DeSantis would certainly back?

Will Florida’s federalism revival fail to get coattails? (Please scroll down to post publication developments that I want to “carve out” at very bottom of this piece.)

What the heck is wrong with all the governors and legislatures falling down on “job one,“ especially in “red” states? Where are all the “other Floridas?” We’re going to need much more than just one state really endeavoring to consistently peel back federal, bureaucratic, and judicial tyranny, which is all the more urgent given how incredibly unhinged and destructive the US government has become be it fiscally, monetarily or culturally. Have the deadbeat governors and the legislators been bought off by the feds or by Corporate America? Have they been blackmailed? Are they spineless wimps? Do they not understand the oaths they have taken to uphold their states’ constitutions? Or, are too many of them fully aware of the oaths they’ve taken, yet are too addicted to the power and rush of despotism or to the allure of unimaginable financial gains thanks to fiat money-enabled redistributionism and cronyism, respectively? In other words, constitutions, oaths to uphold them, decency, sovereignty, freedom, and humanity be damned? Or, are such governors and state legislators utterly convinced that they will be able to sustain their privileges and wealth as the country and living standards crumble? Or, are our elected leaders simply reflections and manifestations of an increasingly uncivil society more interested in handouts and alleged safety over precious and rare freedom married to personal responsibility?

Whatever is going on, none of it is good. None of it augurs well. To the contrary, happy federalism exceptions notwithstanding, including fighting federally mandated vax tyranny (please scroll down to very bottom of post). Will more slacker state legislatures address the pivotal 2020 election fraud and unconstitutionality, in the process re-asserting their federalist constitutional right and duty while moving to mitigate the risk of “electing” another illegitimate president. Ultimately, people get the government they collectively deserve, freedom lovers and the blueprints to sustain them and free market capitalism — and thus the wealth of nations — be damned.

Fortunately, there are some signs that more and more Americans are ready to ignore the Coronacrats’ unconstitutional diktats on the masking front, on the physical distancing front, on the lockdown front, and on the socially, emotionally, and physiologically disastrous “stay at home and isolate” front. Not only are everyday Americans increasingly aware of the Coronacrats’ hypocrisy regarding “all that,” whether it is how they lead their own lives or how they conduct their lavish, unmasked parties, or when the leftist elites’ favorite unmasked anarchists demonstrate and smash innocent citizens and their property (that long, hot summer of 2020), but more and more Americans are gathering peacefully in large numbers in a natural, healthy, happy, and social manner, whether it is at July 4th festivals in small town Florida or at late summer ball games across America:

Enough such Americans, endowed with the requisite civil courage, civic duty, ethics, common sense, and honesty engaging in sustainable behavior — especially when they are totally sober and their like-minded buddies aren’t nearby, but a tough, every day situation “singles them out” — will be required to counter a long-standing, increasingly self-mutilating societal collapse; a “Jonestown” event at the national level (much the same can be said for the majority of OECD nations). Perhaps, just perhaps, enough such Americans will in fact encourage reticent state level leaders to revisit the oaths they took and push them into tyranny-defusing policy action.

In any event, “freedom field generals,” such as President Trump and Governor DeSantis, will very much need at least a small “army” of such Americans ready to also nullify (“no, we won’t close” or “just say no“) unconstitutional, freedom-robbing decrees if society is to have any hope of restoring inalienable rights and the rule of law. A general can’t lead a fight against a cancerous enemy — a despotic, deeply entrenched, destructive, lawless, rent-seeking enemy that controls virtually all institutions — wanting to eviscerate the last remaining vestiges of individual freedom, Main Street property right protections, and constitutional fidelity without at least a stout minority of “we the people” being on the “battlefield for liberty.” This is even true, no especially true, if it seems like a lost cause, and even if it will often feel very lonely, at least initially. Last but not least, this is all the more true given what is sadly obvious, and was presciently predicted would occur some 64 years ago, namely today’s status quo:

“When you see that trading is done, not by consent, but by compulsion – when you see that in order to produce, you need to obtain permission from men who produce nothing – when you see that money is flowing to those who deal, not in goods, but in favors – when you see that men get richer by graft and by pull than by work, and your laws don’t protect you against them, but protect them against you – when you see corruption being rewarded and honesty becoming a self-sacrifice – you may know that your society is doomed.” ~ Ayn Rand

Or, a tyrannical, increasingly centralized status quo formulated brilliantly and frighteningly by Mark Levin:

“They (the statists/lefists) created a massive leviathan, they want to double its size in two weeks, and they’re using this leviathan, which is an appendage of the Democratic party and visa versa, let’s be honest — so they’ve used the CDC to go after landlords and guns, they’re using OSHA to go after the “unvaccinated,” they are using the Department of Education to violate federalism and the 10th Amendment and to go after a governor (Ron DeSantis). … You can see the enormous destruction to our constitutional system, to the police powers of the states, to undermining of states’ authority vis-a-vis their school systems, the centralization of power that is taking place whether it is the virus, whether it is taxation, whether it is voting, we are under assault. The entire system is under assault.

