Post #51: some youtube queries related to a recent video tied into post #47 10/4/2018

Trade weighted US$: 90.11; US 10-yr: 3.2%; S&P 500: 2,902; Oil: $7463; Gold: $1,206; Silver: $14.67

Allow me a somewhat different post.

A gent shared the following with me on the heels of my most recent youtube video titled “Financial and economic challenges juxtaposed against bubble valuations:”

“What are your thoughts on a collapsing bond market in a rising interest rate environment? Is it difficult to sell Treasuries when buyers know that the bonds will fall in value as the next higher interest rated bond series will have better returns? I ask this because if money stays away from the massive bond market, where will it go? Will it keep flowing into the stock market? Even if it is precarious? Such an unknown future. And I assume the value stocks you mentioned would have to have minimal exposure to interest rates?”

My two-stage 10/4/18 youtube response was as follows, with stage one directly below (I’d be remiss if I didn’t tell you that I tidied up and slightly improved my response here, but the message and most of the text is essentially what you can find on my youtube channel response — trust, but do verify, as the GREAT Ronald Reagan said):

Hi Mike: thank you for your observations. I apologize for my somewhat tardy response. Under the hopeful moniker of “better a bit late than never,” let me take a few stabs at your questions, which are very apt/topical.

In so doing, I’d like to refer to the stagflationary 70s as a understated preview of coming attractions. In that era, and as mentioned in the video you kindly reference and as I also referred to in a few posts, we actually had US stocks lead US Treasuries into the crapper.

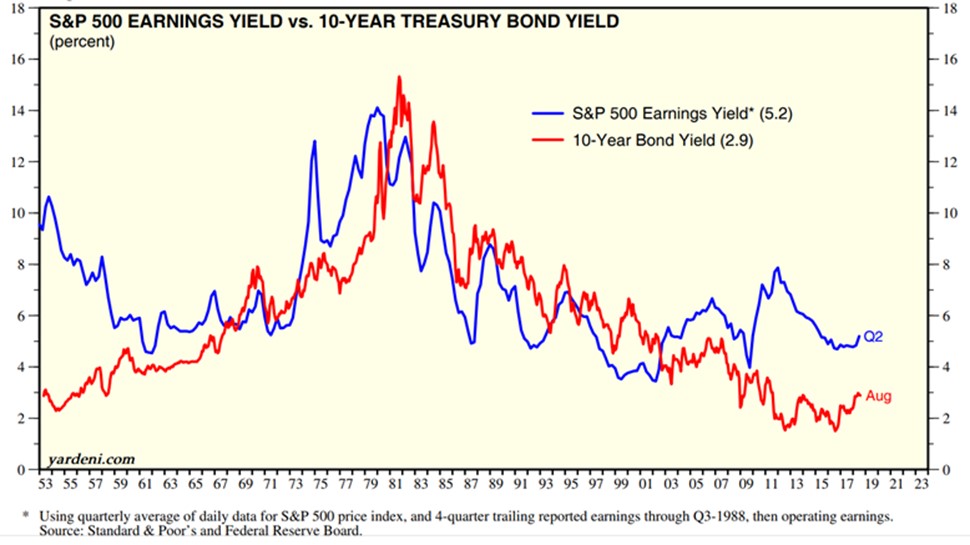

Let me see if I can position the great Yardeni.com chart that I reference into place below (www.yardeni.com/pub/sp500trailpe.pdf, figure 8):

Source: http://www.yardeni.com/pub/sp500trailpe.pdf

I am back down here. Hope this chart copy/paste effort works on youtube. Life is an adventure! My bigger point: falling stocks could ultimately “lead” falling bonds higher, as in the era (the 70s) I believe we are likely to revisit, but on steroids this time around.

Plus, and this is the biggest aspect of all, in my view, we are going to have a monetary crisis when investors realize that there is no escape from monetary debasement purgatory. That is, as I hope I said fairly well, bonds are ultimately reflections of the soundness of the currencies in which they are based. With the Potemkin village dollar about to smell the “emperor wears no clothes” coffee (there is no sustainable growth/productivity, there is are no sustainable interest rate increases possible given our winded, big government, mis-allocated, heavily-indebted, regulatory and litigation-mired economy), the most overvalued junk currency of all is going to take a big, big hit.

I don’t think there will be a recovery for a long, long time (it took decades to get into this mess, and you don’t get out of it in a Trumpster N.Y. minute, for God’s sake!) from the upcoming hit. Other nations, esp. those with mercantilist trade policies, will move to weaken their currencies relative to the dollar, which means they too will likely engage in (MORE) monetary debasement as well.

