DK Analytics, Post #37: Rising political risks, a flagging economy, & assets priced for perfection

Trade weighted US$: 85.81; US 10-yr: 2.94%; S&P 500: 2,685; Oil: $67.75; Gold: $1,335; Silver: $17.13

Rising political risks associated with the largely criminal enterprise known as the US government:

The endless Trump Russian election interference witch hunt (candidate Trump couldn’t address interference, only the prior administration could!) or, more accurately, “offshoots” thereof, could result in a declining capacity for Trump to function effectively as the nation’s chief executive. It could also trigger a governmental paralysis and/or lead to presidential impeachment proceedings based on so-called “process crimes,” which amount to “technicalities” over substance. Some highlights of this sad state of affairs, which threatens to further entrench our kleptocratic form of government — on both sides of the aisle — follow:

- After over one year of relentless digging with a sizable task force of exclusively Democratic lawyers, zero evidence of Trump collusion with Russians has emerged, yet the witch hunt continues and widens and neither US Attorney General Sessions nor his deputy Rosenstein is willing to rein in Robert S. Mueller’s special counsel, which gets anything it wants in terms of manpower or budget to “look for a crime;” turns innocent until proven guilty on its head! It is as if his special counsel’s real mission is to undue the presidential election results. (Maybe Rosenstein’s 4/19 statement that Trump isn’t a target of the Mueller probe marks a turning point? Don’t hold …)

- Meanwhile, Mueller’s special counsel won’t investigate ample evidence pointing to a) Clinton collusion with the Russians (Clinton paid for a warrant to surveil a Trump campaign associate during the 2016 election), b) humongous Clinton foundation fraud, c) massive, FBI-coordinated destruction of evidence/obstruction of justice, d) gross negligence in handling classified information, and e) Clinton’s treason as Secretary of State.

- There is also no effort by Mueller’s special task force to investigate multiple signs of alleged abuses of government surveillance powers by the Obama Justice Department in obtaining warrants to unjustly monitor and unmask Carter Page and other Americans, enormous 4th amendment violations which are being swept under the rug.

- Yet Mueller, with a checkered history as FBI head during the anthrax threats, the IRS scandal, and much more, has not only complete Democratic backing, but wide Republican support. This is underscored by the fact that the GOP-controlled Senate is drafting a Mueller protection bill while Republicans warn Trump not to fire partisan hack Mueller, stating that it would be “political suicide!” Upshot: the Constitution-thwarting “DC swamp,” perhaps best captured by noting that apparently both former Bush presidents voted for Hillary over Trump — a kind of collusion by Marxist Democrats with crony Republicans — is rebelling against Trump and wants to put him down. In other words, the swamp wants to remain above the law, so we can’t return to the RULE OF LAW.

- Speaking of a rule of law infidelity, the FBI raiding Trump’s personal lawyer’s office constitutes government’s intrusion into privileged communications between a lawyer and a client and is a potential violation or a violation of aspects of the 4th, 5th, and 6th amendments:

- The 4th Amendment: The right of the people to be secure in their persons, houses, papers, and effects, against unreasonable searches and seizures, shall not be violated. In other words, if the government improperly seizes private or privileged material, the violation has already occurred, even if the government never uses the material from the person from whom it was seized.

- The 5th Amendment: no defendant (in this case President Trump) shall be compelled in any criminal case to be a witness against himself. In other words, said cannot be used to incriminate the defendant which counsel represents or, by extension, that defendant’s counsel.

- The 6th Amendment: the defendant shall have the assistance of counsel for his defense. “Privileged material” will result, which prosecutors don’t get to see or use. When overlaid on to the 4th Amendment, it prohibits government officials from intruding on the privacy of lawyer/client confidentiality rights of citizens.

- In the interim, as predicted in my April 5th, 2018 video, EPA head Scott Pruitt’s biggest challenge won’t be the “Pravda press,” but the entrenched, constitution-mangling and property rights-eviscerating EPA bureaucracy. Will an increasingly maligned and compromised Trump be supportive, i.e., will Dr. Jekyll be at Pruitt’s side when it gets really ugly? Fortunately, Dr. Jekyll seems to be at work, as evidenced by Pruitt’s new second in command, a former coal industry lobbyist, Andrew Wheeler.