Some portfolio allocation food for thought given our status quo:

How does this all tie in to asset allocations and asset prices? Like this: in an age of fiat government and fiat money and the resulting cronyism, increasing redistributionism from makers to takers, ever-rising regulatory complexity impediments and an estimated $1.75trn in annual regulatory compliance costs for the small business backbone of the economy, evisceration of price discovery (imperfect, albeit it sound market-based allocations underpinning productivity enhancement and rising standards of living), ZIRP and QE-determined asset valuations, and the unsustainable rise in debt fathered by artificially low interest rates, most assets are mis-priced, and real economic growth prospects are going from bad to worse — which will require even more electronic money printing! Talk about a vicious cycle. In the interim, the valuation disconnect between the very bonds and stocks most impacted by fiat money and the underlying economy most distorted and ravaged by unsound money and unconstitutional government remains both the reallocation (away from overvalued assets) opportunity and the overvaluation risk for accounts featuring substantial exposure to those bubble valuation assets.

In a related manner, and I know you’ve heard this from me too many times, it will behoove investors who are ignoring Mr. Market’s boom to bust history to stop ignoring it and to instead ignore the perennially self-serving Wall Street advice to stay “fully invested” in so-called traditional assets. Specifically, investors should prepare themselves for the long overdue and inevitable reversion from today’s overvaluation boom to “tomorrow’s” undervaluation bust. That bust will result in bond and stock valuations that will make mean valuations such as a 4.5% yield on a 10-year Treasury and a P/E on the S&P 500 of 16 look like bubbles. Consider realizing the “bubble-blowing” valuation gifts in bonds and stocks still on offer. Consider reallocating a material portion of your investable portfolio elsewhere. To gain incredibly valuable “optionality,” start by purchasing short-term government bonds of OECD nations that have no interest rate risk. Put up with ZIRP and nominally negative real yields to to avoid a very stout interest rate-induced bond and stock valuation compression (please see figure 10 and hone in on the graphed section between 1970 and 1981), also known as sharply rising interest rates. For framing purposes, recall that the 10-year Treasury’s yield topped out at over 15% during 1981, a point in history when America had a hugely better balance sheet and manufacturing base, and an incomparably smaller monetary base in both absolute terms and, more importantly, relative to the size of the economy. Said differently, bond valuations stand to get drubbed even much more significantly than they did in the late ’70s and into the early ’80s, especially when considering our historically low bond yields.

Furthermore, as regards purchasing US T-bills or their foreign equivalents, count on fiat governments putting their fiat banks’ printing presses to work to repay you when you invest in short-term government bonds, should tax collections fall short, which they invariably will, and already are, by increasingly gaping margins. Then capitalize on that “optionality” to venture into attractively-valued real asset investments, an investment window that could well appear on a fleeting or tactical basis thanks to a “risk-off” persuasion associated with increasingly pronounced economic weakness. Invest in particular in the vital and scarce energy and ag arenas. Such assets will become even scarcer and more valuable over time (strategically) as the last remnants of free market capitalism threaten to disappear throughout developed nations. Perpetually rising crony capitalism and fascism will serve to further fuel unrivaled currency debasement (ZIRP and $120bn of monthly QE in the US), as they and other forms of plutocracies or oligarchies always do. Meanwhile, amidst spreading signs of increasingly intractable parts shortages, rapidly rising producer price inflation (both the inevitable progeny of virus policy-induced supply problems), an inescapable move away from just-in-time inventory to getting stocked up, sustained policy incentives not to work, progressively more strident vax tyranny, and unparalleled money creation over the past 15 years starting to move from the financial economy to tangible assets, we may be on the brink of igniting the mother of all stagflations. (Note that hyperinflation has always accompanied economic weakness and usually outright contraction.)

Last but not least, and especially if the stagflation of the ’70s and early ’80s was but a “warm up” of what is ahead, don’t forget to get portfolio insurance, also known as physical silver and gold. Such an allocation, if only of satellite size, could well offset, and potentially even overcome, those assets in your portfolio that get substantially repriced to the downside, despite timely repositioning efforts away from bubble valuation assets. This way, if what remains of inalienable rights and sanity gets taken away together with much of your property, at least you’ll have some discreet and transportable wealth which will be poised to explode in dollar and other fiat currency terms. Said could prove highly valuable in terms of procuring adequate amounts of energy, food, and other critical supplies and tools down the road as our economic system breaks down. Bullion may also prove useful to bribe corrupt government officials or border guards, should that become necessary. Monetary, economic, and political history unfortunately tells us such bribes may again occur in the developed world. Sadly, this time around, they may well first become common in the biggest banana republic of all in the making, the US, with much of the erstwhile rule-of-law developed world a few steps behind, but heading to, and then off, the same cliff.

