Post #70: An on-campus unmasking request for daughter Sarah failed; round one loss to health, sanity, and tyranny

US$:90.98; Fed’s B/S: $7.2trn; US 10-yr: 0.93%; S&P 500: 3663; Oil: $41.55; Gold:$ 1,8440; Silver: $23.94

An on-campus unmasking request for daughter Sarah failed; round one loss to health, sanity, and tyranny

Executive Summary:

This is an atypical post about hopefully initiating a grassroots effort to once again breathe naturally and freely, revisit humane policies, re-institute sanity, and re-establish basic civil rights on Lee County, FL public school campuses; it is an appeal effort that, frankly, “radiates” to wider societal interaction and freedom in general. In so doing, this post also effectively revisits expanded governmental and bureaucratic tyranny, scientific facts be damned, as regards the “trumped-up” Corona virus (COVID-19) threat. Specifically, it relates to my daughter’s difficulties (she is not alone) thanks to the local “masking-up” diktat for seven hours a day, five days per week since the beginning of the current school year in late August here in Lee County, Florida. In particular, every day she rides the school bus to Estero High School, is on campus, and rides the school bus to return home is mandatory “masked-up” time.

In a nutshell, facts and true health risks are being callously pushed aside by political and CYA calculations, yet daily school bus and school campus masking decrees from Monday to Friday are being shamelessly peddled as protecting the lives of our public school children. For those parents and students sharing our family doctor’s, daughter Sarah’s, my close friends’, and my own pronounced unmasking convictions, I hope that this post will inspire you to join us in a grassroots effort to liberate students to breathe free and to communicate fully and naturally, with vital facial expressions and identities again being on complete display. I state this despite the pronounced round one defeat on December 4th, 2020. If enough of us “chime in” here with science on our side, we may ultimately prevail — hopefully in time to prevent irreversible developmental, emotional, mental, and physical damage.

The appeal and its aftermath:

My unmasking appeal to the Lee County School District “504 Committee” on December 4th was as follows:

Given (more details and source links in “deeper dive” section):

- That 99.997% of all young people, or essentially 100%, as in public school students, recover from the Corona virus, should they contract it

- That young people are poor spreaders of the Corona virus

- That according to a plethora of scientific studies, masks are broadly known to lack efficacy in terms of preventing the spread of the Corona virus. Recent scientific studies in Switzerland and Denmark, which I have shared with Mrs. H in email format, confirm just that

- That sustained masking-up for protracted periods is known to pose serious and potentially lasting physical, mental, and emotional risks, including higher youth suicide rates

- That my daughter’s novel issues (headaches, pronounced drowsiness, substantially reduced mental acuity, being sick much more often) began after she was forced to wear a mask, as shared in Dr. A’s unmasking request letter — please note that Sarah had a nearly perfect attendance record at Estero High until this year, and was well-integrated into campus life, enjoyed her classes and teachers, and achieved a great GPA

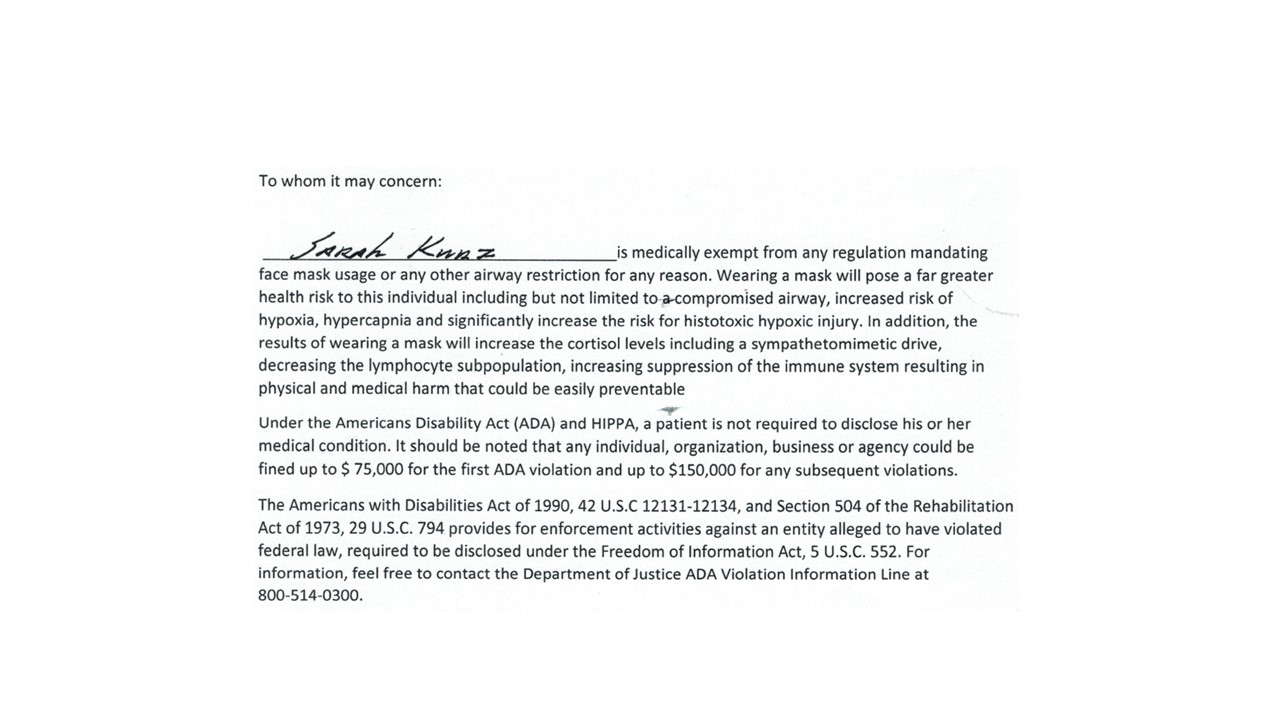

- Dr. A’s medical mask exemption notice and its clear call-out of far greater long-term health risks to Sarah if she continues to wear a mask such as oxygen deprivation (hypoxia), pulmonary disease (hypercapnia), and cells’ reduced ability to take up oxygen (histotoxic hypoxic injury)

- Sarah’s right to peaceably assemble in public places based on the FL Constitution (Article 1, Declaration of Rights, Section 5)

- Sarah’s right to peaceably assemble in public place based on the US Constitution (1st amendment)

- Governor DeSantis’ Executive Order #20-244, suspension of COVID-19-related fines and penalties – the order, consistent with EO 20-92, suspends the collection of fines and penalties associated with COVID-19 enforced upon individuals …,

… I petition you, as Sarah’s papa, to allow Sarah to come to Estero High School, be a student at Estero High School, and return from Estero High School to her home without a mask.

Thank you very much for taking the time to allow me to make my unmasking case on behalf of Sarah as guided and underpinned by our family doctor’s (“Dr. A’s”) medical advice.

The 504 Committee’s decision concerning my unmasking appeal for my daughter after an hour-long discussion, as communicated verbally and via an email file attachment:

Not eligible — the student was evaluated and is not eligible under Section 504. There is no educational impairment.

My email response to the 504 Committee’s decision:

Hi Mrs. H (head of 504 Committee),

Thanks for reaching out. Although it was good to hear your friendly voice and see your kind face, I honestly think we were “railroaded,” including on the “voting front” (frankly, had I known the “attendee dynamics” here, I would have tried to get a handful of friends onboard). I say this despite the pleasant, respectful, and civil demeanor of the call’s discourse extending to all participants, and despite the time and effort you invested in making it happen, for which I remain grateful, as I’m sure my close and dear friend Doug does as well.

Separately, allow me to make some observations. In so doing, my intention isn’t to be brash or disrespectful, but simply to be honest, given what I believe to be at stake. Specifically, in my opinion, you and your colleagues, as employees of the Lee County School system, are essentially being forced to uphold a school bus and on-campus masking policy for kids:

- That have next to zero downside health risks from the COVID-19 virus or the Corona virus

- That are very poor/very unlikely transmitters of the virus to others – much less likely transmitters, for example, than the likelihood of them transmitting a “run of the mill” flu

- Who have to wear masks that display no statistically significant reduced transmission of virus efficacy (as food for thought, just dwell on the widespread societal masking-up for the past eight months juxtaposed against stubbornly high new virus cases, i.e., assuming the test results provide accurate readings — there is ever more evidence of “false positives,” which only add insult to already copiously disruptive relationship, family, societal, and economic injury caused by the draconian virus policy response forced upon the masses).

- That have no choice but to be masked-up “lab rats” virtually all-school-day long thanks to a masking decree that is detrimental, or substantially worse than detrimental, either emotionally, mentally, or overall health-wise, especially after months of forced compliance – in short, kids who are subjected to “all that” yet for whom the Corona virus poses an extremely remote, virtual non-existent threat, which also applies to the people they come in contact with (as amply discussed and documented numerous times – please see attached for ease of reference, and also click here and here should there be additional non-mask efficacy verification interest).

In a related manner, please forgive me for wondering how your collective consciences can “whitewash” what you are supporting or promoting. Hopefully the day won’t come, when you and your colleagues will seriously regret having stood for such a policy. I hope this for you, but much, much more than that, I hope it for Sarah and all the other masked-up kids suffering under this inhumane, dehumanizing, depressing, ineffective, counterproductive, absolutely unnecessary (!!!), and (in my view) despotic masking-up diktat on school buses and all day at Lee County campuses (save for “oxygen breaks”).