Now, there is a lot of speculation (and excitement) in the alt media community about over 24,000 executive branch sealed indictments. Specifically, when will they be unsealed and arrests made, so that the rule of law once again extends to the ruling class? Hope springs eternal that felonious indictments will be unsealed with increasing frequency as the 2018 election grows closer. Moreover, that once “unleashed” — and assuming such a process couldn’t or wouldn’t be derailed — increasingly large swaths of the federal ruling elite in Washington DC and throughout the nation that have acted lawlessly will be implicated and charged with crimes.

Such a “cleansing” would help purge the kleptocratic and bureaucratic lawlessness (unconstitutional legislation followed by property rights-eviscerating extortion by both elected officials and unelected bureaucrats) that is so intimidatingly widespread. It would also constrain despicable, amoral, and unconstitutional behavior by powerbrokers, which would be pivotal to any effort to return the US to a representative, constitutional republic while boding well for rescuing the west from an all-powerful, unrepresentative administrative state (the unelected bureaucracy).

Given the vast and powerful vested interests against such arrests, one could be forgiven for believing that a status quo sustaining conspiracy, from brazenly corrupt power brokers (both elected and unelected) to federal level bureaucrats, whose US number exceeds 2m, has “too much skin in the game” to risk losing privileged, powerful positions on the one hand or salaries and benefits that increasingly tower over private sector compensation on the other hand. Therefore, we sadly personally doubt that either lawless agency heads (e.g., former IRS and FBI chiefs) nor the sycophant rank-and-file bureaucrats will “allow” this to happen. (Ask yourself, reader, how many “public servants” at the IRS or the FBI became whistle blowers and thus stood tall for the oath they took to uphold the US Constitution/the rule of law during the IRS’ Tea Party police state harassment or during the FBI’s 4th Amendment gutting lawlessness perpetrated against the then incoming Trump administration. Hopeful caveat: if the “mighty” are forced to point fingers at criminal activity by other bigwigs in order to secure plea bargains for themselves, then indictments could mushroom.)

The upshot of all this: the president will likely consume a growing portion of his time fending off efforts to castrate his administration; call him a potentially “early lame duck.” It could also cause his cabinet to “freeze up” or drive away potentially gifted constitutional cabinet picks to replace his still all too “swampy” cabinet. Obviously, if the Democrats retake the House or the entire Congress, then Trump impeachment efforts will be “the order of the day,” which would could turn Trump from a “lame duck” into a “dead duck” in terms of executive branch/”CEO” functions.

President Trump’s — and the Republicans’ — broad-based failure to deliver what they so fervently promised when they sought a governing mandate in 2016 may well cost them their congressional majority this year should the GOP base “stay home in disgust.” Specific broken promises include the following: a) true Obamacare relief (only non-payroll relief, not widespread relief) instead of Obamacare enshrinement, b) government spending brought under control in place of unprecedented profligate spending (the discretionary part of federal spending is to grow by 13%), c) lower federal government deficits (at a $1.2trn annual run rate, they are nearly doubling), d) defunding of misnamed “sanctuary cities” (their funding remains), e) widespread regulatory relief (collectively, executive branch administrative state agencies/bureaucracies got more funding!), f) a border wall (not — only $1.6bn in funding out of over $1.3trn in projected discretionary spending!), and g) no more amnesty for illegal aliens (Trump offered 1.8m illegal aliens amnesty, more than twice what the Democrats had sought!).

Therefore, look for “divided government,” even more pork, more cronyism, more redistributionism, sustained unconstitutional red tape that costs American business an estimated $2trn to comply with (as this is written, there are still 775,939 documents at the Federal Register and 6,128 new federal regulations have been posted in the last 90 days), lower tax revenues, and still bigger federal government deficits — which heightened economic weakness will amplify thanks to reduced tax receipts and more recessionary transfer payments. And add to these challenges the potential political turbulence related to what constitutes a de facto largely bipartisan effort to impeach Trump, which Democrats retaking the House would “turbocharge.”