And if, against all odds, spreading federalism abetted and enabled by civil courage can help return us to a liberty-drenched, representative, constitutional republic, then those freedom-loving individuals that have the means to underpin and propel such a wonderful outcome may be able to play a critical role not only to benefit themselves, their family, and their friends, but on behalf of future generations that will also yearn to live free, a desire as natural as breathing. After all, this is precisely what the unparalleled American Founders and Framers bestowed upon us, at tremendous cost in blood and treasure for hundreds of thousands of Americans at the time. It would be nice if we could take a page out of their “Mission Impossible, Made Possible” book.

Sincerely,

Dan Kurz, CFA

DK Analytics

The obligatory boilerplate:

This commentary is not intended as investment advice or as an investment recommendation. Past performance is not a guarantee of future results. Price and yield are subject to daily change and as of the specified date. Information provided is solely the opinion of the author at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Information provided has been prepared from sources deemed to be reliable but is not a complete summary or statement of all available data necessary for making an investment decision. Liquid securities can fall in value.

FYI: select edits, grammatical improvements/corrections, and/or additional links have been incorporated into this post past the initial publishing date of September 8th, 2021. That said, neither the thrust of the piece nor the overarching message that was communicated at the initial publishing date will be altered in the slightest. Separately, I am grateful, as always, for various links to great articles and graphs that my friends Doug and Debi furnished me with. Said often find their way into my publications. Thank you, D&D!

Post publication developments that I want to “carve out:” Older ones directly below, newer ones progressively further down the page.

— Federalism spreading! (19 Governors, 2 AGs Resist Biden’s Vaccine Mandates)

— A gutsy Lee County, FL state representative is involved in removing a tyrannical Lee County education department bureaucrat that refuses to leave it up to parents to determine whether their kids masked up (I was deeply involved in trying to achieve same for nearly one year. Related links, from the first to the second to the third effort. The first one was an appeal to the bureaucracy, the second one to the governor, the third one to parents.)

— DeSantis Responds to Biden’s Vaccine Mandate: ‘In Florida, We Will Fight Back.’

— If you can’t beat ’em, join ’em. If Big Pharma working in cahoots with our political, fascistic FDA and CDC can’t demonize and ban Ivermectin enough, well then Pfizer will reformulate it to make billions of $. Suddenly, Ivermectin will no longer be a horse de-wormer, but FDA-approved and CDC-marketed “Pfizermectin.”

— Courts Will Rule Against Biden on Vaccine Mandate Penalties: Alan Dershowitz. Excerpts: “No. 1, is this something the federal government can do as compared to the states?” Dershowitz told Newsmax. “The states have police power. The federal government doesn’t have police power. The federal government’s powers have to derive from the text of the Constitution.” It’s likely that courts will say that the government can enforce vaccine mandates but will argue that it is only Congress that can order punishments and fines, he said (recall that only the legislative branch can legislate and create new statutory law, not the bureaucracy and not the courts, whether at the federal or the state level — Dan). “I think the courts will say the federal government does have the power because this is a national issue across the state lines. It’s not limited to states. It’s contagious,” Dershowitz said. “I think they will say that in the event that science supports it, there can be mandated vaccinations with exceptions.” But such mandates are “generally relegated to the legislature in our system of government, so I think the courts will focus on that issue first and say that the president may not have the authority to do this without congressional authorization,” Dershowitz said.

— Prominent immunologist now regrets voting for Biden. Excerpts: Dr. Noorchashm slammed Biden’s White House and the Centers for Disease Control and Prevention in late August for an “irrational focus on mandated vaccination, instead of immunity,” which he claims causes harm by not promoting determination of medical necessity and vaccinating already immune individuals. The last straw for Noorchashm came when Biden announced his sweeping vaccine mandate last Thursday. “LET ME BE CLEAR @POTUS: To mandate vaccination of any COVID-recovered American against his/her will is unscientific, unethical and illegal,” Noorchashm wrote on Twitter. “@WhiteHouse U have overstepped and are operating in dangerous territory when it comes to already immune Americans. Cease and desist!” Noorchashm, who voted for Biden in the 2020 presidential election, instantly regretted helping the Democrat get into the White House. “I voted for Biden….As a McCain republican. It was an error and I now regret it,” the immunologist tweeted on Friday morning. “Last night’s chest beating press conference by @POTUS was one of the most destructive and divisive speeches ever given by a US president who claims 2 B a well-reasoned uniter, acting on science.”