Given what is at stake here and given the novel, mask-related challenges that Sarah has been facing and dealing with, like a good soldier, since the beginning of this school year, I will sustain the on-campus-related unmasking effort on Sarah’s behalf based on the means at my disposal (thanks for the contact addresses and appeal “avenues”) even as I remain dumbfounded not only by your policy, but by your committee’s absolute refusal to consider and implement — or to promote implementation of — Dr. A’s “medical exemption” and his associated on-campus unmasking request. The impairment Sarah (and I’m certain, many other students) is facing IS the mask, Mrs. H, and it is an impairment as easy to remove as a face mask (literally), for the “global” good and well-being of everyone involved on campus and on public school buses.

In a disappointed yet sincere manner,

Dan Kurz

A deeper dive:

I’ve been engaged in what has become a marathon effort to garner an unmasked status at Estero High School for my daughter Sarah. The effort commenced in the summer of 2020, i.e., since we learned that Lee County public schools would reopen, yet mandate masking-up for everyone on campus as per the start of the new school year. By late September, and because Sarah continued to have novel and material issues (drowsiness, dizziness, headaches, reduced cognitive ability, and facial rashes) associated with the masking-up decree, I reached out to our long-standing family doctor (“Doctor A,” an MD), whose name will not be disclosed here for reasons of discretion. I did so in the hope of achieving relief for my daughter. Doctor A was all too familiar with the masking-up symptoms that Sarah was increasingly challenged by, and he issued a medical exemption from any regulation mandating face mask usage for Sarah. The medical exemption notice, as well as an accompanying unmasking request he signed, were shared with the appropriate administrators at Estero High School in early October, who then shared them more broadly within the Lee County School District.

Dr. A’s medical exemption notice dated October 5th, 2020:

The accompanying unmasking request that was signed by Dr. A on October 5th, 2020:

From: Dr. A

On behalf of: Sarah O. Kurz, senior student at Estero High

To: Estero High School decision maker(s) in Lee County Public School System

Regards: Unmasking request for Sarah Kurz as an on-campus student at Estero High

To whom it may concern,

It has been drawn to my attention that Sarah has had difficulties since the beginning of the new school year, a year which commenced with mandated, virtually full-time wearing of masks by all the inhabitants of Lee County Public School campuses. Specifically, Sarah:

- Has come home nearly every day with a considerable headache, in clear contrast to prior years, when this was the exception, not the norm.

- Was sick three days recently (which prompted her dad to seek an appointment with me on her behalf, which took place on October 1, 2020). This stands in stark contrast to not having missed more than a day or two of school since her freshman year at Estero High.

- Has endured pronounced drowsiness and reduced mental acuity during and after school since the start of the new school year. In fact, Sarah has had to fight falling asleep at school, a new experience.

Separately, please note mask-wearing risks for kids are quite significant:

- Inhaling the slow build of CO2 can cause headaches, dizziness, and impaired cognition

- Inhaling micro-mold caused by trapped water vapor from exhalation can cause throat and respiratory infection

- Sustained, mask-based oxygen deprivation can lead to brain damage

- Ingestion of bacteria or parasites on the mask from kids’ unwashed hands touching it can lead to pin worms or digestive illness.

For the record, let me state the following, which a recent CDC publication will affirm: The death rate — also called the infection fatality ratio — of young people that contract COVID-19 (the Corona virus) is virtually zero.

Florida Governor Ron DeSantis referenced the same CDC data when he issued his Executive Order #20-244. However, the governor listed it in converse infection survival rate terms instead of in infection fatality rate terms. The COVID-19 infection survival rates are nearly 100% for every age group from the 0 – 19 year-old to the 50-69 year-old cohorts:

Moreover, young people are poor COVID-19 transmitters: “scientific studies suggest that COVID-19 transmission among children in schools may be low. International studies that have assessed how readily COVID-19 spreads in schools also reveal low rates of transmission when community transmission is low. Based on current data, the rate of infection among younger school children, and from students to teachers, has been low, especially if proper precautions are followed. There have also been few reports of children being the primary source of COVID-19 transmission among family members. This is consistent with data from both virus and antibody testing, suggesting that children are not the primary drivers of COVID-19 spread in schools or in the community.”

Low rates of COVID-19 transmission among children in school makes mask wearing redundant at best, destructive at worst. For details, please see mask-wearing risks above and, most especially, please refer to my one-page medical exemption note on this matter.

In addition, even if young people were prolific COVID-19 spreaders, which they most clearly are not, there have been a litany of studies done on the poor efficacy of masks in terms of preventing the spread of influenza. Such studies are provided at the NIH PubMed Medical Library. All studies listed in the NIH PubMed Medical Library (please see below) conclude that even N95 respirators, or medical masks, used properly in a medical venue, do not reduce the spread of an influenza in statistically significant terms. Links to such studies follow:

- Radonovich et al. 2019

- Long et al. 2020

- Liang et al. 2020

- Sokol et al. 2016

- Jacobs et al. 2009

- Cowling et al. 2010

- Bin-Reza et al. 2012

- Smith et al. 2016

- Offeddu et al. 2017

And here are links to studies proving that non-pharmaceutical cloth masks in non-health care settings do nothing for the prevention of influenza:

- Xiao et al. 2020

- Aiello et al. 2010

- Aiello et al. 2012

- Barasheed et al. 2014

- Cowling et al. 2008

- MacIntyre et al. 2009

- MacIntyre et al. 2015

- Suess et al. 2012

- Simmerman et al. 2011

Separately, Sarah, which clearly poses no material COVID-19 risk to herself or others on campus, needs to be and deserves to be on campus at Estero High to get a full and normal learning and social interaction experience. In fact, the 1st Amendment of the US Constitution guarantees her the right to peaceably assembly in public places – as does Florida’s Constitution in Article 1, Declaration of Rights, Section 5.

Sarah also needs to be on campus to complete and double-down on her culinary course work to benefit from “real life” learning and mentoring that remote or distance learning cannot even tenuously provide, but only an on-campus kitchen featuring a teacher chef can enable. This is all the more germane given that Sarah is considering a culinary career.

In summary, based on:

- The above clarifications, illuminations, facts, and figures,

- The recent Executive Order #20-244, which suspends fines and penalties associated with COVID-19 (public policy restrictions) in the State of Florida: “Section 4. Suspension of COVID-19-related Individual Fines and Penalties. This order, consistent with Executive Order 20-92, suspends the collection of fines and penalties associated with COVID-19 enforced upon individuals,”

- The negative impact of virtually full-time Estero High campus mask wearing is starting to impose on Sarah’s health, vibrancy, and mental acuity,

- Sarah’s on campus-based presence, education, and development rights,

- And, last but not least, on Sarah’s career choice trajectory, …

… I kindly request that you excuse Sarah from the Lee County School system’s virtually full-time mask wearing decree while you continue to grant Sarah on-campus schooling access at Estero High.

For more specifics on this matter, once again please see the one-page medical exemption from wearing a mask that I have granted Sarah Kurz as her primary care physician, which Sarah’s father will include with this information. Please note that I request this “on campus” mask wearing exemption for my patient without promoting or advocating a remote learning solution, which would be most unwelcome and counterproductive from a host of maturation, learning, exposure, enrichment, socialization, and emotional stability perspectives as stated elsewhere (please also see your Sarah Kurz Estero High appeal-based enrollment files).

Thank you,

Dr. A

Nearly two months after Dr. A’s exemption notice and the related on-campus unmasking request, and after nearly four months of belabored breathing into the current school year, a Zoom meeting took place to address my petition (appeal) to unmask Sarah as relates to her school busing and campus time. As already stated, the meeting was titled a “Section 504” Committee Meeting. Section 504 relates to a federal law that protects the rights of individuals with disabilities. It requires school districts to “level the playing field” by eliminating disability-related obstacles and ensuring that students with disabilities have access to the same activities and programs as their non-disabled peers. As mentioned elsewhere, the Lee County School District made the following determination: “the student was evaluated and is not eligible under Section 504. There is no educational impairment.”

Translation: the Lee County School bureaucrats conspired to make an unmasking determination not based on the novel (new) health issues Sarah has been experiencing since having to come to school masked-up, but based on whether or not she had preexisting disabilities or impairments that caused her to become nervous or anxious about having to wear a mask for virtually the entire school day (you can’t make this stuff up, it’s so beyond the pale ridiculous and outrageous)! As all Lee County School participants at the Section 504 Committee (“Committee”) Meeting agreed that Sarah had no preexisting issues, the foundation for unmasking her disappeared. During an hour-long Committee meeting conference call, my close, long-time friend Doug and I failed to impress upon the Lee County bureaucrats that it wasn’t any historical health or mental or emotional issues that should bestow upon Sarah an unmasking waiver. We failed to convince them that the culprit for her markedly increased headaches, marked drowsiness, reduced mental acuity both on and off campus, and three times the sick days so far this school year as in all her first three years at Estero High combined were related to, if not directly caused by, roughly 35 hours of “door-to-door” masking-up each and every full school week since late August.