We think investors will begin demanding higher risk premiums for growing political uncertainty amidst pervasive “D.C. lawlessness” that not even the propaganda MSM will be able to fully squelch; call it a “slow-burn” erosion of confidence that will eventually and suddenly flip into anxiety (“human nature 101”), which will trigger selling panics. Rising political threats to property right protections will also beckon, potentially including on capital restriction or trade fronts. Layer on top of this worsening economic fundamentals, increasingly precarious finances, and the likelihood of central banks revisiting QE (possibly unparalleled currency debasement) — issues that we mention below — and vastly overvalued bonds and stocks stand to be re-priced substantially to the downside (higher bond yields and lower stock P/Es) to compensate investors for expanding return on capital and return of capital risks. When confidence turns to anxiety …

Growing economic expansion risks:

- The March 2018 household-survey count of employed Americans declined by 37,000 while the ranks of full-time American employees dropped by 311,000 (shadowstats.com).

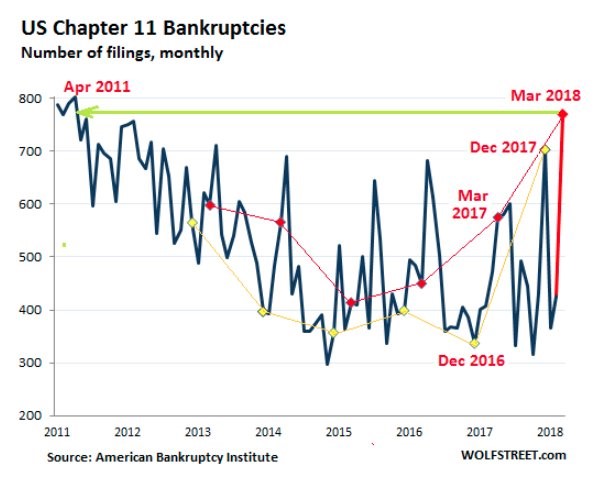

- A 63% year-over-year surge in US filings for Chapter 11 bankruptcy protection was tabulated in March.

- The worst-ever quarterly US merchandise trade deficit threatens to deflate GDP growth (shadowstats.com).

- US crude inventories are down 7% year-over-year at a 10.9% annualized rate over the last 6 months.

- German exports fell a seasonally adjusted 3.2% month-over-month in February, the biggest monthly drop since August 2015 (http://www.macrostrategy.co.uk), raising question marks about the vitality of the EU’s economic dynamo amidst growing EU liquidity and solvency concerns related to the ECB’s asset purchases winding down.

- Declining global productivity: The failure of the technology is starting to be felt. Case in point: the rapid increase in DRAM prices over the last 18 months, which was due to the failure of technology laws (e.g., Moore’s Law), fed into a 10% increase in the ASP of smartphones worldwide last year, its fastest on-year growth yet (http://www.macrostrategy.co.uk).

- Domestic (US) inflationary pipeline pressures are building both in commodities (below) and in manufacturing. Needless to say, sustained dollar weakness would aggravate US inflationary pressures, potentially substantially.

Source: https://fred.stlouisfed.org/series/PPIACO

Growing financial risks:

