Metrics and valuations:

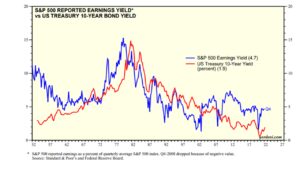

US$:103.2; Fed’s B/S: $44bn short of $9.0trn and down $10bn from prior week; US government debt: $30.4trn; total US debt: $88.3trn or 3.6x US GDP; US net international investment position: -$18.1trn; US 10-yr: 2.8%; the real yield: -14.2%; 700-year average real risk free yield: +4.78%; Vanguard Bond ETF YTD return: -9.0%; CPI: 8.5%; ShadowStats CPI: 17%; S&P 500: 4183; S&P 500 GAAP P/E: 21.1x for a 4.7% earnings yield; Oil: $101.92; Gold:$ 1,884; Silver: $23.37

Post #80: Short-lived QT, revisited – we will soon all be Japanese

The Fed’s balance sheet (sorry about the terrible quality of this graph — please click on link to get a crisp image):

Source: https://fred.stlouisfed.org/series/WALCL

First, a US dollar valuation comment:

As some of you may know, I have long thought the buck tremendously overvalued, especially based on the huge and growing deficits America has at both the governmental and the trade levels. Just as I like free cash flow generating companies, same thing applies for countries and their currencies. Alas, the dollar has long defied gravity, cheering on a hugely negative free cash flow nation and extending America more rope to hang itself with. And it continues to defy gravity and econ 101. There is only one explanation that makes any sense to me whatsoever currently, and it is a tragic thought: with no resolution in sight on the Ukrainian war front — deep state puppet Zelenksy won’t save his own people by declaring the Ukraine a neutral nation, the West refuses to stop arming the Ukraine as both Sweden and critical Finland are being incentivized to join NATO, and Russia most understandably refuses to have NATO and NATO missiles on its border after decades of NATO (the US and its European lackeys) provokingly and accord shatteringly moving east — money/capital could be heading for American shores to distance itself from a potentially frightening and possibly even nuclear war in Europe. God help us all if this happens.

If the ultimate horror doesn’t happen, despite our psychopath politicians, let me ask you this: would you rather own a currency whose central bank prints the money to buy huge amounts of vital goods and commodities that America needs to procure overseas or the currencies of nations that sell them to America and the ROW, very much including the Russian ruble?

Fed QT and Fed QE:

Back to the topic of this post, namely short-lived QT, revisited, a topic that I have published on numerous times, including in Post #44, where one of the sections was titled: “That Fed QT (bond sales) will morph into record Fed QE (bond purchases or debt monetization) amidst reversion beyond the mean.” Note that between November 2016 and September 2019, the Fed’s balance sheet fell from $4.47trn to $3.78trn, a reduction of nearly $700bn over 2.8 years, or an average annual reduction of $250bn. Please see the Fed (fred) link above for both the depiction and the balance sheet numbers upon which the graph is based.

From that $3.78trn low point, the Fed’s balance sheet, mostly consisting of short-term US debt and to a lesser degree mortgage bonds, has ballooned to $8.96trn in just 2.7 years, an increase of 137% or a whopping $5.2trn. Makes the $700bn balance sheet reduction over a similar time period look puny.

The Fed’s counterfeiting — or bond purchases, most recently at the rate of $125bn per month or $1.5trn p.a. — has not only soaked up bonds, in the process creating an artificially low yield (financial repression or the enablement of outsized government spending and deficits), but the central bank bond purchases have increased the monetary base by a similar magnitude, again opening the door to widespread growth in the money supply in a fractional reserve monetary system such as ours/the world’s.

That same Fed now wants to revisit QT (if it ever gets off the ground), which is the same as shrinking its balance sheet or the monetary base. The Fed has targeted selling bonds at up to a $95bn monthly clip, which amounts to $1.1trn a year in bonds that it will sell, in the process taking the same amount of money out of the system. Mopping it up, if you will. (And this is prior to considering the leveraged impact this will have on a fractional reserve monetary system, which traditionally has been 10:1.)

Now, $1.5trn in less money created/printed coupled with $1.1trn p.a. of money absorbed and effectively disappearing from the monetary system spells a sea change of $2.6trn p.a. in liquidity. That’s huge.