Needless to say, and beyond pathetic and disingenuous, no one on the Committee from the Lee County side, including a nurse that was present, even acknowledged the likelihood that the mask was the culprit. In fact, the nurse on the conference call went out of her way to state that Sarah hadn’t come to the nurse station more often since masking-up began in late August, so she couldn’t confirm that Sarah was having any issues. I told her that Sarah didn’t come to the nurse station because she knew that she would have to put her mask back on, and because she was a “good soldier.” I also told the nurse that she knew as well as me that people can resist unhealthy states or environments successfully for a long time until suddenly, there is a breakdown or a serious medical issue. But this too fell on deaf Committee ears.

The bureaucrats also surely voted against an unmasked status for Sarah for another reason — or, let me say the “real” reason behind their decision. Specifically, because an unmasking decision for my daughter would be diametrically opposed to the school district administrators’ vested interest in upholding the masking-up status quo, no matter how insane, scientifically unsound, student health damaging (restricting students’ oxygen access while forcing them to inhale the CO2 they are exhaling), and despotic this decree is. If school system administrators promote campus population virus health “safety” by demanding ineffectual masking-up by everyone on campus, how can they reverse that by suddenly (de facto) admitting that their diktat is unsound at best, and destructive to students’ health and to civil rights at worst? And never mind the total bureaucratic loss of face this would bring with it, much less the collapsed credibility.

This is all the more true given the so-called Main Stream Media’s (MSM) “alignment” with both local, state, and national bureaucrats and their elected brethren, left-wing politicians. Specifically, the endless US “Pravda press fear porn” about the Corona virus has been amplified in CNN-indoctrinated school classrooms (CNN is not only entrenched in airports, but in public schools) and by other MSM outfits more generally, such as NBC, CBS, ABC, the New York Times, the L.A. Times, and the Washington Post.

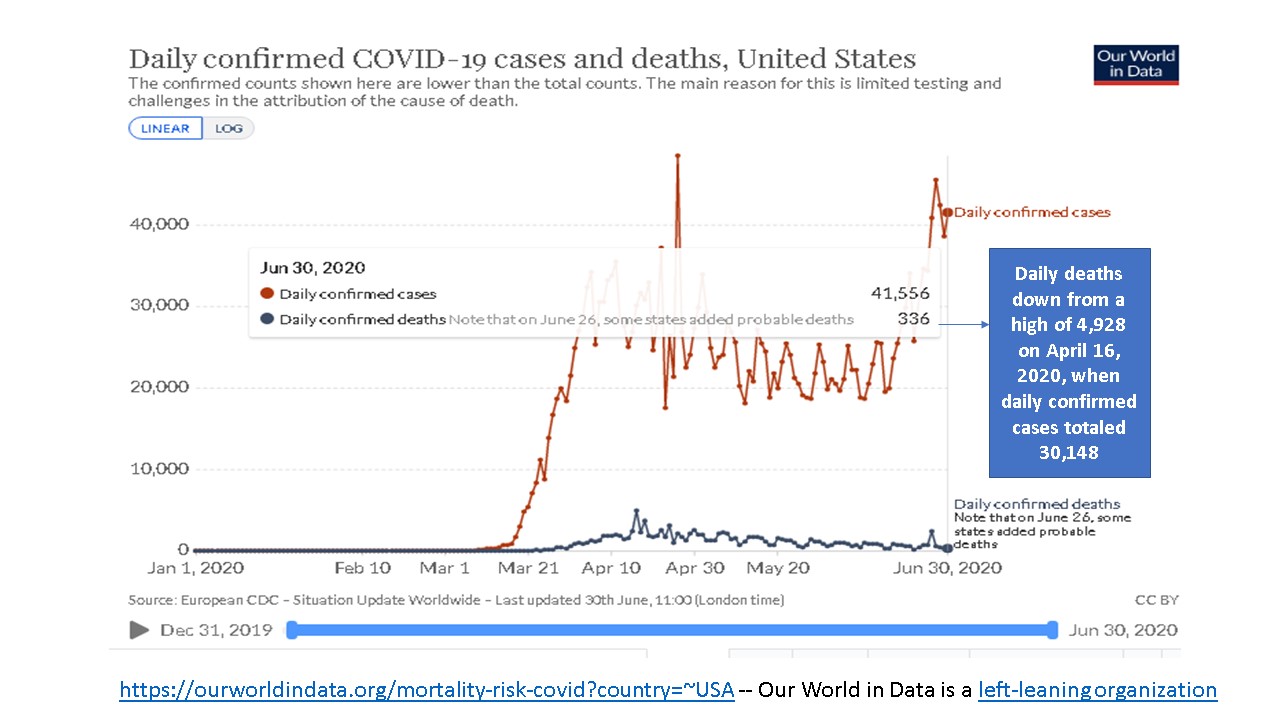

Not only are highly questionable new virus infection rates hyped, but misleading stories about overwhelmed hospitals are repeated endlessly. Juxtapose this fear porn against declining national weekly Corona virus deaths: as this post is being written, national weekly virus deaths are down 83% from the April high watermark of 17,094 to 2,849 for the first week in December. Also note that on average, 7,789 Americans die each day for a whole host of reasons, yet we don’t institute toxic public policy responses as a result.

Or, contrast the local and national fear porn with sharply declining Florida-based Corona virus deaths, where weekly Corona virus deaths are down 99% from the August 1st weekly peak tally of 1,515 people to a December 5th weekly tally of 117 people, which amounted to 5% of all weekly deaths in the Sunshine State (population 22m) during the same week.

Or, consider the CDC confession earlier this fall that only 6% of all Corona virus deaths in America could be solely attributed to the virus, not to severe chronic health issues, also called comorbidities (typically, Corona virus deaths occur when people have 2.9 comorbidities), being “onboard.” Terrible diseases such as heart disease, cancer, and diabetes are being referred to here. Said differently, if a person suffering from any of those, or other chronic maladies, suddenly came down with the flu and died, the cause of death wouldn’t be the flu, but the underlying disease … But, if such a person sadly perishes with the Corona virus on board, the virus gets blamed for the death (BTW, hospitals were incentivized monetarily to do so), not the comorbidities! In a related sense, let’s reflect on the fact that the Corona virus, on its own, has led to “only” around 18,000 deaths in the US, the equivalent of 2.3 days of average US daily deaths of 7,789 people. And let’s not forget that there have been extremely few student deaths related to this virus in the US, which has a population of some 331m people, of which roughly 25%, or 83m, is compromised of young people.

Most importantly and most germane — and to repeat — dwell not on “24/7” virus alarmism, but on the fact that Americans between 0 and 19 years of age — your school-age kids — have a Corona virus survival rate of 99.997%! In the interim, consider that, in Lee County, FL, not a single student death related to the virus has been reported to date. How do I know? Because such a sad occurrence would receive endless media attention, virtually to the exclusion of other sad causes of student deaths, which might appear “on page 34 of the News Press.”

Finally, if our family doctor’s mask exemption for Sarah was in fact honored by the Lee County School system, think of how many “me too” requests this would trigger on the one hand? On the other hand, consider all the fear porn-indoctrinated, sadly misguided parents that actually believe that the Corona virus constitutes a “Bubonic Plague/Black Death, revisited” risk for their school-age kids. And now imagine Sarah and/or other “me too” kids walking around unmasked on campus!

Conclusion:

Notwithstanding the Stalinist bureaucracy and extremely pronounced Corona virus fear porn that we are up against, if enough students complain about masks’ many troubling and inhumane aspects to their parents, over time — hopefully prior to irreversible psychological, emotional, or physical health damage — a grassroots revolt against the “do as I say, not as I do” Coronacrats (politicians and bureaucrats) and their “Covidacracy” (virus-based despotism/civil rights violations) can prevail. Would you like to join us — Sarah, yours truly, and my good friends Doug and Debi, who have been so supportive and helpful — in this effort?

With the SCOTUS (Supreme Court of the United States) shockingly refusing to review pronounced and widespread state and federal constitutional violations that took place before, during, and after the November 3rd election, “masking-up, corrupt, serial liar Joe,” patriarch of the Biden Crime Family, and extremely likely to soon be president-elect and then president, will seek to double down on the ineffective yet health-harming mask tyranny under which so many suffer, including our school-age children. While federalism is close to being eviscerated, the remaining residual will surely soon come under even greater attack given Marxist Dems’ virtually certain assumption of the presidency. Fortunately, red state Florida has a freedom-loving, sane, and health-conscious governor. Hopefully DeSantis will not “go RINO” on us, as patriots push back against ever-expanding federal tyranny on the one hand, and on growing public school despotism on the other hand. I believe parent-patriots should do this for the health, sanity, joy, and well-being of their kids and for their future. They don’t deserve anything less. They deserve the same freedom and normalcy that we had when we were growing up, and there were quite a few viruses (pandemics) “raging” back then.

Hopefully Governor DeSantis’ Executive Order #20-244 (E.O.) will not wilt under sustained and growing pressure from the lock-down/mask-up leftist bureaucrats at the local, state, and national level, or as a result of “ambulance-chasing” litigation. Instead, may the E.O. establish itself much more strongly and widely, to include public schools unmasking in practice, not just in theory, throughout this great state. This is all the more urgent given what a Biden Administration would bring. May that September 25th, 2020 E.O. gain a foothold and expand from Pinellas and Hillsborough counties through all Florida counties, in the process re-instituting lost constitutional freedoms and inalienable rights for those most “broadsided” by the “COVID-19 restrictions,” very much including our public school-age kids, who are nearly always too young to vote for the very politicians, such as Governor DeSantis, that attempt to grant them relief:

Friday’s E.O. also suspends fees and penalties for individuals who violate COVID-19 restrictions, removing the enforcement mechanisms in Pinellas and Hillsborough ordinances that require masks when inside public areas. The order did not address fines incurred by businesses.