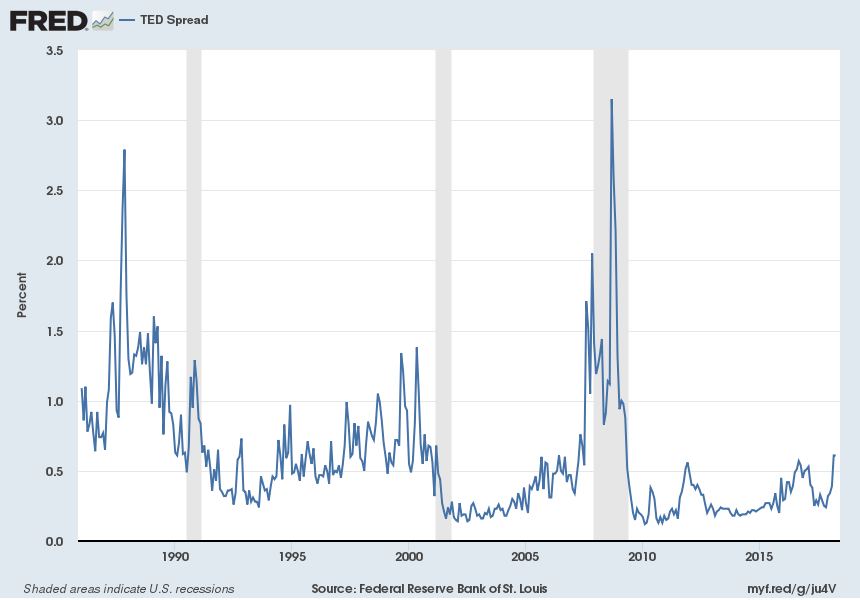

- Both the LIBOR and the TED Spread keep rising markedly, pointing to rising short-term financing costs for trillions of dollars of loans due to declining trust between banks (growing counterparty risks) and to increasing eurodollar scarcity, as regards USD-based LIBOR:

TED spread: spread between 3-month USD LIBOR and 3-month Treasury Bill Source: https://fred.stlouisfed.org/series/TEDRATE

- Three-month Hong Kong borrowing costs have risen to the highest level since 12/2008, raising risks to the housing market. Diminishing liquidity may prompt banks to lift mortgage rates (http://www.macrostrategy.co.uk/)

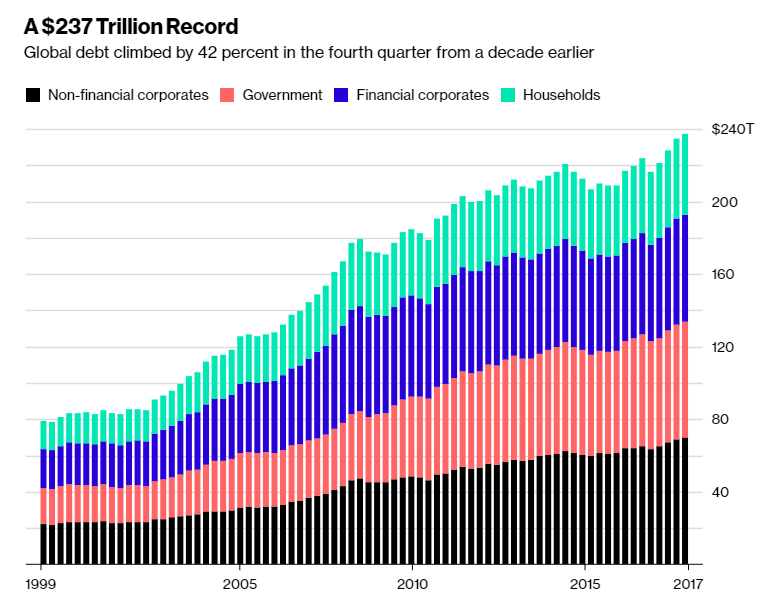

- Global debt at end of 2017: $237trn, which is 3.1x global GDP and is up $21trn, or 9.7%, in one year, signifying sustained misallocations, a continued decline in productivity, and increasing demographic challenges. (Just consider that a one percentage point increase in average global borrowing costs would soon translate into $2.4trn in higher annual interest expense, which would amount to global GDP headwind of 3%, and we’d still have historically low interest rates; normalized interest rates would translate into between 6 – 7% headwind, and interest rates which reflected our global insolvency, much less reversion beyond the mean, could not be paid, only “printed!”)

Sources: Institute of International Finance, www.bloomberg.com/news/articles/2018-04-10/global-debt-jumped-to-record-237-trillion-last-year