— Horowitz: As vaccinated COVID hospitalizations soar, government blocks the one option that works. Excerpts: Now that the vaccines are no longer working and the mass vaccination appears to have made the virus worse through a leaky vaccine syndrome known as “the imperfect vaccine hypothesis,” why are we all not uniting behind early treatment? Notice how no other governor aside from Ron DeSantis is even promoting the monoclonal antibodies, much less making them more accessible and telling everyone to get treated on day one. I can’t tell you how many emails I get from my show listeners who complain they can’t access the monoclonal treatments for various reasons in some states. Why would our government not make sure every American is as inundated with information about the monoclonals as they are with information about the vaccines that are already obsolete? There are no good answers to this question that do not reveal a very dark and sinister motivation. But the answer is likely related to why the government-medical establishment has declared war on all early treatments and has refused to approve outpatient antibiotics and steroids for treatment, much less ivermectin, hydroxychloroquine, and several dozen other promising therapeutics. By ensuring that there is zero approved outpatient treatment, our government has trapped nearly every American who has not been infected – vaccinated and unvaccinated – into a death trap in the overrun hospitals. And that seems to be exactly where they want us.

— CDC Director: Agencies Urgently Working on COVID-19 Vaccine for Younger Children. Excerpts: The UK Joint Committee on Vaccination and Immunisation (JCVI) earlier in September said it will take a “precautionary approach,” saying that “given this very low risk, considerations on the potential harms and benefits of vaccination are very finely balanced.” In June, scientists from University College London, as well as the Universities of York, Bristol, and Liverpool, discovered that most children who died of COVID-19 had underlying health problems. Overall, the COVID-19 mortality rate among children is 2 deaths per 1 million children in England, they found (bold text courtesy of your author).

— Members of Congress and Their Staff Are Exempt From Biden’s Vaccine Mandate

— Department of Education opens civil rights investigation into Florida ban on mask mandates; New CDC figures appear to bolster Gov. DeSantis argument for parental choice over mask mandates. Excerpt: “This data was based on reports from 260 medical centers in the U.S. The major findings were that 1,790 kids were hospitalized with COVID during the period from August 2020 to August 2021, and a total of eight have died.” (Bold text courtesy of this site’s author.)

— Major Food Industry Employer- Biden’s Tyrannical Vaxx Mandate will be Met with 1776. Alfie Oakes of https://www.oakesfarms.com/ joins The Alex Jones Show to call on people to urge Florida Governor Ron DeSantis to take a meeting with him by emailing him your concerns about Biden’s Medical Tyranny Lockdown: governorron.desantis@eog.myflorida.com and text “USA” to (833)-501-0831 to show your support for Alfie Oakes. TALK ABOUT CIVIL COURAGE and an action bias! Two liberty giants at work!

— Hot Mic Catches Israeli Health Minister Admitting Vaccine Passports Are About Coercion

— DO MASK MANDATES WORK?

— Arizona attorney general suing Biden administration slams ‘complete hypocrisy’ of COVID vaccine mandates

— It isn’t just against a tyrannical federal government that states should push back, but against the globalist elite also threatening to pursue medical tyranny, eviscerate affordable energy for the masses, end national sovereignty, and strip property rights from Main Street makers and job takers.

— A tactical win for freedom, parental rights, and sanity in strategic war against rapidly spreading despotism: Federal Judge Sides With DeSantis on Mask Mandate Ban.

— This is precisely what red states need to put down, led by the Sunshine State: Missouri Math Teacher Dismissed Following Private Conservative Facebook Posts

— FDA Hearing: Doctors and Experts Testify Government Data Demonstrates COVID Shots are Dangerous and May Kill More Than They Save. Excerpts: The FDA hearing prior to the decision was stunning. The hearing was 8 hours long and it included SHOCKING testimony from American doctors. Dr. Joseph Fraiman, MD told the FDA on Friday that government does not have data to show the vaccine was more beneficial than it is harmful for teenage boys. Dr. Fraiman told the FDA panel he has NOT seen that those who show vaccine hesitancy are uninformed. “That is not what I’ve seen… The vaccine hesitant I’ve met in the ER are more aware of the vaccine studies and more aware of their own COVID risks than the doctors do. For example, many of my nurses refuse the COVID vaccine despite seeing more COVID deaths and devastation than most people have.” Dr. Fraiman went on to say he cannot assure a nurse associate who is 30 that the vaccines are safer than catching the virus is for a healthy woman her age. Steve Kirsch, the Executive Director of the COVID-19 Early Treatment Fund was up next to testify before the FDA. Kirsch argued the vaccines kill more people than they save. Kirsh pointed out that there patients were 71 times more likely to suffer a heart attack after taking the vaccine than those taking other vaccines. 20 died from the drug, 14 from the placebo. Steve Kirsch also pointed out that early treatments are more successful than boosters, noting that cases in Israel are at an all-time high and cases in Uttar Pradesh, India where they administer Ivermectin, the cases are nearly non-existent today.