Thus, I don’t think, with $250trn in global debt (or almost) and some $16trn in central bank balance sheet expansion, that we’ve seen anything yet! Which brings me back, admittedly in a round-about but hopefully still logical way, to your question. Where will all the money go that’s sitting in bonds (a huge chunk of the $250trn). Well, part of the answer is that a lot of it will be destroyed in an era of rising interest and, thus, discount rates (relates to stocks and RE and leases).

We all know what happens to the value of government and corporate bonds when the market suddenly (it usually happens pretty fast, and then keeps on truckin’) requires greater risk protection (against insolvency and inflation, which is a stealthier form of insolvency “until it isn’t,” hello Venezuela, Turkey, etc.). Investors’ bond holdings collapse in market value, in line with their capital, unless they want to wait until maturity, if it is a somewhat solvent debtor, to get their “debased” bonds back while forgoing market interest rates in the process as they remain “locked in.”

Same goes for stocks. The printing press can levitate bond and stock values beyond any semblance of price discovery or rational valuations (which price in constructive odds of earning a real return and capital preservation). This IS precisely what we’ve been seeing for the past decade. When this no longer works, i.e., the printing presses either run in reverse (Fed QT) or when the central banks start up their electronic printing presses in untold, even more currency destructive lines led by the Fed, then at some point confidence in fiat currencies is lost, and bonds take a hit, and another hit, and then it feeds on itself until we go into manic low bond values, manic high bond yields.

Point being: when you invest money, you no longer have money, you have bonds and stocks (and RE) based in a fiat currency –hell, you no longer have money when you deposit in a bank, save for a stub, but that’s another dangerous story. In any event, my point is that the value of those assets can shift dramatically for a host of reasons, from perception to reality, from boom to bust. Thus, when you go to sell and thus go back into cash (which really isn’t if it gets deposited in a bank account, buy select short-term OECD gov’t debt instead), you may only have a fraction of the money back which you invested. It’s exactly the above which I think will happen.

Most, or at least many, investors will get stuck in the reset take-down of bond and stock values. Their unrealized gains will turn into unrealized losses. So their reallocation firepower will be much reduced. As will their net worths. But in the process, I am firmly convinced that the HUGE global creditor constituency will pummel bond and, by extension, stock valuations (the trigger being currency or monetary crises uncorked by USD destruction).

If only 1% or 2% or 3% of creditors get worried and begin to sell, that’s from a few trillion dollars to nearly $10trn looking to sell. Add this to the $10trn plus in new global debt (and between $2trn and $2.5trn, if not $3trn, including the net trade deficit, in new aggregate American debt BEFORE an even weaker economy) and a Fed throwing another $600bn into the even bigger bond fire sale nearly straight ahead of us, and I can’t help but think that we are going to have massively lower bond prices/hugely higher yields before all too long. (Confession: I have been saying this for quite a while.)

Said is ESPECIALLY apt as soon as investors can no longer assume (pretend) that financial repression has worked, and that we can get out of currency debasement (QE, ZIRP, NIRP) purgatory after all. In a related manner, the buck and US government bonds may have a brief and oh-so-erroneous flight to safety tailwind. But this time around, for all the above reasons, I believe it will prove very fleeting, which will then serve to reinforce the downward pressure on both the buck and US bonds, which will spread globally as we inevitably slide into an even more pronounced global currency devaluation contest for political reasons.

So where will the rapidly vanishing “invested money” go for shelter, for capital preservation, for solvency protection, for inflation protection? I can only speculate, just like everybody else. But I would speculate the following:

In closing (almost), and sorry about the length of this — I may just try to leverage this into a post! — everything happens at the margin, Mike, as we both know. Prices are determined at the margin. Just ask central banks and their “10-year old tail wags the dog” puts. When perception changes, be it based on the Fed’s QT effort, or that the central bank tail will be overwhelmed by the $250trn global creditor dog, bond NPVs/valuations — and everything tied to them, and I mean everything — can change quite quickly (sorry, grandma), whether you are in Australia or in Germany or in Japan or in Canada or in America. Most important, in my view, is that you are in the right kind of “investment grade” bonds, namely short-dated ones, which won’t get whacked by the upcoming global interest rate surge.