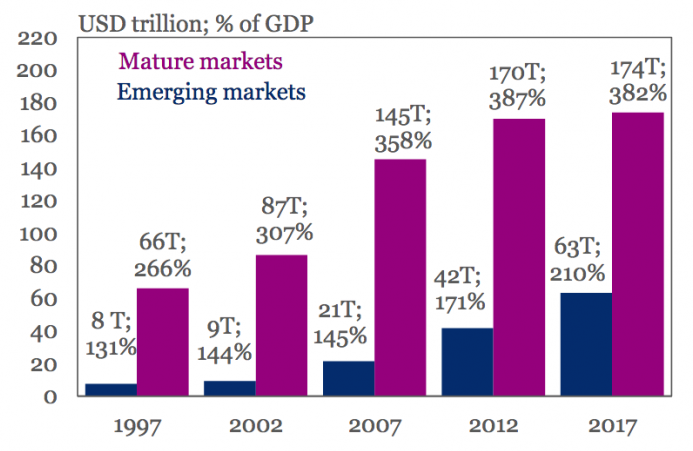

- In contrast, global nominal GDP, which stood at $75.8trn in 2016, has long been growing at a fraction of the rate at which global debt has expanded. This also attested to by a relentless rise in the global debt/GDP ratio:

Sources: IFF, BIS, IMF, https://finance.yahoo.com/news/global-debt-rose-327-trillion-2017-highest-level-record-130208754.html

- And all that “on-balance sheet” debt doesn’t address the unfunded, non-financeable “off-balance sheet” commitments that central governments have (the US has $210trn, according to one source), from social security to medical care commitments for a burgeoning retirement ranks courtesy of a) inadequate contributions and b) retiring baby boomers. Nor does it address tremendously unfunded defined benefit pension plans, both public and corporate, which exceed $6trn in the US alone.

- (We would be remiss if we didn’t state that the $416trn in mostly off-balance sheet, non-exchange traded interest rate derivatives outstanding would threaten banks’ solvency should interest rates rise markedly.)

Peak EPS risk (last we checked recessions haven’t been outlawed, esp. not the overdue variety):

- Flattered by repatriation gains at lower tax rates, 40% lower corporate tax rates, and a record stock buyback round likely in the making — one-time or financial engineering stuff — largely non-organic EPS gains of an expected 16% – 17% will have a short “half-life” in a weakening economy. (“Repatriation” happened in 2004, and S&P 500 EPS fell off a cliff two years later — in 2006 — and it took five years to top the 2006 S&P 500 EPS tally!)

- Share buybacks in 2018 have averaged $4.8bn per day, double the pace from the same period last year, and could reach more than $800bn this year, which would eclipse both $530bn in 2017 and even 2007’s all-time high of just under $700bn. Not surprisingly, a recent Bloomberg analysis found that about 60% of tax cut gains will go to shareholders, compared to 15% for employees. More financial engineering-based EPS growth, revisited.

- The $1.5 trillion GOP tax cut legislation (over 10 years) is a boon to corporations, should it remain law. It slashed the corporate tax rate to 21% from 35% and it reduced the rate on corporate income brought back to the United States from abroad to between 8% and 15.5% instead of 35%. As welcome as lower corporate tax rates are, capitalizing on them ultimately depends on achieving organic (top line) growth on the one hand and on avoiding a material increase in debt-servicing costs at both customer and corporate levels on the other hand. Given a perpetually more interest rate sensitive domestic and global economy, this isn’t an idle organic growth or financing cost concern, especially when considering the pronounced P&L operating leverage (fixed cost structure) inherent in many businesses. Stated differently, top line weakness typically leads to outsized profit compression.

- Poor earnings/EPS quality (also from a heightened foreign currency exposure perspective thanks to decades of “outsourcing” production)! US corporate debt is up from $3.5trn to over $6.1trn in less than a decade. And the “million dollar plus signing bonuses,” multi-million annual compensation, job-hopping, 1,000x line workers’ compensation, “slash and burn” C-Suite crowd keeps repurchasing high P/E shares with cheap debt (thank you, global financial repression) and with cash flow to underpin their multi-million dollar option gifts. Their prolific option grants a) typically vest way too early for top management to have a strategic focus and b) don’t incorporate rising book values per share thanks to retained earnings (non-distributed earnings); call it your proverbial non-aligned interests double whammy for strategic shareholders! Thus, instead of focusing on driving sustainable organic growth (we may delve into this topic in more detail in a separate post) and broad-based, lasting value creation, top management, richly compensated prior to “lifting a finger” and typically lacking strategic parallel interests with other shareholders and stakeholders, is motivated by corporate anorexia: reduce costs, R&D, and cap ex (slide 15), even if cuts into the enterprise bone. The associated EPS myopia will, if past is prologue, be partly “addressed” by issuing stock at much lower (than buyback) prices to reduce “balance sheet leverage.” The resulting dilution and the value destruction for the benefit of the “1% today” will be paid by non-privileged shareholders “tomorrow.” How so? Via lower future earnings power (and the associated lower macroeconomic growth) and via lower future P/Es, the progeny of underinvestment, debt-based EPS levitation, and the coming beyond the mean reversion of interest rates that a decade of unparalleled global financial repression has delayed.