— MS Gov. Reeves and President Biden throwing punches over COVID-19 vaccine mandate. More federalism stirring! Reeves called the president’s new COVID-19 vaccine requirements unconstitutional and pledged to challenge Biden’s legal authority to implement those requirements. “Huge difference between laws passed by a state’s legislative body with input of the people vs. one man threatening American workers’ ability to feed their family,” a tweet by Reeves read. “If you can’t comprehend that, you’re in the wrong job-or the wrong country!”

— 72% of Americans Will Quit Work Rather Than Take a COVID Vaccine (The unvaxxed are being referred to.)

— Parents Band Together, Force Resignation Of School Superintendent Who Pushed For Teaching Critical Race Theory

— DeSantis Office: Over Half of Those Seeking Lifesaving COVID-19 Treatment in South Florida Fully Vaccinated. Excerpts: A spokesperson for Florida Gov. Ron DeSantis’s office said that more than half of those who are seeking monoclonal antibody treatment in the south of Florida are “fully vaccinated” individuals amid supply issues. “More than half the patients getting the monoclonal antibody treatment in south Florida are fully vaccinated,” DeSantis spokeswoman Christina Pushaw wrote in response to a comment on Twitter that suggested that only unvaccinated people are the reason why there is a significant demand for monoclonal antibodies. Florida, she wrote hours earlier, “is above average in vaccination rate” and that “more than half of the patients in south Florida getting monoclonal antibody treatment are vaccinated and have breakthrough infections. Vaccinated or unvaccinated -Denying treatment to Covid patients is wrong.” Monoclonal antibodies are engineered immune system proteins that boost an immune response against an infection.

— https://podcasts.apple.com/us/podcast/mark-levin-podcast/id209377688?i=1000535824359: Minute 58 mark, medical tyranny and unethical, Hippocratic oath-pummeling politics by major institutions from the federal government to your local pharmacy are conspiring against citizens seeking proven, affordable, therapeutic remedies in order to save lives. Despotic, criminal, and evil. Have a listen. Better yet, speak up and go on the offensive to help save lives and role back tyranny.

— Why we desperately and rapidly need a federalism revival (state and federal powers and rights returned to constitutional size, the rapacious, capricious, lawless federal government shrunk back to the confines of strictly enumerated and limited powers and to separation of powers): Life, Liberty & Levin 9/19/21| FOX BREAKING TRUMP NEWS September 19,21

— Eric Clapton plays venue with vax mandate — despite saying he wouldn’t

— Horowitz: Now that vaccinated people need the monoclonal treatments, Biden admin and media attack the treatment. Excerpts: “For those of you who couldn’t believe that the government’s war on ivermectin and every other treatment was rooted in a sinister motivation, its new attack on the monoclonal antibodies should indelibly cement the terrifying thought in your mind. The government and the media are now using the same attack pattern on the monoclonal antibody treatment that they used on hydroxychloroquine and ivermectin now that it has become popular with people desperate for treatment – vaccinated and unvaccinated alike. The vaccines are no longer working, especially for those who got them early on — particularly the elderly — and many of the people who got them badly need treatment. As Gov. DeSantis reported, the majority of those seeking monoclonals are vaccinated, a fact I have verified in the facility closest to me in Baltimore. The vaccines cost a fortune and failed. Now these same people need treatment. The same government officials rationing the monoclonals have already scared 99% of doctors away from prescribing and pharmacists from filling cheap off-patent drugs that have cured the few people who can access them. The monoclonals are made by the cool kids at big pharma and are approved by the government. Except our government paid them off up front and then refused to even make the public aware of their existence. Thus, even things produced by big pharma are now attacked, so long as they actually work and people begin successfully using them. It’s so cute to watch the government and media suddenly become concerned about expensive treatments after spending billions on the vaccines. There is a simple solution, and that would be mass production of ivermectin and encouraging all physicians to treat everyone early with it and other cheap drugs. But now that the government has essentially banned them, the monoclonals are the only show in town. This is where the Biden administration wants to place Americans they don’t like into a death trap.