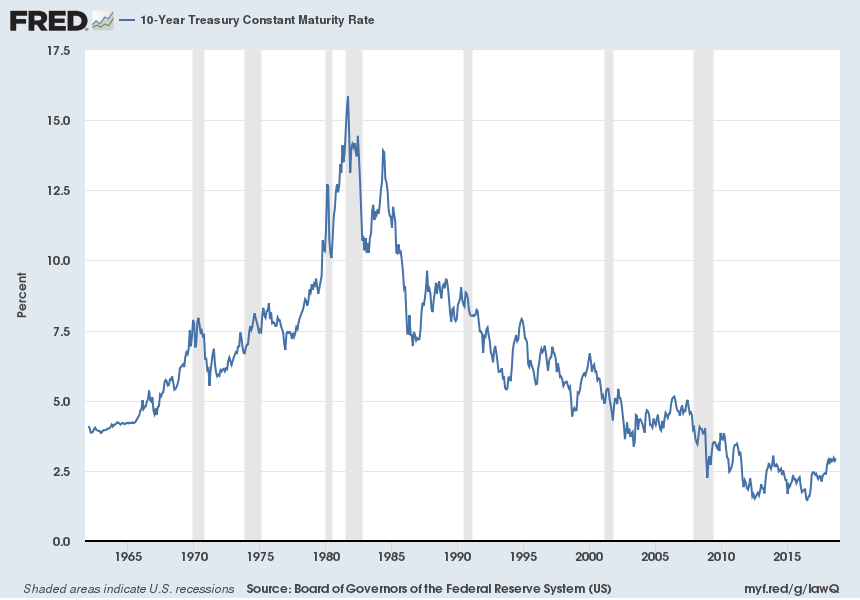

Let me see if I can copy/paste a Fed chart on the US 10-yr bond into place below here to try to drive home the quite quickly point as people forget what happened in the 70s or 80s, or just weren’t around, like your oldster but lovin’ it author, Dan (Hope this all works, and that I didn’t just charcoal an hour or two, because as of tomorrow I’m off to my substitute teaching “moonlighting” for three consecutive weekdays, so I will be a bit Internet shy for a while). Oh yes, and that chart! Please see below. And take a look at how fast the rate climbed from 8.8% to 12.6%, or from 10% to 15.4%! How does in less than a year sound?!

My second-stage youtube response, also from earlier today, was as follows:

Sorry, Mike, missed one thing — you’d think that my “over the top” response would have at least captured everything! Here goes: I think value stocks will also get hit, should interest rates/discount rates rise smartly (what I believe is in store). But, given their shorter lower P/Es/de facto shorter durations, they should get hit significantly less than growth stocks.

In post #47 I go into this at some length. I also offer a NPV calculation for both value and growth stocks. One is at a lower discount rate (today’s), and one is at a higher discount rate (I believe tomorrow’s). The rising interest/discount rate “hit,” which is more of an indicative effort than a precise calibration given the “dismal science” and given assumptions that are intelligent guesses based on human nature and not on the immutable laws of nature/physics, is as follows:

My value stock example (links provided in post) would decline by 38%, the growth stock (linked to the Russell 2000) would shrivel by 48%. Point being: unless you’ve purchased great investment grade stocks at a fraction of today’s prices years ago which currently offer you very low P/Es (based on your purchase price) and very juicy dividends (based on your purchase price), you should consider “letting go” and facing tax consequences as applicable given your jurisdiction.

In my opinion, which is based on our political, financial, and economic landscape juxtaposed against bubble valuations, most stocks are going to get clocked. Widespread bargains should be available within years, if not substantially sooner (as in perhaps months), that will likely remind us of the 70s stagflation valuations. I’m referring to metrics (doesn’t that new age word sound so cool?) such as P/Es of 6 or 7, E/Ps of 14 or 15, and dividend yields of 8% plus.

Hope this lighter than usual post provides some useful questions courtesy of a fine, knowledgeable gentleman by the name of Mike (questions that you may also be pondering) as well as some worthy of your time” attempts to address them by yours truly. I also hope that this unconventional piece puts a little smile on your face or elicits a “yup, that’s true” response once or twice as you read it.

Sincerely,

Dan Kurz, CFA

www.dkanalytics.com

This commentary is not intended as investment advice or as an investment recommendation. Past performance is not a guarantee of future results. Price and yield are subject to daily change and as of the specified date. Information provided is solely the opinion of the author at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Information provided has been prepared from sources deemed to be reliable but is not a complete summary or statement of all available data necessary for making an investment decision. Liquid securities can fall in value.