“I think we need to get away from trying to penalize people for not social distancing and work with people constructively,” DeSantis said.

Hope dies last! In the meantime, if enough of us stand tall for science and our school-age kids instead of kowtowing to those whose salaries we pay or to “masking-up virtue-signaling” or to an indoctrinated, misinformed mob (thank you, MSM), perhaps we can start a grassroots effort to help give Governor Ron DeSantis’ E.O. much needed teeth! After all, we are supposed to be the sovereigns, not our “overlords.” Once again, please join us in this effort if you too share our concerns and our convictions! Please use this post as a “starting point,” as potential food for thought. The more of us that have a go against the entrenched public school bureaucracy that we finance thanks to public schools getting nearly 50% of every property tax dollar that we pay, the more likely they are to listen to reason. A determined, vocal, and righteous minority can be effective. It can also motivate those sitting on the fence, and a movement can really catch fire. All the sudden people will be asking in disbelief what on God’s green earth we were doing to our children. I have a dream, and there is always “round two!”

Thanks a ton for your interest!

Sincerely,

Dan Kurz

dankurz59@outlook.com

FYI: Additional information and a few links relating to discussed topics have been added to select sections of this post after the initial publication date in an effort to better buttress the stance espoused without changing the content or the nature of the matter discussed. Dr. A’s writings are exactly as he signed them. The Lee County bureaucratic assertion is precisely as it was communicated to me. Separately, select post-publishing text and link improvements have also been undertaken. Once again, neither the message nor the thrust of this article were changed.

The obligatory boilerplate:

This commentary is not intended as investment advice or as an investment recommendation. Past performance is not a guarantee of future results. Price and yield are subject to daily change and as of the specified date. Information provided is solely the opinion of the author at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Information provided has been prepared from sources deemed to be reliable but is not a complete summary or statement of all available data necessary for making an investment decision. Liquid securities can fall in value.

Post #69: America tramples over Constitution; interview with Lior Gantz of Wealth Research Group

Post #68: Headed towards full blown tyranny — an interview with that sharp Kenneth of Crush the Street and yours truly

Post #67: The lockdown has gone from a mistake to a crime by Dennis Prager, drilled down on by yours truly

US$:92.85; Fed’s B/S: $7.0trn; US 10-yr: 0.65%; S&P 500: 3580; Oil: $41.55; Gold:$ 1,934; Silver: $26.92

The lockdown has gone from a mistake to a crime by Dennis Prager, drilled down on by yours truly (below)

A considerable portion of what Mr. Prager so accurately and piercingly dissects and laments I have published on 10 different times in either video, interview, or post format since March 21st, 2020. The first content related to the Corona virus policy response debacle was a video titled “Is the cure was worse than the disease?” For anyone that listened, there was little doubt what the answer was.

I long ago stated that the small business bankrupting lockdowns were tantamount to the biggest crimes ever perpetrated on Main Street economically (if this isn’t a 5th Amendment, Takings Clause violation of the highest order, I don’t know what is) and in terms of a catastrophic loss of freedom (a mockery has been made of the 1st Amendment).

In fact, too much of our local, state, and federal Corona virus policy response and the ever-shifting CDC “guidelines” continue to constitute some of the most hugely disenfranchising tyranny and disinformation campaigns ever “cooked up.“ In the interim, they’ve been “served up” multiple times a day, for some five months, by our Pravda press, which has been in cahoots with leftist politicians, bureaucrats, and K Street crony capitalists all too happy to join in the Covidocracy (George Gilder’s brilliant term) as they get bailed out, … and their Main Street competition wilts. I collectively call these fascist crooks “the Coronacrats.”

Based on the insanely destructive Corona virus policy response fallout (charts 1 – 3) pretty much the world over, you’d think that 20% of the world’s population was threatened with eradication by this virus, when in actuality 0.01% of the global population has perished. In the US, that percentage is approximately 0.05%. However, the US percentage would likely be astoundingly lower if it wasn’t for financial, regulatory, and political (anything to get rid of the “Orange Man” threatening to eventually drain the swamp) incentives to blame the virus for as many deaths as possible. And that isn’t conspiracy theory. Belatedly, straight from the CDC horse’s mouth just a few days ago, namely on August 26th, 2020, came the following comorbidity information, a tacit confirmation of tremendously overstated Corona virus (COVID-19) deaths:

Comorbidities

Table 3 shows the types of health conditions and contributing causes mentioned in conjunction with deaths involving coronavirus disease 2019 (COVID-19). For 6% of the deaths, COVID-19 was the only cause mentioned. For deaths with conditions or causes in addition to COVID-19, on average, there were 2.6 additional conditions or causes per death. The number of deaths with each condition or cause is shown for all deaths and by age groups.

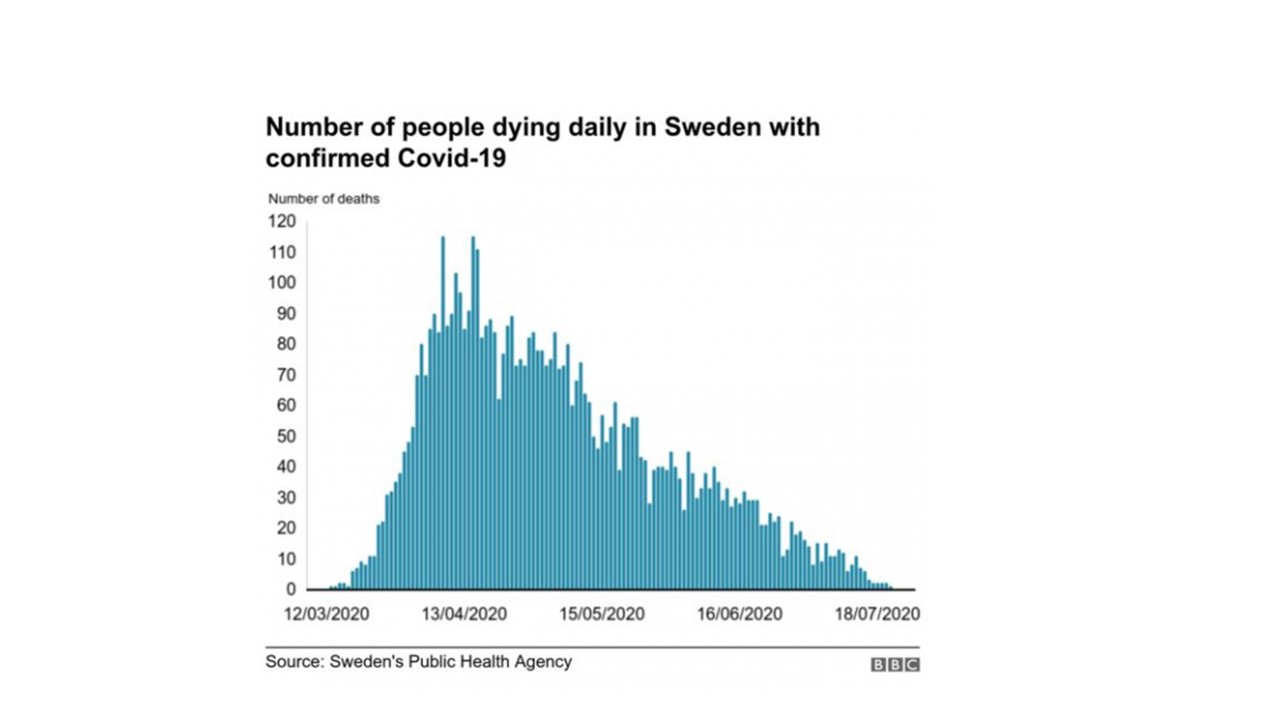

Clearly, the world should have followed in Sweden’s footsteps, a country that could not afford to print or avail itself of ECB-printed euros to offset laying its economy and freedom to waste; a country whose healthcare regulators believed in traditional isolation for those most at risk; a country whose decision makers took their cue from historical pandemic evolution, specifically that a virus can’t be broadly isolated, and that if the virus spreads among the young and healthy, nature’s “herd immunity” will put it down sooner rather than later, at minimal overall cost in terms economic destruction, job losses, social upheaval, and lives lost:

From 18/07/2020 to 01/09/2020, daily avg Swedish deaths from Covid-19 stood at 2.5 persons

Yet “sheeple” abound

Amazing, what sheeple (way too many) Americans have become, for they have fallen for the “Black Death, revisited” scare mongering hook, line, and sinker — modern day pandemic reflection, the fact that there aren’t 7.8bn humans by accident, confidence in our immune system’s capacity to put down viruses, rapidly declining Corona virus deaths (the backside of that virus bell curve), and ever more facts slicing through the MSM virus fog of deception be damned:

Here, in red state Florida, where Corona virus deaths (prior to the “comorbidity recalibration”) amount to but 0.03% of the Florida resident population and are increasingly flat-lining, kids that virtually never succumb to the virus, and are highly unlikely spreaders, are being forced to wear masks all day at school! Stores have big entrance door signs telling you that you can’t come in without masks on (I went in four stores yesterday without a mask, and I was able to keep it off in three, but boy did I get stares). And, believe it or not, there are some fools out and about in 96 degree heat riding their bikes, doing yard work, and doing construction work with masks on. There are even those “maskerating” in black pavement hot strip center parking lots going to their cars with grocery carts, as I was told was the case prior to returning to Southwest Florida from Switzerland on August 22nd. Some shoppers even keep their masks on when they drive off! You can’t make this stuff up. GOOD GRIEF!