— Study: Pfizer Vaccine Increases Myocarditis Threefold. Excerpts: As the mass administration of COVID-19 jabs continue worldwide, we’re beginning to see some of the more common side effects emerging. Myocarditis, or inflammation of the heart muscle, is among them. This condition can cause symptoms similar to a heart attack, including chest pain, shortness of breath, abnormal heartbeat and fatigue.A large study from Israel revealed that the Pfizer COVID-19 mRNA jab is associated with a threefold increased risk of myocarditis, leading to the condition at a rate of one to five excess events per 100,000 persons. Other elevated risks were also identified following the COVID jab, including lymphadenopathy (swollen lymph nodes), appendicitis and herpes zoster infection.

— Psaki Suggests Illegal Immigrants Don’t Need To Prove Vaccination Status Since ‘They’re Not Intending To Stay Here’

— DeSantis Says Feds Slashing Florida’s Share of Monoclonal Antibody Treatments. Excerpts: The federal government is set to slash Florida’s allotment of monoclonal antibody treatments to fight COVID-19, Gov. Ron DeSantis said Thursday. Speaking at a news conference at Broward Health Medical Center in Fort Lauderdale, DeSantis said Florida is expected to see a “dramatic reduction” in the number of monoclonal antibodies from the U.S. Department of Health and Human Services that the state will have to make up for. “To just spring this on us, starting next week we’re gonna have to do that, there’s gonna be a huge disruption and patients are gonna suffer as a result of this,” DeSantis said. “So we’re gonna work like hell to make sure that we can overcome the obstacles that HHS and the Biden administration are putting in us.”

— The inhumanity, criminality, and evil of it is beyond description: Video Shows Crying Toddler at New York Daycare Forced to Wear Face Mask.

— CV19 Vaccines are Poison – Karen Kingston | Greg Hunter’s USAWatchdog. Excerpts: New research has come out this week from pathologist Dr. Ryan Cole, and he is seeing cancers in the fully vaccinated 20 times higher than normal. Kingston is not surprised and says, “I believe that’s (20 fold increase of cancers) a very conservative estimate as far as the increase of cancers we are going to witness in people who are injected with these ‘Emergency Use Authorization’ injections. What happened with the FDA is they violated their own laws. . . . They actually have to prove that they have done all the tests and prove there is minimal risk to humans. That would be the pre-clinical testing or the animal testing, but they skipped the animal testing . . .” Kingston says another bad side effect of the CV19 vaccinations is Erectile Dysfunction or ED, but it doesn’t stop there. Kingston explains, “Erectile Dysfunction, I believe, is a very common side effect in men with these mRNA vaccines. Why? Because they cause the proliferation or production of spike protein. What do these spike proteins do? . . . They cause blood clotting. According to the FDA, this is called disseminated thrombolytic coagulation. This is a fancy word for blood clots throughout your body and small blood clots. So . . . if your capillaries have small blood clots in them, they will experience Erectile Dysfunction. I believe a lot of men who have been vaccinated are probably experiencing this problem. . . . Some people are sick right now from the vaccines and may not even know it. . . . One of the first symptoms is chronic fatigue syndrome. So, if you are exhausted and you are injected, it is probably a side effect from that injection. This is why I brought up ED. People are considering this to be a lifestyle condition. So, whether it’s ED or exhaustion, they are not attributing it to the vaccine.” Kingston says these side effects are only the beginning of increasing sickness caused by the vaccines.

— Sex-ed curriculum used in Richfield schools asks students to role play gay sex scenarios. Watch civil courage in action. Concerned mothers fight back against a depraved school board.

— Freedom Ron, the leader of federalism, is again standing tall for Floridians: Florida Acquires Monoclonal Antibodies From GlaxoSmithKline After Biden Administration’s Rationing

— Our lawless, demagogic, fascistic federal government at work (and why federalism is more important than ever): Jan. 6 House panel subpoenas Trump allies Bannon, Meadows, 2 more

— Why stout federalism, continued. Tucker: Why would Biden do this to his own country? I have long called this out.

— More freedom, sanity, and science courtesy of Freedom Ron’s latest appointment: Dr. Joseph Ladapo: Florida’s New Surgeon General

— Catching up to Florida. Norway Official: COVID-19 Can Now Be Compared to the Flu as Country Removes Pandemic Restrictions

— US COVID-19 Vaccine Progress Tracker | Vaccinations by State | USAFacts

–9/29/21 Billions hidden in $3.5 trillion bill to tilt election scale

— 9/29/21 Mark Levin exposes Democrats’ reckless schemes and lies (related to the $3.5trn — really $5.5trn — “spending bill”)

— 9/29/21 Tucker: These are the moral priorities of the Democrats (let illegal aliens in by boat load without any virus tests or vax requirements but fire Americans that refuse vax)

— 9/30/21 Arkansas Bill Would Create Antibody Exemption for Biden Vaccine Mandates

— 10/1/21 Tucker shreds Australia’s tough COVID restrictions

— 10/1/21 NYC Restaurateurs: Business Down 40 to 60 Percent Due to Vaccine Mandate

— 10/1/21 Harvard Business School goes virtual to fight COVID outbreak among jabbed students — Of the 74 COVID cases on campus, 60 were graduate students. All of the graduate students were jabbed.