Juxtapose this against a fiscal 2021 US federal deficit of $2.8trn prior to a formal recession. This is a spending binge-fueled deficit: Congress enacted a whopping $7trn in new spending over the past 18 months. The deficit, which is already expanding markedly half-way through fiscal 2022, will likely bloat by $1trn to $2trn given lower tax revenues and higher transfer payments associated with an even stouter recession (than the one I am convinced we are in currently). Said would be prior to another $5.8trn in the spending pipeline on redistributionist entitlements ($1.8trn) and on green energy cronyism ($4trn), which, if enacted, would pulverize leveraged output (productivity!), property right protections, and energy affordability even further. The gathering recession will feature significant job losses, greatly reduced consumer purchasing power, and heightened poverty in an increasingly stagflationary environment — official US consumer inflation is now running at 8.5% on an annualized basis or about 17% p.a. in street terms. As such, in a deepening recession the federal deficit could be even larger than $3.8trn to $4.8trn as goods and services people need continue to get ever pricier and those that they want, yet have to forgo, inevitably become cheaper, but define neither Main Street consumer inflation nor do they offer material “affordability relief.” That affordability relief will have to come from heightened, deficit-widening transfer payments, especially in election years — think 2022.

Also juxtapose Fed QT against a trade deficit in goods and services moving into the $1trn plus range annually, and you have a financing dilemma that by definition will exert substantial pressure on the cost of money (up to 12 months in duration) or capital (more than one year in duration).

In aggregate, if the Fed really commences with substantial and sustained bond sales, about $2.6trn in less liquidity will be set against something on the order of $3.8trn plus in federal government deficit financing needs in a mounting recession (note that average total federal receipts amount to “only” about $4trn in a non-recession year, about $2.5trn below total federal outlays). Moreover, and as observed, Fed QT or bond sales would not only make it substantially more difficult to finance a $1trn trade deficit with foreigners increasingly reluctant to finance US deficits, but foreigners looking to front run or at least “ape” the Fed may even begin selling some of their net US dollar-based assets of over $18trn, especially given the growing weaponization/politicization of the US dollar and thus its declining transactional allure and significance. And yes, the US is a net overseas debtor of over $18trn, meaning if foreigners really sought to jettison dollars for other transaction currencies (think of Russians selling natural gas in rubles or the Saudis eventually selling oil in renminbi) in which to conduct international trade, the buck would collapse and US inflation would go through the roof. All said, there could suddenly be a major, multi-trillion-dollar shortfall of capital to finance something like $4.8trn in USD-based financing needs at the governmental and trade deficit levels BEFORE any net sales of US assets by foreigners. And the Fed wants to sell bonds?

Short of WWIII, please tell me how this won’t ultimately result in higher, potentially significantly higher, interest rates as a heavily indebted American private sector, both corporate and households, will require a greater incentive to even consider purchasing government bonds now that the Fed wants to get out of the game on the one hand and even sell bonds (QT) into the market on the other hand.

To add insult to injury, a misallocated, $1.9trn annual compliance cost American bubble economy with ever more regulatory cost and regulatory insanity that also has a) total interest-bearing debt of $88trn, b) short-term financing, and c) a de facto increased interest expense of roughly $880bn for every 100 basis point (one percentage point) increase in the average cost of financing is a very fragile economy indeed. As a percent of US GDP, $880bn amounts to a chunky 3.6% of national output. A 200 basis point increase, which would correlate with a 4.8% “risk free” rate of return on a 10-year US Treasury bond, a level not too far above its average multi-century yield of 4.5%, would amount to $1.76trn in additional interest expense, or a whopping 7.2% of current GDP, an economy killer. A 15.84% yield on the 10-year Treasury, or the previous peak in investment grade bond yields back in September 1981 when America was much less leveraged and was still a net creditor nation to the tune of over $227bn, would result in a $11.44trn higher financing cost, which would equate to 46.8% of current US GDP, an obvious impossibility but of illustrative use in terms of depicting how unsustainable our financing has become even if creditors accept smaller negative real returns instead of demanding positive real returns. (Note that a 15.84% yield on the 10-year Treasury would still be below current real world consumer inflation of 17%, a rate poised to go higher, possibly substantially.)