A hoped for awakening

May enough people comprehend and resist this despotic, malignant folly by politely rejecting the lockdowns, social distancing, and mask insanity that are imposed on virtually all social and business activity in varying degrees, from churches to vet hospitals to McDonald’s to airlines:

Alaska Airlines upholds the prevailing prevarication that “wearing face coverings significantly reduces transmission of the COVID-19 virus.” To a virus thousands of times smaller than the mesh of a mask, a cloth appears like an immense lattice of large and completely open windows and doors.

Its chief effects are to make politicians and pettifogs feel important and citizens feel ignominious. The cloth confines larger bacteria, aerosols, and sputum near receptive surfaces, such as your eyes, nose, and mouth and thus cultivates both mental and physical disease.

A punctilious study by Swiss researchers pored through dozens of peer-reviewed analyses on the impact of masks and found no significant benefits and several downsides.

After all, if Speaker Nancy Pelosi considers masks beneath her dignity when she visits her hair dresser, or if Governor Gretchen Whitmer’s husband can attempt to move to the front of the boat launch line (to get his boat out on to the water while others are backed up due to executive order lockdowns), why should “we the people” comply with liberty and commerce (Constitution) eviscerating diktats? This is all the more true given that such decrees have thrown millions upon millions of Americans out of work and into emotional and financial desperation, including the prospect of between 30m – 40m Americans getting evicted prior to year’s end!

There are 330m of us in America, and there are “only” about 24m of “them” at all governmental levels throughout the country. Even if only a quarter all the American sheeple, or 83m (mostly) citizens, again become free people, there would be no way that the bureaucrats that would get involved could stop a non-compliance (with unconstitutional diktats) mass movement – and neither could their big-cap crony handmaidens. Why? Because they wouldn’t be able to turn so many of us away at the WalMarts, the CVSs, the Home Depots, etc. without cratering their P&Ls.*

It is time to just say NO. Or at least give it a whirl! Care to join me in a grassroots effort, one person at at time, to halt and then reverse the single largest public policy response blunder in the modern (post-WWII) era? A criminal blunder which threatens to cast a very long shadow on our already heavily misallocated, hugely indebted, counterfeit currency world (chart 24) — a world which was already set to “crash and burn.” But instead of the Corona virus policy response constituting the straw that broke the camel’s back, the response is more akin to a bridge falling on the camel!

Greetings,

Dan

*- Plus, the Deltas of the world would again have a chance of recovering from a 94% drop in passenger revenues in Q2:2020 without the taxpayer funding a load factor (capacity utilization) ceiling that would still leave them spewing billions of dollars of red ink. In plain English, a heavily downsized Delta would actually have a chance of surviving. We will be paying much higher fares soon enough, but at least we’ll still be able to fly someplace. Of course the entire airline industry could declare bankruptcy and thereby shed its liabilities, but the industry’s liabilities are creditor assets, and heaven knows we’ve got enough underfunded pension plans that don’t necessarily want to own jets parked in Arizona that won’t earn them a dime. After all, many airlines have already used the tax deductible nature of interest expense coupled with artificially low interest rates to leverage the crap out of their high operating leverage, incredibly capital intensive businesses’ balance sheets to enrich the industry’s C-Suite; it would be a shame if the same top brass could now add insult to injury by stiffing the very creditors that (foolishly, granted, but tell Grandma about that) enabled them to do de facto LBOs in order to recklessly goose EPS and share prices. Screwing both taxpayers and creditors is a bit rich, don’t you think?

FYI: Edits and select link inclusions to buttress post claims continued after publishing date. Post substance remained unchanged.

P.S. — I don’t quite know how to best communicate this, but it is entirely probable that a bright, well-read, gutsy civil engineer that a) knows a lot about local cronyism, b) happens to live in SW Florida, and c) wants to fight against the complete evisceration of liberty, sound money, and the unparalleled US Constitution may chime in now and then with posts of her own on this site — right, Debi? If this is an awkward introduction, revisited, please forgive me, readers and Debi alike!

The obligatory boilerplate:

This commentary is not intended as investment advice or as an investment recommendation. Past performance is not a guarantee of future results. Price and yield are subject to daily change and as of the specified date. Information provided is solely the opinion of the author at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Information provided has been prepared from sources deemed to be reliable but is not a complete summary or statement of all available data necessary for making an investment decision. Liquid securities can fall in value.

Post #66: Perhaps our toxic public policy stew isn’t such a surprise?

US$:92.99; Fed’s B/S: $7.0trn; US 10-yr: 0.75%; S&P 500: 3486; Oil: $42.01; Gold:$ 1,929; Silver: $27.02

Perhaps our toxic public policy stew isn’t such a surprise?

I have gratefully subscribed to Wolf Street articles for a few years. Wolf Richter, founder and prolific lead editor, recently published two articles that really got my attention. I’m referring to the following pieces:

https://wolfstreet.com/2020/08/22/haunting-photos-of-san-franciscos-desolate-financial-district-during-morning-rush-hour-visual-effects-of-working-from-home/

And:

https://wolfstreet.com/2020/08/26/the-zombie-companies-are-coming/

Let me give you a taste of Mr. Richter’s telling “haunting photos” of what could be mistaken for a modern day ghost town (San Francisco):

Below what I sent to Mr. Richter’s comments section of his Wolf Street site as regards his “Haunting Photos of San Francisco” piece:

This is what happens when the virus policy response (the “cure”) is much, much worse than the disease. For a virus — our current Corona iteration — that has claimed only 0.01% of the globe’s population and roughly 0.03%* of America’s population (never mind the hugely inflated US Corona virus death count due to both financial and political reasons, without which the US death tally could be up to 30 – 50% lower), the economic and freedom destruction triggered by tyrannical demagogues imposing their shutdown/lockdown will on us is just mind-bending.

And this is prior to hugely heightened individual impoverishment, family businesses nurtured for generations lost forever, and surging suicide rates. The pictures you present are the Corona virus policy equivalent of a neutron bomb having been detonated. The buildings are still standing, but it has become a ghost town devoid of human interaction and communication. Truly sickening and sadly likely very long-lasting in terms of the policy response devastation, be it societally, financially, economically, or in terms of grotesque violations of inalienable rights.

I couldn’t find my “two bits worth” in the Wolf Street site’s comments section. Not the first time. And surely not the last, i.e., unless I cry uncle. It might be high time. In any event, I shared my unpublished comments with a few colleagues and friends. In so doing, I added a few paragraphs about Mr. Richter’s apparently growing inconsistencies, which followed what I wrote Wolf Richter above. Those paragraphs:

Wolf Richter is amazingly talented and super-fast with numbers, data, sources, and graphics. His site’s daily free articles, most of which he authors, are just astonishing in terms of staying on top of multiple macroeconomic trends (Mr. Richter probably thrives on three hours of sleep a day!). But despite his prodigious knowledge, his varied business experience, his global perspective, and his professed adherence to free market capitalism, at the end of the day he apparently can’t overcome his German-born leftist/statist tendencies and convictions.

As such, in my view he utterly fails to grasp that free market capitalism can’t possibly survive with ever greater statism – yet he pans the very money printing that finances central planning, “zombie-ism,” and crony capitalism, also collectively known as statism or fascism, the more virulent it gets (as in daily)! Separately, and also quite revealingly, based on a few back-and-forths I initiated in his comments section, he’s convinced that gold and silver are barbarous relics, not free market-underpinning, price discovery-enabling, sound & honest money.

Moreover, based on his numerous articles that either directly or indirectly touch the virus front as well as his refusal to show any comments that I have sent that disagree with his “slant” here, I’m utterly convinced that Wolf Richter believes that the Corona virus is a first-rate pandemic (not a 0.01% of the global population killer) that requires the very government-imposed massive shutdowns and lockdowns that kill the free market capitalism he claims to support. Talk about an incredible and scary disconnect! Said is all the more true if truly bright, capable, influential people have such a glaring blind spot; Mr. Richter is by no means an exception — arguably, he is likely indicative of most commentators and policy makers. Accordingly, perhaps our globally toxic public policy stew isn’t so surprising after all?

Here is how a truly sage global macro analyst responded to my email earlier today, which was comprised of both my Wolf Street comments section efforts as well as my rant directly above:

Fascinating your last paragraphs because I had come to a similar conclusion. I used to love his stuff, and I always look for it in the morning when doing the daily, BUT he completely got the virus and the policy response wrong, and, as you say, he has just totally deserted capitalism. As you also infer, that 1bpt assumes that all the deaths with coronavirus were from coronavirus when in reality it’s only something like 8% of those that don’t have multiple comorbidities. I’m with you totally on his pieces.