— 10/4/21 People Injured by COVID-19 Jab Share Their Horror Stories

— 10/5/21 Vermont Woman Fired, Denied Unemployment for Refusing Vaccine, Becomes Homeless and Flees to Florida

— 10/6/21 ‘We’re in the middle of a major biological catastrophe’: COVID expert Dr. Peter McCullough

— 10/7/21 On Tuesday’s Mark Levin Show, Attorney General Merrick Garland has no authority to label parents that protest as domestic terrorists and use the FBI to silence them. The letter from the National School Boards Association smacks of an inside job to help the Federal government further nationalize its reach into local communities. The Biden administration wants to strike fear in the hearts of parents and community members who dare assemble to question their government. If they succeed, the public will have ceded our children, our future, and our liberty to the Marxist left. Then, Manhattan Institute Senior fellow Chris Rufo calls in and explains that this is simply an outrageous attempt to politicize the DOJ even further and prosecute parents for protesting under the Patriot Act. This is a suppression tactic to infringe upon one’s Constitutional right to free speech and assembly similar to how the Obama administration used the IRS to stifle conservatives in the Tea Party movement in 2010. Later, Victor Davis Hanson, author of “The Dying Citizen: How Progressive Elites, Tribalism, and Globalization Are Destroying the Idea of America” joins the show to explain the fragility of citizenship. The destruction of the middle class, border security, the administrative state, and academia are contributing to the demise of American citizenship. (In a nutshell, this is a full-bore attack on the first amendment, the ninth amendment, and the 10th amendment, namely on free speech, on uncodified inalienable rights, and on federalism– DK)

— 10/8/21 Young mom who died from COVID vaccine was coerced into receiving jab via government mandate, heartbreaking obituary says

— 10/8/21 Mark Levin RIPS AG Garland for ‘weaponizing’ FBI against parents, reveals multimillion dollar motive for CRT push: ‘This is making the FBI into the East German Stasi’

— 10/8/21 Practical Reasons Why Vaccine Injuries Are Rarely Reported And in case “to left” disappears: https://media.mercola.com/ImageServer/Public/2021/October/PDF/vaccine-injuries-vaers-whistleblower-pdf.pdf

— 10/12/21 Horowitz: The data is in, and we are now worse off than before the experimental shots. Excerpts: “Finally, there is a not insignificant risk of the vaccine virus reverting to wild-type virulence, as has sometimes occurred with the oral polio vaccine—which is not intended to be fully virulent or transmissible, but which has reverted to become both neurovirulent and transmissible in rare instances. This is both a medical risk and a public perception risk; the possibility of vaccine-induced disease would be a major concern to the public. Whether this vaccine actually sheds the spike protein onto other people is still not yet proven (although Pfizer seems to indicate it can spread through skin-to-skin contact in “inhalation”), but the principle of mass vaccination with a faulty vaccine making a virus both more transmissible and more virulent is something that is hard to deny at this point. The reality is that more people have died from COVID-19 in 2021, with most adults vaccinated (and nearly all seniors), than in 2020 when nobody was vaccinated. Something is not adding up, and perhaps those who have been dabbling in gain-of-function research in recent years have the answer.”

— 10/12/21 ‘A Definite Loser’: Ron DeSantis Rails Against Vaccine Mandates Implemented By Biden

— 10/12/21 VICTOR DAVIS HANSON: America and ‘the dying citizen.’ Excerpts: Given our privileges, affluent and leisured Americans must always ask ourselves whether as citizens we have earned what those who died at Gettysburg or on Omaha Beach bequeathed at such costs. Refusing to stand during the national anthem is not and should not be illegal. But such blanket rejection of American customs is admittedly now a collective narcissistic tic — and hardly sustainable for the nation’s privileged to sit in disgust for a flag that their betters raised under fire on Iwo Jima for others not yet born. Sometimes citizens can do as much harm to their commonwealth by violating customs and traditions as by breaking laws. Instead, freedom requires constant reinvestment in and replenishment of a nation’s traditions and ideals. Self-criticism of one’s country is salutary to ensure needed changes, but only if Americans accept that an innately self-correcting United States does not have to be perfect to be good — and especially when, in a world of innately flawed humans and failed states, it remains far better than any of the alternatives abroad.