I’ve long called our Frankenstein finance and economics the progeny of a highly toxic public policy stew enabled by the printing press. A wealth of nations’ poison that punishes savers and thus stunts real (versus printed) capital formation with which to invest in order to facilitate both productivity and organic growth — you can’t have free market capitalism without capital, and sustained crony capitalism only works wonders for the fascist elites while threatening reimposition of serfdom for the masses. Now consider this epic mess against the backdrop of a grossly misallocated bubble economy and the long-standing, misallocation-enabling zero interest rate policy that, together with unprecedented Fed money printing and foreign financing of US deficits, has resulted in deeply negative real US interest rates of around MINUS 14.2% (a 10-year Treasury yielding 2.8% less 17% real world consumer inflation). The deeply negative real rates promise to stoke even more inflation and even more malinvestment and redistributionism from non-crony, Main Street makers to takers from K Street to illegal aliens while it fleeces creditors, pension funds, and grandma. How long until bond vigilantes return? Will they want to sell their vulnerable low-yielding bonds, which are already closing in on a -10% return only four months into 2022, together with the Fed before they decline further, or will they start front running the Fed?

Moreover, dwell on a 40-year bond bull market that is set to reverse powerfully into a very deep and long bear market given our extreme money printing induced indebtedness, raging inflation, and ever-growing solvency risks in public and private sectors alike. Again, the only ugly caveat here would be if the Russian/Ukrainian war spills over into wider Europe, which would then cause a flight into the dollar, again letting America get away with fiscal, monetary, and rule of law “murder.” In fact, this may already be occurring. This is the big wild card, although obviously no one will be able to hide if the war goes nuclear. Then the only concern will soon be survival. Globally. In other words, everything else will be rendered academic.

Assuming we are spared such a horror despite our psychopath politicians, how long does the Fed think it can carry forward a tightening policy in an over-indebted economy with short-term financing on the one hand and asset bubbles that rising interest rates would pop on the other hand? It was already tried between 2016 and 2019, and it was an utter failure. Debt, grotesque misallocations, cronyism, Coronacrat Main Street destruction, and even more onerous, freedom and property rights pummeling decisions, legislation or regulations, including even more insidious social, environmental, corporate, and government engineering, promise to increase the political and economic straight jacket further still, requiring yet more money printing as the economy and the enabling productivity wilt in progressively more pronounced terms. To wit (please note that productivity growth not only underpins economic growth and enhances consumer purchasing power, but it tempers inflation — in fact, each secular growth company IS a deflation story):

Nonfarm business sector labor productivity decreased 7.5 percent in the first quarter of 2022, the U.S. Bureau of Labor Statistics reported today, as output decreased 2.4 percent and hours worked increased 5.5 percent. This is the largest decline in quarterly productivity since the third quarter of 1947, when the measure decreased 11.7 percent.

Therefore, look for a rapid, even more outrageous return to QE and a reversal of any baby steps on the Fed Funds rate front sooner rather than later, which, in a high inflation landscape, promise to increasingly entrench consumer goods inflation and add even more pressure on the dollar’s reserve currency and leading commercial currency (the petrodollar) role beyond that which is already beckoning in Russia, China, Iran, and Saudi Arabia. Add to that the corporate shift from just-in-time to just-in-case (it costs more and is unavailable) inventory practices, consumer hoarding, the rising proclivity to spend increasingly rapidly depreciating dollars, euros, pounds, and yen, and you have the HUGE global increase in the monetary base of leading central banks all the sudden getting a lot of money multiplier traction to yield way too many counterfeit currencies chasing a deficit of goods and services made much worse by the “plandemic” lockdowns and the related supply chain destruction.

Stagflationary investing and inflation:

Allocation advice: get out of incredibly overvalued bonds, get out of non-resource focused equities that sell things you want but don’t need, especially hyperinflated growth stocks in the tech sector that will suffer most when economics again trumps politics and real interest rates go from about -14.2% in the US back into positive territory. Consider increasing your exposure to the vital ag/food and dense energy arenas because this is what people won’t stop buying; it’s what they need to survive. In the reallocation process, raise liquidity, and, when you do that, opt to start or increase your allocation to physical precious metals in your possession. And recall this: if you can’t touch it, you don’t own it, which also goes for stock certificates. Physical precious metals are not only a store of value that protects purchasing power over time, but gold and silver could prove to be money on steroids once confidence in our sick world being able to sustain itself wanes, making precious metals a source of funds on steroids with which to purchase Blue Chip crony stocks once they again sport single digit P/Es/double-digit earnings yields (figure 10, page 7 — or, please see chart below) and high single-digit dividend yields. We saw this in the stagflationary ’70s, and this time around valuations ought to be even more enticing because our stagflation will be much, much worse on the heels of decades of terrible fiscal, monetary, regulatory, and economic policy which have crushed productivity growth and brought us record debt.