How you might interpret “all that”

Please consider this piece as an update on past content, be it videos or posts, where I have kept suggesting that the Corona virus policy “cure” is much worse than the underlying disease. Unfortunately, our officials’ cure is anything but (a cure). Rather, it is just one more example of our globally toxic public policy stew as described above and extending far beyond, including frequently discussed free-market throttling regulatory compliance costs ($1.9trn or about 10% of GDP in the US alone), out-of-control corporate legal/litigation costs (in the US, nearly 3x the EU’s in terms of a percentage of GDP), our productivity and output eviscerating green energy cronyism, and the West’s increasingly strident redistribution of small business/Main Street income and property to Wall Street, K Street, and other constituencies, very much including “takers” and undocumented third world amnesty recipients — because that is where the votes are! And if that wasn’t free market capitalism toxic enough, leading central banks are bent on continuing to finance the unsustainable with their electronic printing presses; is it any wonder that global debt to global GDP is at unprecedented, nose bleed level of 331%, according to the IFF? In aggregate, and as often repeated in socialist or autocratic countries that issue their own fiat currencies, this is a recipe for stagflation, which ends up being a disaster for the vast majority of people subjected to it, as history richly attests, from ancient China to the former USSR to today’s Venezuela.

With such a toxic public policy widely implemented — and arguably being doubled-down on — around the world (I shudder to think what officialdom’s “shutdown/lockdown cure” would be should 0.02% of the world’s population succumb to a communicable disease), can bond and stock bubbles really be maintained, much less enlarged, much longer? And how long will the currencies that said assets are reflected in maintain their purchasing power? I’m referring to currencies that are being printed into oblivion (chart 24 attests to global monetary base growth translating into increasingly robust global money supply growth, also known as inflation) juxtaposed against what will likely prove to be long-lasting supply side shocks. Those supply shocks include massive numbers of small businesses whose doors may never reopen — where up to 50% of OECD denizens employed in the private sector typically work(ed), many of whom are now unemployed, no matter how much the government bureaucrats fudge the numbers.

Some closing thoughts

When you review your portfolio and dwell on how much of it has a “bubble glow” to it, please do recall that, at least historically, asset class valuations aren’t mean-reverting affairs, but reversion well beyond the mean market realities, which are also known as a manic-depressive Mr. Market or a reflection of our own emotional swings. In plain English, if history is any guide, and on the heels of an incredibly seldom, 40-year plus bull market in bonds, your bonds and stocks could suffer lasting market value implosions of 50% – 80% in sympathy with sharply rising discount rates juxtaposed against collapsing earnings power, as measured in today’s dollar (or other fiat currency) terms. Rising interest rates will ultimately reflect investors demanding heightened risk premiums amidst continued material financing needs and towering levels of debt in both absolute and relative to output terms.

The rising cost of external (creditor) funds will also increasingly reflect unrivaled monetary inflation and default risks finally being broadly realized, or priced in, by investors. Not even today’s unprecedented global financial repression will be able to keep these risks from increasingly manifesting themselves, as economics always trumps politics — eventually. Translation: while price discovery has been suffocated by the concerted efforts of leading central banks the world over, meaning that creditors and investors have failed to discount “troubled waters” ahead valuation-wise while funding what shouldn’t be funded (our rampant misallocations), this doesn’t mean that when fiat currency manipulation fails to keep earnings power up and defaults down, that investors won’t become very aggressive coincident or even lagging indicators in terms of portfolio reallocations, much as the 2008-2009 financial crisis proved, most especially in the equity and precious metals markets.

What Mr. Market will end up doing to valuations given that we’ve markedly doubled down on all that hobbled a wealth of nations trajectory in 2008 is anyone’s guess, but it may well result in a peerless compression of both bond and stock valuations, which would result in currently unimaginably high (double-digit) yields and unbelievably low (single-digit) P/Es, respectively. Terrific future ROI opportunities will probably beckon, as stated recently, i.e., should already maligned private sector property rights not get completely erased by global communism. In the meantime, do consider an allocation to precious metals, which will likely prove to be fiat cash on steroids, making for a potentially fantastic source of funding for purchasing great income earning assets and properties that will once again be on the bargain counter, perhaps like never before.

Here’s hoping you found this post worthy of a read.

Greetings,

Dan

*- Fact checking today raised that 0.03% to 0.05%. All else remains unchanged. Separately, America’s higher than global average Corona virus death rate, while still tiny, could very well be due to America’s outsized (no pun intended) obesity problem and the chronic health issues that sustained obesity is known to trigger. In other words, with a considerably higher portion of Americans’ health compromised by obesity than is the case globally, Americans are likely more susceptible to succumbing to additional health challenges, including common seasonal flus and viruses.

FYI: Edits and select link inclusions to buttress post claims continued after publishing date. Post substance remained unchanged.

P.S. — I don’t quite know how to best communicate this, but it is entirely probable that a bright, well-read, gutsy civil engineer that a) knows a lot about local cronyism, b) happens to live in SW Florida, and c) wants to fight against the complete evisceration of liberty, sound money, and the unparalleled US Constitution may chime in now and then with posts of her own on this site — right, Debi? If this is an awkward introduction, please forgive me, readers and Debi alike!

The obligatory boilerplate:

This commentary is not intended as investment advice or as an investment recommendation. Past performance is not a guarantee of future results. Price and yield are subject to daily change and as of the specified date. Information provided is solely the opinion of the author at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Information provided has been prepared from sources deemed to be reliable but is not a complete summary or statement of all available data necessary for making an investment decision. Liquid securities can fall in value.

Post #65: AG Barr to the rule of law rescue?

US$:93.10; Fed’s B/S: $7.0trn; US 10-yr: 0.71%; S&P 500: 3387; Oil: $42.01; Gold:$ 1,930; Silver: $27.05

AG Barr to the rule of law rescue?

In a nutshell, don’t hold your breath. Leading conservative/constitutionalist radio talk show host Mark Levin had a fine interview with Mr. Barr on his “Life, Liberty and Levin” TV show last weekend. It was a pivotal discussion about how destructive, violent, anarchist, un-American, uncivil, and rogue the left has become in its efforts to fundamentally transform America. That transformation is away from an erstwhile codified citadel of liberty to an increasingly Marxist nation featuring iron-fisted tyranny (for flavor, consider the Corona virus policy responses, especially in blue states, where prolonged lockdowns have led to serious and widespread behavioral issues). This effort, of course, is being led by the party of slavery, the party of segregation, the party of re-segregation, the party of the KKK, the party of internment of Japanese Americans, the party opposed to civil rights, and the party that led to unbridled third world amnesty which fueled ever growing voter disenfranchisement, Balkanization, and stagnant US jobs (for Americans). I’m talking, of course, about the power-obsessed, “Constitution, Americans, and America-be-damned” Democratic party.

So far, so good. It’s a great thing that Barr and his Department of Justice (DOJ) are at least calling the left out. But there is a huge fly in the ointment, in my view. It isn’t just about restoring law and order in America’s crime-infested, burning cities under racist/Marxist BLM and Antifa siege with local, state-level, and national Democratic power holders either approving or enabling rank lawlessness, and RINOs generally too intimidated to speak out against it. It is also about going after the very lawless elected officials and bureaucrats that have made a mockery of the rule of law while the same cast of characters has often set the stage for the anarchy and destruction that law-abiding urban Americans have faced, and are currently facing in unprecedented terms, from coast to coast, especially in Democratically-run cities (the vast majority of them). This prosecution of former and current rogue public officials is precisely what isn’t happening. That is the devastating fly in the ointment. I addressed this in an email with a friend of mine who initially drew Barr’s interview on Mark Levin’s TV show to my attention.

Here is what I wrote my friend:

Got a chance to listen. GREAT interview. Barr nails it, as does obviously Mark. Allow me a criticism or two; you may well consider it “majoring in minors,” but I think it goes to the heart of any honest system of government, and that starts with telling the truth.

Barr mentioned that Trump’s economy until recently saw virtually zero percent unemployment, and that this will recur. This is disingenuous at best. Trump himself called the unemployment rate fake as a candidate when it was around 5% (U3, or the most flattering measure). Furthermore, Trump mentioned, as a candidate, that real world unemployment was likely north (if not well north) of 20%. Translation: take the U3 measure, turn it into the U6 measure, and then add back all the discouraged workers that have been looking for a job for more than a year and were conveniently taken out of the job seeker category back in the Slick Willy (Clinton) administration, and you a get “real world” US unemployment rate of around 30%. Today!

One more point, arguably an even much, much bigger one concerning honest government – a government run by people that are not above the law. Here we are, some 3.5 years into the Trump administration. Barr has (thankfully) been on board since February of 2019, or about 1.5 years. We have mountains of evidence of treasonous and felonious acts by the heads/the top brass of former and early Trump administration politicians and bureaucrats ranging from Hillary to the former Obama AGs to the top brass of the FBI and the CIA to the judges that recklessly (or worse!) issued warrants to spy on Americans, a clear Bill of Rights violation if there ever was one. Former FBI head Comey, in the summer of 2016, not only still “toiled” as the top (bad) cop of America, but he also put on a judge’s hat and effectively told America, after reading a litany of indictable charges against Madam Clinton, that Hillary “didn’t really mean any harm,” but if the average American acted in such a manner, then the full force of the law would come down on him. Comey even wagged his finger “at us” as he issued his stern warning for us little people.