–10/12/21 The New Secession Movement | City Journal. The ultimate federalism answer to sustained federal government lawlessness, one which I have long called out, as in right here: https://dkanalytics.com/wp-content/uploads/2016/07/DK-Analytics-Post-4-State-level-_nullification_-of-unconstitutional-federal-edicts-only-ASAP-recourse-7_28_15.pdf

— 10/12/21 Your Vote Won’t Count

— 10/13/21 Outraged parents say Loudoun County school board is ‘complicit’ in alleged school sexual assaults, demand resignations

— 10/13/21 The Unvaccinated Are Looking Smarter Every Week

— 10/14/21 Will Ron DeSantis Save Christmas? Excerpts: The media has been very busy issuing warnings to American consumers of late. CNN told us to get ready for emptier shelves. News outlets suggested shopping early for Christmas to avoid shortages. Pictures of dozens of container ships off the West Coast that are not allowed to dock have gone viral. What can a concerned consumer do? Head to Florida. Last week, the Florida Ports Council put out a press release telling shippers that the state’s ports are open, staffed, and ready for business. “Florida is where your success comes in, and our seaports are the solution to ensure the cargo shipping logjam doesn’t become the grinch that stole Christmas,” said Florida Ports Council President and CEO Michael Rubin. He added, “With inflation growing, shipping and manufacturing industries can save time and money by calling on Florida ports. Why pay to moor off the coast of California, when Florida shipping lanes are open and serving as the gateway for getting goods to America’s market?” More than 60 ships holding thousands of shipping containers were moored off the California coast when the council sent the letter. Rubin asserted, “Florida is open for business, and we are the solution to help resolve the global supply chain crisis. Instead of waiting off the coast of California, cargo vessels can offload and move their product to Florida and other discretionary markets in the same time it takes to find space in an increasingly congested California.”

— 10/15/21 Biden administration reverses all punishment of Andrew McCabe “The Deep State takes care of its own, scoring a big victory yesterday thanks to the Biden administration defaulting, using an old trick to reverse all punishment of former FBI deputy director Andrew McCabe, who lied repeatedly to FBI officials — normally a crime that can be prosecuted severely. That he lied is undisputed. See this inspector general’s report. Former attorney general Jeff Sessions fired McCabe just before his pension vested, but the thoroughly politicized Department of Justice declined to prosecute him. Losing pay and pension rankled McCabe, so he sued. Rather than fight McCabe in court and let a jury decide, Merrick Garland’s Justice Department has caved in completely and given McCabe everything he wanted in a “settlement agreement” that includes half a million dollars in attorney’s fees and about $200,000 in pension payments he missed plus future pension payments for the rest of his life. Having already stepped down from his position as deputy director of the FBI — to which he was appointed by James Comey, who raised him from the ranks — McCabe will not be getting his old job back — just the cushy package of benefits and pension payments that retired senior government bureaucrats enjoy. He joins Lois Lerner of the IRS in the ranks of guilty political hacks who escape punishment for their partisan misdeeds in office. Me: When traitorous, felonious Andrew McCabe, who perjured himself before Congress, gets all his federal retirement and health benefits reinstated and numerous January 6th protestors get denied due process rights and are left to rot in solitary confinement, then you really know that a mob runs the country. B.R. response, Debi.

— 10/17/21 Republican AGs Say There Is No Federal Vaccine Mandate for Private Workers, Vow to Sue

— 10/17/21 Civil War 2.0? | Power Line

— 10/17/21 Senator Johnson on Sunday Morning Futures with Maria Bartiromo: Biden flip flops on vaccine mandates. KEY video on the insanity, tyranny, demagoguery, and destructiveness of the clot shot mandates.

— 10/19/21 Doctors Can Prescribe Ivermectin, Hydroxychloroquine Off-Label for COVID-19: Nebraska AG

— 10/19/21 On Tuesday’s Mark Levin Show, people deprived of a religious exemption for vaccinations can sue their employers. The federal government has no authority to issue any such mandate, only states have that type of police power. Professor Ken Terry writes on the legality of vaccination mandates, noting that they have quarantine powers but no precedent to force inoculations

— 10/22/21 Putin Blasts Pushing Transgenderism On Children As “Simply Monstrous” In Critique Of West’s ‘Wokism’ | ZeroHedge

— 10/24/21 Florida Governor Calls for Special Session to Counter Vaccine, Mask Mandates

— 10/24/21 DeSantis Calls On Businesses To Pay For Adverse Reactions To Vaccine If They Mandate It