Source: S&P 500 Dividend & Earnings Yield (yardeni.com)

Precious metals dry powder may also be useful for purchasing investment grade bonds, i.e., if there will be any left, that again offer double-digit yields thanks to investors demanding such returns to offset outsized inflation and insolvency risks. Reflect on the late 1970s and into the very early 1980s as a preview of coming attractions, revisited. Today’s investors will also increasingly balk at buying ever more bonds thrown on to the market given firming stagflation, in the process ultimately demanding positive real yields, at first only at the margin, then much more so. This is because neither ZIRP nor NIRP help defined benefit pension plans generate the 7% – 8% annual returns they need to avoid eventual insolvency much less meet their payment obligations in nominal dollars or other fiat currency terms. It is also because bond losses will multiply as a secular bond bear market establishes itself, adding to the sting of yield starvation on the one hand and mandating double-digit yields on new bond commitments in order to have any chance at all of meeting commitments made to pensioners on the other hand, something an even greater coming glut of bond issuance ought to underpin. In short, boom-bust history will repeat. Take advantage of bubble valuations to position yourself correctly as time grows short for the inevitable bond and stock busts that will make today’s negative returns (-9% YTD in bond land) look good in comparison.

Speaking of stagflation or negative real growth accompanied by rising inflation, it will continue to percolate given a massive, utterly unprecedented expansion in the domestic and global monetary base, widespread and lingering “plandemic“-triggered sourcing and production issues, and, last but not least, a huge change in inflation psychology. We are looking at the beginning of a secular story. As alluded to above, a “crack up boom” is on the horizon as corporations and people will increasingly want to unload depreciating currency to stock up on inventory and to buy vital real goods, respectively. Progressively more negative real interest rates will add even more incentive to borrow cheaply and purchase progressively more expensive “scarcity assets.” And a weak economy defined by consumers’ wages and salaries continuing to broadly lag services and goods inflation, likely by growing amounts, will ironically usher in a return to QE, Japanese style, from what I am convinced will be very abbreviated QT for political reasons. That last shoe to drop will turbocharge inflation, i.e., until governmentally-imposed “wage and price controls, revisited” prove to be yet another supply side hammer, worsening both scarcity and (black market) inflation, in the process driving another nail into the economy’s coffin while further fraying the social compact, a horrific double-whammy.

For a precursor of what is ahead at the consumer price level, consider that US producer prices surged at a historic 11.2% annualized rate in March, (again) handily outstripping annualized “8.5%” consumer inflation and way ahead of annualized wage gains of 4.7% during the same month. Even more significantly, US import prices surged at an unprecedented 12.5% annual rate in March as export prices rocketed 18.8% higher YOY, also a record, indicating a) that sanctions-impacted import prices will continue to surge despite a strong dollar and b) that domestic prices will eventually surge in sync with how much more exporting corporations are charging their foreign customers. And remember that consumer inflation and economic weakness go hand in hand in fiat currency economies.

Note that there are pundits pointing to the “global” deflationary impact from rising prices of goods and services that you need, such as food, energy, lodging, and insurance, and those that you want, such as Netflix streaming and Disney entertainment, which will come under pressure – as if this will moderate overall inflation substantially in a fiat currency world. As said, it won’t. Things that you need will go up in price in the process absorbing an ever-greater portion of our liquid means, and things that you want but don’t need will suffer less demand and less pricing power. This is called Main Street price inflation, and thus national price inflation, which the Fed and other central banks will inevitably stoke even further in an effort to rescue their asset bubbles, their political friends’ election prospects, and, as regards the Fed, the money center bank balance sheets and earnings – in short, the balance sheets and earnings of the Fed’s owners. For perspective on just what central banks will do to save asset bubbles, consider the BOJ’s decision to launch unlimited bond purchases to keep the 10-year JGB from rising above 0.25% as inflation in Japan and in Germany is soaring on the back of supply chain disruptions, Western sanctions against Russia, and of course unprecedented counterfeiting by the BOJ over decades and the ECB since 2008. This is called spiking the inflationary punch bowl. We will all soon be Japanese.