Have we seen ANYONE of at least a few handfuls of high level or top brass bureaucratic and elected criminals even get indicted by the supposedly lawful, ethical DOJ that supposedly eminently capable, rule-of-law man Barr heads? Should we wait until Biden assumes the presidency to finally indict these varied disgusting, oath-shredding, Constitution-curdling crooks?? What a freakin’, pathetic banana republic with above the law power brokers running free and making millions in the MSM and by giving speeches! Yet everyday Americans get fined for not wearing masks, wanting to run their businesses only to find that they’re forced to shut down or that their power and water have been shut off (L.A.). Yet everyday Americans get treated by the IRS like quasi criminals (or worse) if they fall short in terms of filing or declarations or payments. And don’t try to defend your home in blue state America; just accept the violence and destruction of often organized rioters and then call 911, but no one may answer because your police force is being defunded. Red state America is having none of it.

Now I know a lot of the harassment, intimidation, and Bill of Rights violations are state-based affairs (I’d argue that the 14th Amendment should offer state like Bill of Rights protections), but I’m trying to make a bigger point: Mark Levin and AG Barr and others can talk the big talk, but until our governing elites are no longer above the law (the Constitution), all this is a bunch of talk with precious little “here’s the beef” walk as far as everyday Americans are concerned — and rightly so. No wonder governmental institutions are often held in such low esteem.

Are all these mega crooks that have abused their elected or appointed positions of power going to skate? Are sorely needed indictments going to be pushed aside by all the sickening diversions the left is continuing to cook up for us from Russia Gate to Ukraine Gate to the virus policy scam to Marxists/anarchists tearing the crap out of the fabric of both our cities and society? And will this B.R. style “looking askance policy” be thanks to neither Trump nor Barr nor the man from Connecticut having enough guts to finally go after these above the law creeps? Or could it be that both sides of the aisle are so steeped in corruption and so eager to sustain their power, prestige, and crony/fascist advantages that this is just all a big, bad, throw us a bone of hope pretend game that we fall for until we realize we’ve been had again?

I, for one, won’t be holding my breath. Less talk, just walk, 3.5 years into the Trump administratin, on this VITAL, no one is supposed to be above the law front. And Barr definitely knows the ropes, so why hasn’t he had the decency and guts to start the process of trying to show the country that DC ain’t above the law while he still has the chance?

Here is how my friend responded:

Of course, I agree completely that Barr is not the be all and end all, or even close, for the reasons you mention, and more. The biggest one to me, because it (not the unemployment rate) is squarely in his wheelhouse is the lack of any prosecutions of arguably the biggest political criminals in the country’s history – i.e., starting with Hillary, Comey, Brennan, McCabe and… yes, Obama, the messiah himself.

That said, he is very refreshingly honest in a relative sense. Could and should he (and countless other bureaucrats, representatives and putative “leaders”) be 500% better? Absolutely. The closest one to that ideal that I can think of is probably Ted Cruz, but I have no doubt that if he were president, on the SCOTUS and/or AG, he’d disappoint as well.

So I basically agree with your critique but as many have said, politics is the art of the possible. That is the framework within which he exists, and that inevitably skews and corrupts. Right now, he’s light years better than Sessions was, and Universes better than Holder or Lynch were. Am I 100% happy with him? No, not even close. But am I much happier with him than many/ most other currently available alternatives? Absolutely.

To which I responded:

Your first paragraph says it all, as far as I am concerned. Politics is indeed the art of the possible. Yet for a man of conscience (Barr), a man that self-identifies as a rule-of-law constitutionalist, a man who has had under his “wheelhouse belt” the “machinery” with which to prosecute “arguably the biggest criminals in the country’s history” for about 1.5 years yet has prosecuted no such person … — this speaks sobering volumes about his true dedication to a system in which no one is above the law, else you can’t have the rule of law. To me, this is sadly less than politics being the art of the possible, and more about rank dereliction of duty, dereliction of the oath he took, and, perhaps most stunningly and destructively of all, sustaining the very “Department of Injustice” that he inherited from the mega crooks Holder and Lynch and the absolutely incompetent, scared crapless Jeff Sessions.

Sure, Barr is 100x better than hapless Jeff and extremely crooked Holder and Lynch, but what good is that if he doesn’t take a potentially rapidly fleeting opportunity to at least attempt to yank America back from its B.R. status in which way too many elites are above the law crooks and way too many of us law-abiding citizens often get treated as if we were crooks by an alphabet soup of unelected, unrepresentative, untouchable federal and state bureaucrats that have long and unconstitutionally issued the vast majority of our de facto legislation. How so? Via promulgating of thousands upon thousands of often effectively cloaked regulations (how can anyone keep up with 72,561 Federal Register pages?) frequently featuring stout fines and even incarceration teeth?”

Back to post content: President Trump, despite some of his beyond the pale assertions, especially as a candidate and early into his presidency, has often displayed the very uncanny knack for sharing “the resonating bottom line” with Americans that won him the 2016 election. In this regard, here is what he recently said:

Attorney General William Barr could go down in history as “the greatest attorney general” or just as “an average guy,” but that will depend on what U.S. Attorney John Durham reveals from his investigation into the origins of the Russia probe, President Donald Trump said Thursday.

“Bill Barr and Durham have a chance to be — Bill Barr is great most of the time, but if he wants to be politically correct, he’ll be just another guy,” Trump said during an extensive interview with Fox Business’ Maria Bartiromo. He said he hopes Durham is “not going to be politically correct.”

“I hope he’s doing a great job,” Trump said. “[President Barack] Obama knew everything. Vice President [Joe] Biden, as dumb as he may be, knew everything, and everybody else knew.”

Trump added that former FBI Director James Comey, ex-CIA Director John Brennan, and former Director of National Intelligence James Clapper “were all terrible and they lied to Congress.”

Is the first Ex-FBI lawyer pleading guilty for falsifying documents to investigate the Trump campaign a hopeful sign? Or, is this just a token, “orchestrated prosecution” by the bigwigs in both parties to offer citizens a middle management bureaucratic “sacrifice” before the top echelon power brokers revert back to widespread, bi-partisan corruption, and cronyism, also called B.R. business as usual?

A recent appeals court decision to overturn the Hillary Clinton deposition order that Judicial Watch won under the Freedom of Information Act suggests the heads of the above-the-law fish are as foul as ever. Said differently, the jury is still out whether we will sustain an arbitrary, capricious, rapacious, despotic rule of man system over a rule of law system based on the US Constitution. If only “the jury” got to decide such cases, for if it is ultimately principally up to leftist circuit (appeal) courts or to the Supreme Court of America, any remaining fidelity to our Constitution and the associated Bill of Rights won’t just be hanging by an ever thinner thread, but these seminal documents will have fallen deeply into a grave with dirt being rapidly heaped on top, quickly replacing daylight that was already rapidly dimming.

What if AG Barr falls short?

As you can surmise, I think this is much more likely than not. If we cannot bring back fidelity to the rule of law for our elitist politicians and bureaucrats, how can we expect to rein in increasingly “green-lighted” anarchy, racism, and destruction? How can we address the highly destructive “cancel culture”* (OURS) and “virtue signalling“* that is increasingly making policy in the US for all of us if our leaders act lawlessly and destructively? The short answer is, we can’t.

In such an unraveling world, how can we reconstitute free market capitalism, stouter property right protections, smaller government, balanced budgets, and sound money, the elixirs of invention, productivity enhancement, deflationary growth, and a wealth of nations trajectory lifting more boats and generating more happiness than any other system? The short answer is, we can’t.

With our toxic public policy stew run, in essence, by lockdown fascists in bed with anarchistic and racist hoodlums, we threaten to careen further and further into stagflation, revisited — this time laced with with record debt, unmatched public sector and pension deficits, unparalleled financial repression, plummeting productivity (prior to an even stronger embrace of “not so green” energy), and an increasingly threatening loss of a functioning (civil) society. Not exactly confidence-inspiring. Not exactly a “wealth of nations” trajectory, shutting down supply and printing money like never before. More like 1970s’ style stagflation on steroids laced with rising civil unrest and destruction.

In plain English, eventually our asset bubbles, especially in global bonds and US stocks, will be pierced, ending over four decades of bull markets as reversion beyond the mean gets really mean, and screaming buys proliferate. This will not only reflect unheralded and expanding balance sheet weakness, a secular reduction in corporate earnings power stated in today’s currency terms, and hugely rising monetary inflation risks, but it will also reflect plummeting confidence in the currency in which those increasingly unsound, overvalued assets are based. In short, we will have a stability-eviscerating and purchasing power-crushing fiat currency crisis led by the currency that has been abused the longest and the most flagrantly, the US dollar. This is how the end of a financial system is spelled.

In such a world, people and investors have always resorted to safe haven, purchasing power-protecting real money, which is physical gold and silver. It won’t be different this time. If the central bankers/central planners want to keep from being rendered fully academic (which history suggests would be wonderful), they will have to again back their currencies with a stout amount of gold — around 40%. As so much fiat money has been printed, and gold (and silver) remain very limited, we could easily be looking at $11,500 gold per Troy ounce and over $230 silver per Troy ounce (history coupled with a bit of simple math as a “15:1” silver-to-gold ratio suggests silver could reach into the $700 range per Troy ounce). Those precious metals dollar prices would be prior to even more money supply expansion both domestically and abroad. In this regard, note that the US money supply has been rising at a 42% annual rate in M1 terms.