Conclusion: pick your asset bubble pin, for they abound — and it’s not a question of if, only when

Rising political risks (and we haven’t delved into growing geopolitical risks, neither the typically tragic and immensely expensive war or trade war varieties, both of which can be highly susceptible to “domestic disenchantment”), rising economic risks, rising financial risks, and rising peak EPS risks all suggest investors ought to “trim exposure” to overvalued stocks and bonds. Moreover, given our accumulating toxic public policy stew fallout (i.e., unsound money enabling unprecedented deficits, redistributionism, cronyism, misallocations, and declining property right protections and the ensuing unparalleled debt and failing productivity), we envision that the Keynesian power brokers in charge of global central bank monetary policy will “double-down” on what has gotten us into so much political, economic, and financial trouble. The latter is all the more true given our rapidly rising dense energy availability, affordability, and EROEI (energy return on energy invested) challenges, and thus, to a large extent, our productivity challenges.

We thus continue to think that QT (central banks selling bonds) will be brief, if it truly gets off the ground at all. However, when it becomes obvious to our central planners that “their” asset bubble progeny, upon which they have based their currency and economic malpractice “success,” are quickly deflating, they will rush to defend them. How? By expanding their balance sheets; by buying sinking bonds. While we don’t know when this will occur, we are convinced that it will. At such a juncture, it will be impossible to deny just how terribly flawed our “Frankenstein” central bank monetary policy has been, especially when dwelling on US debt of $68trn and global debt of $237trn.

So, if the bond vigilantes don’t “bolt” to front-run what will likely prove to be a very fleeting QT round by global central banks (again, if it commences at all), thereby driving up dollar-based interest rates in a world in which domestic and trade-related US financing needs could trump (no pun intended) $1.8trn on an annualized basis, surely rising inflation aggravated by “QE redux” will finally unnerve creditors. Why? Because they will be looking at entrenched and likely unprecedented currency debasement instead of a “financial repression worked” scenario. In such a world, even if outright defaults by various parties unable to meet obligations, from municipalities to states to massively underfunded public and private pension funds to “too big to fail enterprises,” can be addressed through the printing press, the value of the currencies in which they’ll be expressed will ultimately rival the value of a sheet of toilet paper.

Thus, an upcoming global fiat currency debasement default will finally take center stage. This will drive up rates, punish bonds, and deliver hyperinflation. Sadly, it’s the only politically feasible path. And the opportunity to sidestep this upcoming implosion in both bond and stock valuations (they are tied at the hip) is staring us right in the face. Sage investors stand to benefit handsomely from the upcoming reversion beyond the mean. And they might be well served to recall that mining-based precious metals (PM) supply is expanding the above ground gold and silver inventory at a puny $138bn and $15bn annual rate, respectively, based on current PM spot prices. The resulting 1% – 2% expansion in above ground PM speaks volumes about PM’s scarcity. It also suggests that any material increase in PM holdings beyond the current 1%-ish stake of investable global portfolio assets, which are on target to reach $278trn, would have to be realized via massively higher PM prices, i.e., the demand curve shifting up stoutly.

Sincerely, Dan Kurz, CFA, www.dkanalytics.com

PLEASE NOTE: This commentary is not intended as investment advice or as an investment recommendation. Past performance is not a guarantee of future results. Price and yield are subject to daily change and as of the specified date. Information provided is solely the opinion of the author at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Information provided has been prepared from sources deemed to be reliable but is not a complete summary or statement of all available data necessary for making an investment decision. Liquid securities can fall in value.