Separately, pundits are also pointing to the potential deflationary fallout from substantial illness and deaths from the Corona virus clot shots. As you may be aware based on various publications on this topic, I share that horrific concern at the health level, but not at all at the consumer price inflation level. Think about the former USSR long suffering under a declining population, low life expectancy, and a large Vodka problem. Did that prevent hyperinflation in that former country? No. Do shortages, lacking medical care, and starving people prevent hyperinflation in North Korea? No. Do wars, falling output, and genocide prevent hyperinflation in African nations suffering from same? No. HELLO, pundits, time for a reality check in a fiat money world with paper and electronic printing presses! It’s like the incessant babbling about “reversion to the mean.” There is no reversion to the mean, only beyond the mean, otherwise known as asset bubbles and busts. That mean valuation level of bonds and stocks is but a rare moment in time on the way to a bubble or a bust, and we’ve been in bubble land for an unprecedented period of time. Markets, just like the humans that create them, have manic depressive tendencies.

In terms of how to position your investable assets for our world, think beyond the Fed and ECB hype and their baby steps regarding raising central banks’ short-term rates to a level that will still be way below consumer price inflation, both as regards the fake CPI and real-world consumer inflation, which is roughly twice as high and rising. Think beyond central bank balance sheet reductions (selling the very bonds that investors don’t want thanks to negative real yields and rising inflation and solvency risks). Just like before, and just like the BOJ today, the Fed and the ECB may well institute open-ended counterfeiting to hold down long bond yields while enabling even larger negative real yields at the short end of the curve they control. Ultimately, the world’s leading central banks will lose both the inflation war and the interest rate suppression war, in the process pushing nations into insolvency, economic chaos, and political instability, a horrific fiat currency legacy, revisited.

THIS TIME IS DIFFERENT, the four most dangerous words in the investment business! Why will it be different this time? Why will there be no “happy ending?” Because the globally unparalleled monetary inflation genie can’t be put back into her bottle and because monetary policy changes typically have a substantial time lag – think of how long it took to really get “official” (deeply understated) price inflation cooking after the initial off-the-rails global money printing binge back in 2008, a binge that can no longer be absorbed or contained in a collapsing bond bubble. Add the deficit-laden fiscal and toxic regulatory policy into the mix, which (I am convinced) has so eviscerated productivity growth, and then consider our gaping retirement underfunding, which politically can only be met with even money printing to at least meet commitments in nominal dollar and other fiat currency terms, and the post #80 title may make even more sense, i.e., until our fiat currencies are increasingly repudiated, which is also why you will want to have at least a physical precious metals insurance policy.

Conclusion:

Investors should be selling long-duration bonds and stocks before central banks do for a spell, and then selling them to the central banks once they follow the BOJ’s lead to initiate unlimited bond purchases to keep long-term rates from rising above 0.25% in the Land of Nippon. And take the gifts from our serial counterfeiters and bubble blowers to increase your exposure to assets that people will need, especially in the secularly challenged ag and dense energy patches (there is a low single-digit P/E fire sale going on in Russia right now also known as Gazprom shares!), two industries that I have been recommending exposure to over the past nearly 13 years, including during my tenure as thematic strategist at Credit Suisse’s CIO Office, and as DK Analytics posts, videos, and reports bear out.

Sincerely,

Dan Kurz, CFA

DK Analytics

The obligatory boilerplate:

This commentary is not intended as investment advice or as an investment recommendation. Past performance is not a guarantee of future results. Price and yield are subject to daily change and as of the specified date. Information provided is solely the opinion of the author at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Information provided has been prepared from sources deemed to be reliable but is not a complete summary or statement of all available data necessary for making an investment decision. Liquid securities can fall in value.

FYI: select edits, grammatical improvements/corrections, and/or additional links have been incorporated into this post past the initial publishing date of April 27th, 2022. That said, neither the thrust of the piece nor the overarching message that was communicated at the initial publishing date have been altered in the slightest.