While an adequate allocation to physical precious metals in your own possession at current price levels will help to take the economic and financial edge off of what will likely prove tumultuous times ahead, they can’t address our increasingly dysfunctional political and societal systems. But, as the saying goes, it’s better to be (relatively) well off financially during hard times than poor. Plus, someday, when Blue Chip crony plays will again be trading for a sub-10 P/E with a 6 – 8% dividend yield (a blast from the not too distant 1970s past), you will likely have the PM purchasing power to “back up the truck” to avail yourself of a possibly once-in-a-lifetime buying opportunity, i.e., if our current fascist system doesn’t morph into full-blown communism, where there is no more private property.

But with rising gold and silver prices, don’t wait too long to get adequate precious metals diversification, especially not with Big Warren of Berkshire Hathaway wading into gold stock(s), which will make it suddenly acceptable for all the Wall Street lemmings to embrace the very gold the talking financial news heads have long been panning (together with Warren) as a barbarous relic earning not a dime of interest. Well, with negative real interest rates abounding and with goods and services inflation on the rise, physical gold and silver in your own discreet possession don’t look so bad. Meanwhile, precious metals stocks have tremendous operating and financial leverage to rising precious metals prices with which to fatten your dividend income. Pretty salivating, those barbarous relics …

Conclusion: go for the PM “bar” instead of placing too much trust in Barr (and our heavily compromised system)

Hope you found this post of interest!

Greetings,

Dan

*- In case these psychobabble terms confuse you, let me cut to the chase: cancel culture and virtue signalling express what amounts to kindergarten bullies enforcing the alpha male’s tyranny, which they have voluntarily subjected themselves to and now insist that everyone else also has to abide by. THAT is what is really going on. Welcome back to kindergarten. Where are the cops?

FYI: Edits and select link inclusions to buttress post claims continued after publishing date. Post substance remained unchanged.

The obligatory boilerplate:

This commentary is not intended as investment advice or as an investment recommendation. Past performance is not a guarantee of future results. Price and yield are subject to daily change and as of the specified date. Information provided is solely the opinion of the author at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Information provided has been prepared from sources deemed to be reliable but is not a complete summary or statement of all available data necessary for making an investment decision. Liquid securities can fall in value.

Post #64: This is how they kill an economy — an interview with Kenneth Ameduri of Crush the Street

— A Crush the Street interview with Kenneth Ameduri and yours truly.

(Post interview links of related topics that may prove of interest: https://www.powerlineblog.com/archives/2020/08/germans-march-against-shutdown.php & https://www.unz.com/mwhitney/sweden-the-one-chart-that-matters/)

Post #63: Straight from the CDC horse’s mouth

US$:96.00; Fed’s B/S: $6.9trn; US 10-yr: 0.63%; S&P 500: 3225; Oil: $40.38; Gold:$ 1,809; Silver: $19.68

Straight from the CDC horse’s mouth (please click on “posts” tab to see table below correctly)

US COVID-19 (Corona virus) deaths continue to PLUMMET. Specifically, to 181 deaths for the week ended 7/11/20 from 3,668 weekly deaths a month ago. US Corona virus-attributed deaths have most thankfully dropped each and every week since the 4/18/20 weekly peak of 16,897 amidst sharply rising new cases. How does one spell rapidly rising herd immunity or the disease’s bell curve “playing out.”

But, too many of our elected officials and bureaucrats – and, of course, the Pravda press – insist that we face a “second wave” crisis that ultimately threatens to kill many more Americans if renewed shutdowns and lockdowns aren’t instituted and enforced. Talk about adding insult to economic and civil liberties evisceration injury (also known as despotism) thanks to potentially doubling down on officials’ Corona virus policy response.

Plus, the media continues to broadcast overwhelmed hospitals related to spreading Corona virus cases. Often, sharply rising bed utilization rates across the country are referred to without considering that this is being materially caused by a surge of so-called elective surgeries and other deemed “non-essential” medical procedures, which are now being done, after having been suspended for roughly three months. This was kindly brought to my attention by a bright and very well-read subscriber to my dkanalytics youtube channel, a lady by the name of Debi Duckels. Debi, a fellow Floridian, also dug deeply into Florida State medical data, which showed that out of 47,933 statewide hospital beds, 8,239 (as of about 12 noon ET on July 15th) are occupied by patients with the primary diagnosis being the Corona virus. That’s 17.2%. Not exactly “virus overwhelming.”

In addition to re-instituting shutdowns and telling us that hospitals are being, or soon will be, hopelessly overwhelmed (when have you heard that one before, yet the results stood in stark contrast?), “everyone” needs to wear a mask, and social distancing must be adhered to — OR ELSE! From a county in Maryland last week, courtesy of a friend:

Truly Orwellian. And this against the backdrop of plummeting Corona virus deaths in the US. You can’t make this stuff up!

Oh yes, those CDC COVID-19 weekly US death numbers from this July 15th, 2020 during the morning hours ET (before they disappear or are altered?). Please see below. I’m getting the data from this link.

| Data as of | Start week | End Week | Group | State | Indicator | COVID-19 Deaths | Total Deaths | Percent of Expected Deaths | Pneumonia Deaths | Pneumonia and COVID-19 Deaths | Influenza Deaths | Pneumonia, Influenza, or COVID-19 Deaths |

| 07/14/2020 | 02/01/2020 | 02/01/2020 | By week | United States | Week-ending | 0 | 58,325 | 98% | 3,774 | 0 | 478 | 4,252 |

| 07/14/2020 | 02/08/2020 | 02/08/2020 | By week | United States | Week-ending | 1 | 59,069 | 99% | 3,777 | 0 | 518 | 4,296 |

| 07/14/2020 | 02/15/2020 | 02/15/2020 | By week | United States | Week-ending | 0 | 58,319 | 99% | 3,797 | 0 | 554 | 4,351 |

| 07/14/2020 | 02/22/2020 | 02/22/2020 | By week | United States | Week-ending | 5 | 58,286 | 100% | 3,654 | 1 | 561 | 4,219 |

| 07/14/2020 | 02/29/2020 | 02/29/2020 | By week | United States | Week-ending | 5 | 58,486 | 102% | 3,773 | 3 | 640 | 4,415 |

| 07/14/2020 | 03/07/2020 | 03/07/2020 | By week | United States | Week-ending | 34 | 58,638 | 101% | 3,905 | 16 | 622 | 4,544 |

| 07/14/2020 | 03/14/2020 | 03/14/2020 | By week | United States | Week-ending | 52 | 57,672 | 101% | 3,896 | 27 | 611 | 4,531 |

| 07/14/2020 | 03/21/2020 | 03/21/2020 | By week | United States | Week-ending | 561 | 58,509 | 103% | 4,494 | 249 | 546 | 5,345 |

| 07/14/2020 | 03/28/2020 | 03/28/2020 | By week | United States | Week-ending | 3,126 | 62,478 | 112% | 6,115 | 1,411 | 440 | 8,220 |

| 07/14/2020 | 04/04/2020 | 04/04/2020 | By week | United States | Week-ending | 9,907 | 71,649 | 128% | 9,831 | 4,716 | 477 | 15,263 |

| 07/14/2020 | 04/11/2020 | 04/11/2020 | By week | United States | Week-ending | 16,011 | 78,325 | 141% | 11,887 | 7,173 | 471 | 20,856 |

| 07/14/2020 | 04/18/2020 | 04/18/2020 | By week | United States | Week-ending | 16,897 | 76,001 | 140% | 11,291 | 7,252 | 262 | 21,011 |

| 07/14/2020 | 04/25/2020 | 04/25/2020 | By week | United States | Week-ending | 15,209 | 72,879 | 135% | 10,239 | 6,520 | 143 | 18,975 |

| 07/14/2020 | 05/02/2020 | 05/02/2020 | By week | United States | Week-ending | 12,969 | 68,081 | 127% | 8,815 | 5,455 | 64 | 16,373 |

| 07/14/2020 | 05/09/2020 | 05/09/2020 | By week | United States | Week-ending | 10,949 | 65,258 | 124% | 7,655 | 4,626 | 46 | 14,015 |

| 07/14/2020 | 05/16/2020 | 05/16/2020 | By week | United States | Week-ending | 8,933 | 62,435 | 119% | 6,565 | 3,690 | 19 | 11,824 |

| 07/14/2020 | 05/23/2020 | 05/23/2020 | By week | United States | Week-ending | 6,932 | 59,096 | 113% | 5,660 | 2,889 | 22 | 9,721 |

| 07/14/2020 | 05/30/2020 | 05/30/2020 | By week | United States | Week-ending | 5,850 | 56,359 | 109% | 4,991 | 2,373 | 10 | 8,478 |

| 07/14/2020 | 06/06/2020 | 06/06/2020 | By week | United States | Week-ending | 4,617 | 54,732 | 104% | 4,564 | 2,002 | 11 | 7,190 |

| 07/14/2020 | 06/13/2020 | 06/13/2020 | By week | United States | Week-ending | 3,668 | 52,189 | 101% | 3,981 | 1,630 | 10 | 6,026 |

| 07/14/2020 | 06/20/2020 | 06/20/2020 | By week | United States | Week-ending | 2,783 | 48,581 | 94% | 3,469 | 1,189 | 5 | 5,068 |